The State of Low- and Moderate-Income Communities

More people indicated that economic conditions were improving in low- and moderate-income (LMI) communities than said they were declining, according to the most recent Community Development Outlook Survey, conducted by the St. Louis Fed’s Community Development area. The majority said that conditions had remained the same as six months ago.

The survey, conducted June 10 through June 30, incorporated responses from a variety of community stakeholders—such as those from nonprofits, financial institutions and community and economic development organizations—from the seven states comprising the Eighth Federal Reserve District.1 Of those responding, 18.7 percent indicated that the general economic conditions of the LMI communities they served were improving compared with six months ago, while 17.0 percent said conditions were declining.

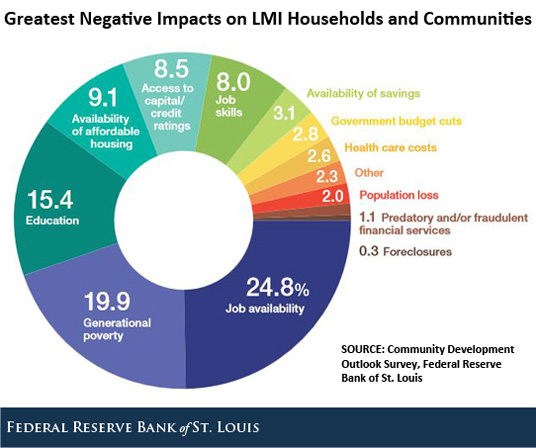

Negative Impacts

As the figure below shows, among all respondents, the three issues having the greatest negative impact on LMI households and communities were job availability (24.8 percent), generational poverty (19.9 percent) and education (15.4 percent). Job availability was also the top concern among respondents from rural areas, while generational poverty was the top concern among those from metropolitan areas. One responder from the government sector in an Illinois metropolitan area noted, “Automation of routine jobs is limiting job opportunities for low-skilled workers.”

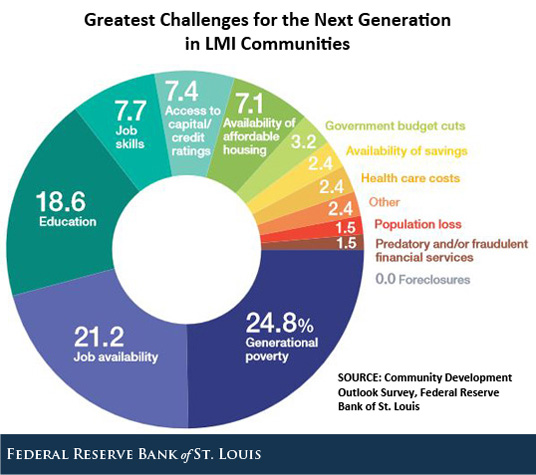

Greatest Challenges

The survey also included responses regarding the greatest challenges for the next generation in LMI communities. As shown below, generational poverty was most cited as the greatest challenge for the next generation. One respondent from a rural Mississippi community noted, “Educational systems are having difficulty overcoming generational poverty (disadvantages and attitudes); consequently, we have virtually no workforce with the necessary skills to get ahead. We need remedies for this.”

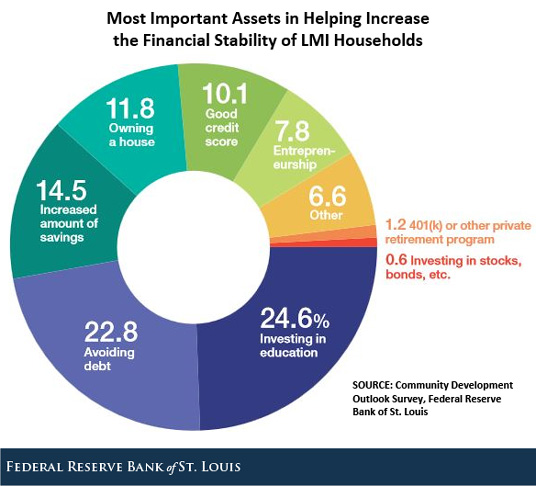

Most Important Assets

According to survey responders, investments in education are most important in helping increase the financial stability of LMI households. An education sector respondent from a rural Arkansas community said, “Education is a way out of poverty.”

Notes and References

1 Eighth District states are Arkansas, Illinois, Indiana, Kentucky, Mississippi, Missouri and Tennessee.

Additional Resources

Citation

ldquoThe State of Low- and Moderate-Income Communities,rdquo St. Louis Fed On the Economy, Dec. 11, 2014.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions