Homeownership and House Prices No Longer in Sync

In the aftermath of the financial crisis, the Federal Reserve has emphasized improvements in the housing market as a necessary condition for the recovery of the overall economy. The strategy of aggressively purchasing mortgage-backed securities to put downward pressure on long-term interest rates appears to have paid off, in terms of house prices. However, the homeownership rate has continued to decline, meaning that housing demand and house prices no longer appear to be linked.

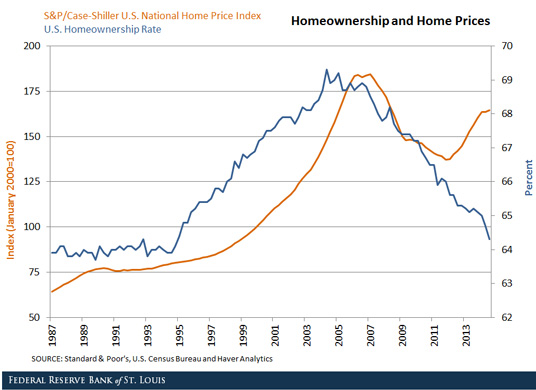

As of the third quarter of 2014, house prices were only 11 percent below their 2007 peak, as can be seen in the figure below. The recovery of housing prices has been relatively uniform across the country, with prices in many cities increasing between 5 and 25 percent. A plausible explanation for the recovery is that low prices have made homes an attractive purchase, but the strong growth of the local economy in some markets has also been an important driver.

Traditionally, the largest housing booms in U.S. history have been fueled by significant increases in the homeownership rate. The postwar boom increased the homeownership rate from 43 to 64 percent. During this period, the country went from a nation of renters to a nation of owners who were chasing the so-called “American Dream.”

For the next 35 years, the homeownership rate hovered around 64 percent. More recently, the homeownership rate increased from 64 percent in early 1994 to 69 percent in 2005, accompanied by a steep increase in home prices. From these two episodes, it appears that housing demand has been closely linked to house prices.

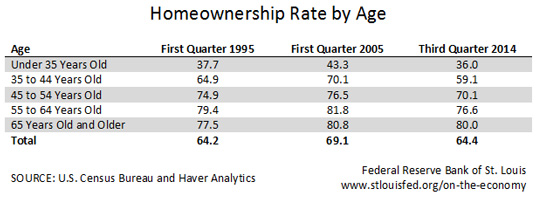

However, housing demand and house prices have become disconnected since the financial crisis. While prices rebounded around 2012, the homeownership rate has been declining for nearly a decade, and the gains achieved during the 1990s and early 2000s have evaporated. The uniform decline of homeownership has occurred for most age groups, but in particular for first-time buyers or households headed by individuals age 35 and under. Only households with heads around the retirement age have been able to sustain their homeownership status.

From the table, it is clear that homeownership has suffered collateral damage from the financial crisis. The structural shift from owner-occupied to tenant-occupied housing has resulted in increasing rental prices across the country. The increase in rental prices has attracted investors to develop multi-family units and to purchase single-family homes to profit from the advantageous conditions (such as low interest rates) in mortgage markets.

The data suggest that this is the first national housing boom in the postwar era that has not been supported by an increased demand for owner-occupied housing. This current episode could solidify the idea that it is possible to have housing booms driven entirely by investors. Therefore, it is no longer clear going forward that the homeownership rate provides a good predictor of future house prices.

Additional Resources

- On the Economy: Are Wages and the Unemployment Rate Correlated?

- On the Economy: Fewer Younger, Richer Households Have Negative Home Equity

- On the Economy: Measuring (Most of) the Slack in the Labor Market

Citation

Carlos Garriga, ldquoHomeownership and House Prices No Longer in Sync ,rdquo St. Louis Fed On the Economy, Dec. 29, 2014.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions