Single Mothers Face Difficulties with Slim Financial Cushions

Many single mothers have very low levels of financial reserves. For example, about a third would not have been able to handle a $400 emergency expense in 2019. This is problematic because savings, even in the form of small cash balances, are critical to withstanding financial crises.

One such crisis came in the form of the COVID-19 recession, and it highlighted mothers’ financial fragility. Single mothers experienced high unemployment rates and were more likely to exit the labor force than single fathers and women without children. Compounding their struggles, single mothers faced mounting child care issues of access, availability and affordability. Their small savings also meant that single mothers felt these financial pressures more acutely than groups with more sizable resources.

Identifying the issues faced by these vulnerable women can inform private and public responses to help mothers and their families become more financially resilient and encourage upward mobility.

Exiting the Labor Force and Experiencing High Unemployment

During the first few months of the pandemic, there was widespread closure of schools and day care centers. Virtual learning, reduced operating hours of schools and day care centers, and quarantine periods have had lasting effects on working parents. Single mothers have been particularly impacted: One in 5 single mothers who experienced these types of disruptions indicated in November 2020 they were no longer working, a rate roughly twice that of other parents, according to the Federal Reserve’s Survey of Household Economics and Decisionmaking. Yet, single mothers were half as likely (7%) to have voluntarily left a job as single women without children, indicating their higher unemployment was less likely to be purposeful.

Losing a job and leaving the labor force can be especially detrimental for single parents who are the sole breadwinners and primary providers for the children in their households. Many find it more difficult to pay for child care (which is already unaffordable for many), which in turn makes finding a new job harder. Child care is a necessity because it allows mothers to participate in the workforce when their children are young and is central to an equitable recovery. Yet, the average cost of care per child was unaffordable for the vast majority (97%) of single mothers in 2019.The average cost of child care was $9,142 per child per year in 2019. The standard for affordability is up to 7% of household income. The 2019 Survey of Consumer Finances was used to calculate the share of single mothers who made $130,600 or less in household income. Because many mothers struggle to remain engaged with the labor force due to caregiving burdens, this lack of affordability and relation to labor force participation is noteworthy.

Slim Financial Cushions

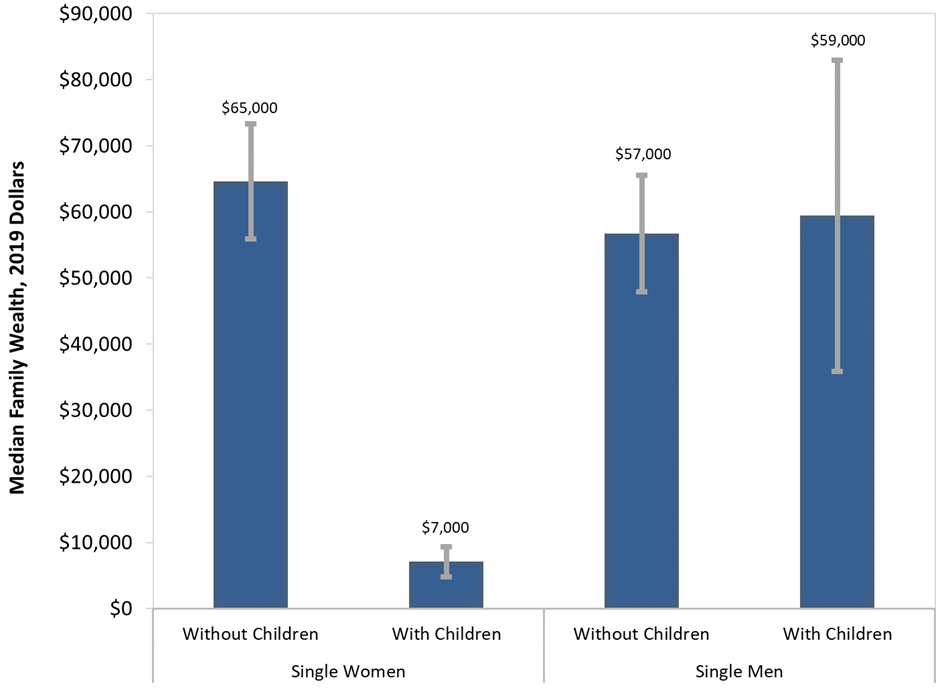

Among singles (i.e., those who have never married, are divorced, widowed or separated) in 2019, mothers of minor children had the lowest levels of median wealth by far, with only about $7,000 in family wealth, as seen in the figure below. Other singles’ median wealth did not significantly vary, ranging from about $57,000 to $65,000. The motherhood wealth penalty is clear: Single women without children had over nine times more median wealth than single mothers, while the median wealth of single childless men and single fathers of minor children did not significantly differ, indicating there wasn’t a commensurate wealth penalty for fatherhood.

Single Mothers Have Very Little Wealth

SOURCES: Federal Reserve Board’s Survey of Consumer Finances and author’s calculations.

NOTES: Wealth is rounded to the nearest $1,000; 95% confidence intervals are shown by the error bars. The differences in median wealth between the three groups with overlapping error bars does not reach the level of statistical significance. Single mothers had median wealth significantly lower than the other three groups.

Wealth is important for housing and food security, and financial well-being more generally, though it varies considerably by race and ethnicity. Single white mothers had $46,000 in median wealth in 2019, whereas single Black and Hispanic/Latina mothers had about $4,000. Single white mothers thus had about 11 times more median wealth, affording them a more comfortable cushion when dealing with unanticipated events like the pandemic. In 2020, Black and Hispanic/Latina women (ages 25-54) were more likely to be single mothers of children ages 0-17 than were white women; the likelihood of being such a mother was 26%, 19% and 11%, respectively.

Supporting Women Lifts the Workforce and Expands Economic Growth

While the recovery is well underway, there is an opportunity to move beyond returning single mothers to pre-pandemic levels of unemployment, labor force participation and wealth. Society could better imagine how to fully and equitably include mothers in the economy.

Many mothers face powerful headwinds, including wage and wealth motherhood penalties, lower labor force participation rates and unaffordable child care. High inflation is a new hurdle to be jumped, a particularly heavy burden for those of limited means, like single mothers. Addressing these issues, pulling more mothers into the workforce and strengthening their financial resilience could translate into widespread economic and social benefits, including potential gains to gross domestic product.

Notes and References:

- The average cost of child care was $9,142 per child per year in 2019. The standard for affordability is up to 7% of household income. The 2019 Survey of Consumer Finances was used to calculate the share of single mothers who made $130,600 or less in household income.

Citation

Ana Hernández Kent, ldquoSingle Mothers Face Difficulties with Slim Financial Cushions,rdquo St. Louis Fed On the Economy, May 9, 2022.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions