Are Wages and the Unemployment Rate Correlated?

One of the most classic TV advertisements is the old “Where’s the beef?” commercial. For those not up-to-speed on ‘80s pop culture references, customers at a fast-food restaurant order a hamburger, express enthusiasm over the large bun and expect to see a sizable patty as well. Instead, they are disappointed to see a tiny hamburger, and a woman exclaims, “Where’s the beef?!” in frustration.

The analogy to the labor markets is that, while the recovery has caused enthusiasm through improvement in many output and labor market indicators, wage growth has been relatively flat. Many seem to expect the decline in unemployment to put upward pressure on the mean wage.

In general, the reason wages might be related to the unemployment rate is that, when business conditions improved, there would be an effect both on the unemployment rate and on a worker’s bargaining power. However, the logic is less clear once we consider the labor market flows of a workforce with a wide distribution of wages, because labor market conditions affect high-wage and low-wage earners differently.

In particular, workers at and above the median wage have a higher job-finding rate and are more likely to be able to move directly from job to job. Therefore, labor market conditions have less of an impact on their bargaining power and wages. In contrast, workers below the median wage are less likely to be able to move directly from job to job and have a lower job-finding rate. These workers have fewer alternatives than higher-paid workers, so an improvement in labor market conditions more directly impacts their bargaining power and their wages.

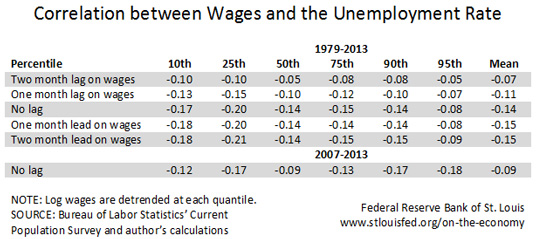

With this in mind, we examined the correlation between unemployment and wages at various points in the distribution for an upcoming article in The Regional Economist. As we might expect, higher levels of wages were less correlated with the unemployment rate. At all points of the distribution, the correlation was quite low.1 During and after the Great Recession, this correlation became slightly weaker overall, but it was not an economically or statistically significant difference.

This is not to say that business cycle indicators do not tend to co-move, nor is this intended to be overly optimistic about the state of the labor market. However, it seems misguided to look for welfare or signaling relevance in the cyclical movements of mean wages. Wage pressure is not really the beef of the hamburger, but perhaps our current tizzy is akin to shouting “Where’s the pickle?”

Notes and References

1 This is consistent with a known feature of wages: that they are rather smooth over the business cycle. Hall, Robert E. “Employment Fluctuations with Equilibrium Wage Stickiness,” American Economic Review, March 2005.

Additional Resources

- On the Economy: Fewer Younger, Richer Households Have Negative Home Equity

- On the Economy: Rising Education Costs Have Had Little Impact on Household Budgets

- On the Economy: What Do Macroeconomists Think about the Impact of Fiscal Stimulus?

Citation

David G Wiczer and James D Eubanks, ldquoAre Wages and the Unemployment Rate Correlated?,rdquo St. Louis Fed On the Economy, Dec. 1, 2014.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions