Forecasting National Inflation Rates

By Silvio Contessi, Economist

A recent line of research has established that global factors significantly correlate with national inflation rate movements, so much in fact that they can help forecast national inflation rates.1

A forthcoming Federal Reserve Bank of St. Louis Review article2 follows this literature and estimates a one-factor model for global inflation using headline inflation rates for nine advanced economies, using monthly data for the period January 2002 through June 2014.3 The nine economies are from three groups:

- Large economies: the eurozone, Japan and the U.S.

- Small open economies which have or had some form of central bank program, such as large-scale asset purchases (LSAPs), designed to increase the size of their central banks’ balance sheet: Sweden, Switzerland and the U.K.

- Small open economies without LSAP programs: Canada, Denmark and Norway

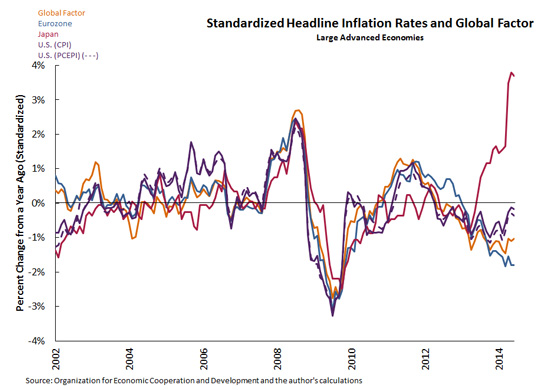

These are all advanced economies, but are fairly heterogeneous in terms of size, openness and unconventional monetary policy experiences. The chart below plots the time series of the estimated global factor along with the large economies' inflation rates. Each time series is standardized by subtracting the sample average and dividing by the standard deviation.4

It is clear that there are generally high correlations between the global factor and the economy inflation rates, as well as between pairs of inflation rates. There are, however, also some notable deviations in the sample.5 Particularly noteworthy is the very visible deviation of the Japanese inflation rate (shown in the first chart) from the global factor series in the past 18 months, corresponding to the new set of economic policies advocated by Japanese Prime Minister Shinzo Abe, known as Abenomics. While most of the advanced world is experiencing low and quiet inflation, Japanese inflation is soaring to levels not seen in more than 20 years and therefore deviating from the factor very visibly.

What correlates with this unobserved factor?

- Research has related global output gaps (or slack) to domestic inflation.6 However, slack is not directly observable, and it is notoriously difficult to estimate.

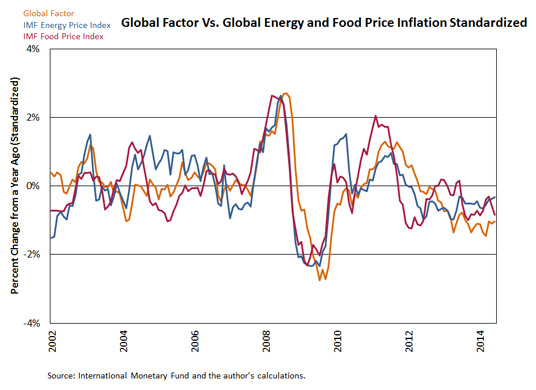

- Commodities whose prices are globally determined are clearly important. For example, the chart below shows that our global factor series comoves discernibly with food and energy price indexes from the International Monetary Fund.

Recent low inflation rates are likely the combination of slack in the global economy (particularly in the eurozone) and the stability of commodity prices. While we would have a hard time tracking slack in real time, keeping an eye on global prices can tell us something about the short-term behavior of domestic headline inflation rates in the near future in several economies (but perhaps not in Japan!).

The second footnote has been updated to include a link to the author's paper, which was published after this blog post. The third footnote has been updated to clarify the personal consumption expenditure price index used in the analysis.

Notes and References

1 Ciccarelli, Matteo; and Mojon, Benoit. “Global Inflation.” The Review of Economics and Statistics, August 2010. Mumtaz, Haroon; and Surico, Paolo. “Evolving International Inflation Dynamics: World and Country-Specific Factors.” Journal of the European Economic Association, August 2012.

2 Contessi, Silvio; De Pace, Pierangelo; and Li,Li. “An International Perspective on the Recent Behavior of Inflation.” Federal Reserve Bank of St. Louis Review, Third Quarter 2014.

3 We used the consumer price index or the harmonized index of consumer prices. For the U.S., we also plotted the standardized headline personal consumption expenditure price index (PCEPI) for comparison with the headline CPI, as the Fed’s inflation target refers to the core PCEPI. Data are not seasonally adjusted and obtained from the Organization for Economic Cooperation and Development. A factor model is a statistical technique that allows us to extract from time series data a latent unobserved common factor to which each of the series is related through an estimated parameter called “factor loading.” Also see a similar exercise for Canada in: Macklem, Tiff. "Flexible Inflation Targeting and 'Good' and 'Bad' Disinflation." Presented at the John Molson School of Business, Concordia University, Montreal, Canada, Feb. 7, 2014.

4 The model used to calculate the series for the global factor yields a series with a mean of zero and a standard deviation of 0.97, so strictly speaking, the global factor is not standardized. However, standardizing and plotting the series would yield a graph nearly identical to the one displayed in this post.

5 Wang, Pengfei; and Wen, Yi. “Inflation Dynamics: A Cross-Country Investigation.” Journal of Monetary Economics, October 2007.

6 Borio, Claudio; and Filardo, Andrew. “Globalization and inflation: New cross-country evidence on the global determinants of domestic inflation.” Bank for International Settlements Working Papers, No 227, May 2007.

Additional Resources

- On the Economy: Recent ECB Policy and Inflation Expectations

- On the Economy: Why Inflation Matters in Setting Monetary Policy

- Regional Economist: Three Faces of Low Inflation: U.S. Japan and the Euro Area

Citation

ldquoForecasting National Inflation Rates,rdquo St. Louis Fed On the Economy, Aug. 21, 2014.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions