Will the Financial Crisis Further Limit the Fed's Independence? Should It?

The recent recession and financial crisis were, in many respects, the worst since the 1930s.The causes and consequences of the financial crisis have been studied in depth. See the collection of articles and papers listed on the St. Louis Fed's Financial Crisis timeline. In response, some economists and policymakers have begun to examine the Fed's policies prior to and during the financial crisis to see if its goals, responsibilities or its institutional structure should be changed to help prevent another financial calamity.

The Federal Reserve Act of 1913 was designed to balance the competing interests of the public and private sector. Some were afraid of excessive government intervention in private capital markets, while others were worried that the financial sector would have too much influence on the nation's economic well being. In this spirit, the Act also sought to balance the interests of Wall Street (financial) and Main Street (business and agricultural). This system, by and large, has served the country well. Fast forward to 2010. In response to the financial crisis and recession, some people argue that power should be further consolidated in Washington, D.C., to avoid another financial calamity. However, as St. Louis Fed President James Bullard and other Federal Reserve officials and private-sector economists have pointed out, moving the levers of monetary policy even closer to the hub of politics could eventually lead to an erosion of the Fed's independence and, eventually, poor economic performance.See President James Bullard's presentation "The Fed at a Crossroads" (PDF).

Clearly, part of the desire to subject the Federal Reserve to greater political oversight is natural in a democracy—and may even be a healthy rebalancing to correct misplaced priorities or policies. Few would quibble with the argument that, in a democracy, central banks should be held accountable for their policies. Indeed, if the central bank puts in place policies that run counter to its stated goals, then that will damage the credibility of the bank. And to a central bank, credibility is something that is valued highly. If a central bank's policies are not credible, then the bank will eventually lose the support of the nation's policymakers, and maybe its independence.

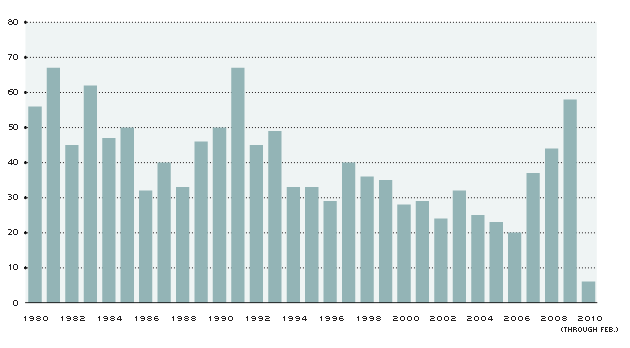

As part of the Fed's accountability to the public, senior Federal Reserve officials testify regularly before Congress. As the accompanying chart shows, the number of Congressional appearances by Federal Reserve officials has increased significantly over the past few years. This development is probably not too surprising given the recent financial market turbulence. In addition, appearances by Federal Reserve officials also tend to be higher during recessions, such as the early 1980s and the early 1990s. Although part of the increase in Congressional appearances over time may reflect a general increase in the number of hearings, it is nonetheless clear that Congress actively scrutinizes the Fed's policies both during times of tranquility and periods of turmoil. The number of appearances over the past three years (2008-2010) is on pace to be the largest in about 20 years.

Congressional Appearances and Testimonies by Federal Reserve Officials, 1980-2010

SOURCE: Data compiled by the Federal Reserve Bank of St. Louis using the Lexis-Nexis Congressional database.

Endnotes

- The causes and consequences of the financial crisis have been studied in depth. See the collection of articles and papers listed on the St. Louis Fed's Financial Crisis timeline.

- See President James Bullard's presentation "The Fed at a Crossroads" (PDF).

Part 1: The Power of Money

Governments have a great power that no one else in the economy has—the ability to print money. This power, however, brings with it a dangerous temptation.

Part 2: Central Bank Independence and Inflation

To minimize the "inflation bias" of of discretionary monetary policymaking, many governments have decided to give their central bank legal independence.

Part 3: A Series of Checks and Balances

While the Federal Reserve was created to run monetary policy, it was given a complicated system of checks and balances.

Part 4: Will the Financial Crisis Further Limit the Fed's Independence? Should It?

As part of the Fed's accountability to the public, senior Federal Reserve officials testify regularly before Congress.

Part 5: A Well-Designed Institution

Over the years, there have been changes in the Fed's structure to improve its independence, credibility, accountability and transparency.

Credits

- Christopher J. Waller, Author

- Kevin L. Kliesen, Contributor

- Steve Greene, Editor

- Brian Ebert, Designer

- Barb Passiglia, Production

- Harry Campbell, Illustrator