The Great Recession Casts a Long Shadow on Family Finances

By Ray Boshara, Director; William Emmons, Senior Economic Adviser; and Bryan Noeth, Policy Analyst.

The authors are all with the St. Louis Fed’s Center for Household Financial Stability.

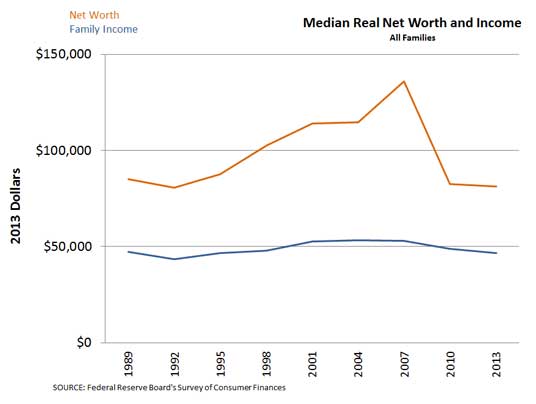

The income and wealth of the typical American family declined between 2010 and 2013, according to the Federal Reserve’s latest Survey of Consumer Finances.1 (See the figure below.) These declines reduced the median real (inflation-adjusted) family income and net worth in the U.S. in 2013 to $46,668 (from $49,022 in 2010) and to $81,400 (from $82,521 in 2010), respectively.

Combined with significant declines between 2007 and 2010 on both measures, the cumulative decline in median real family income between 2007 and 2013 was 12.1 percent, while median real net worth declined 40.1 percent. The financial impact of the Great Recession was so severe that all the gains achieved during the 1990s and 2000s were wiped out. Median real family income was 1.0 percent lower in 2013 than in 1989, while median real net worth in 2013 was 4.3 percent below its 1989 level.

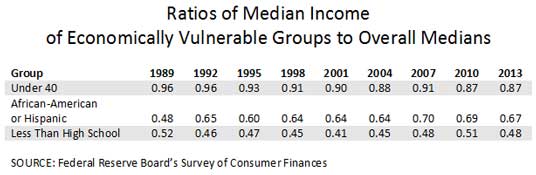

As discouraging as these declines are, several economically vulnerable groups have fared even worse. As the table below shows, the median real income among families headed by someone under 40 has fallen from 96 percent of the overall median income in 1989 to only 87 percent in 2013. The median income of families headed by an African-American or someone of Hispanic origin (of any race) reached only 67 percent of the overall median in 2013, down from 70 percent in 2007. Among families headed by someone without a high-school degree, the median real income in 2013 was only 48 percent of the overall median, down from 51 percent three years earlier.

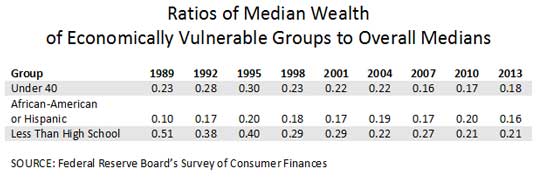

Those groups typically classified as economically vulnerable have experienced severe balance-sheet stress, too. The table below shows that the median real net worth of a family headed by someone under 40 declined from 23 percent of the overall median in 1989 to only 18 percent in 2013. The progress made by African-American and Hispanic families in closing the wealth gap with the overall population through 2010 was largely reversed by 2013, leaving the median wealth of these groups at only 16 percent of the overall median. And the median wealth of families headed by someone with less than a high-school education plunged from 51 percent of the overall median wealth in 1989 to just 21 percent in 2013. Reflecting recent research conducted by the St. Louis Fed’s Center for Household Financial Stability, age, race and education continue to be among the strongest predictors of who gained and lost wealth during and after the Great Recession.2

Even in the sixth year of economic recovery, the Great Recession’s impact on American families’ income and wealth continues to be felt widely.3 The most economically vulnerable groups of families generally have suffered even larger setbacks than the typical family in the overall population.

The data now affirm what most Americans have been feeling since the recession ended—that their own recovery is not yet complete. And as many families continue to accumulate new debt at a slower pace or actually “delever” their balance sheets, shedding the debts accumulated in the run-up to the financial crisis, we believe less than robust economic growth will continue.

Notes and References

1 The Survey of Consumer Finances provides detailed information on the sources of income, financial assets and liabilities, and financial arrangements of a large representative sample of U.S. families. The 2013 SCF is the ninth triennial survey in the series, dating to 1989. Information about the 2013 SCF is available at http://www.federalreserve.gov/econresdata/scf/scfindex.htm.

2 For example, see the St. Louis Fed’s 2012 Annual Report essay “After the Fall: Rebuilding Family Balance Sheets, Rebuilding the Economy,” the Review article “Economic Vulnerability and Financial Fragility” and the In the Balance issue “Housing Crash Continues to Overshadow Young Families' Balance Sheets.”

3 The National Bureau of Economic Research determined that the Great Recession ended in June 2009.

Additional Resources

Citation

ldquoThe Great Recession Casts a Long Shadow on Family Finances,rdquo St. Louis Fed On the Economy, Sept. 9, 2014.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions