Rockets and Feathers: Why Don't Gasoline Prices Always Move in Sync with Oil Prices?

The U.S. Energy Information Administration reported last year that American consumers spent, on average, just under 4 percent of their pretax income on gasoline in 2012—nearly $3,000 per household.1 In the previous 30 years, this percentage was this high only once before—in 2008. Given the impact on the average American's budget, it is important to understand how gasoline prices are affected by fluctuations in oil prices.

A number of economists have studied the manner in which changes in oil prices affect changes in gas prices—the so-called pass-through. The prevailing sentiment is that the pass-through is not symmetric: The speed at which gas prices change differs depending on whether the price of gasoline is relatively high or relatively low compared with the price of oil. Both casual and industry observers say that gas prices adjust to changes in oil prices faster when gasoline prices are relatively low compared with oil than when gasoline prices are relatively high compared with oil. This uneven pass-through can be seen when oil prices rise after being steady for some time—gasoline prices shoot up quickly. In contrast, when oil prices fall after being steady for some time, gasoline prices retreat slowly. In the gasoline industry, this phenomenon is known as "rockets and feathers."

Although crude oil prices are determined in a more-or-less centralized market, retail gasoline prices vary by season and by location, depending on supply, demand, inventories, regulations and—in particular—taxes. The formulation for gasoline can also vary over time, across seasons and across locations, depending on environmental regulation and the average temperatures during the winter and summer. Therefore, the sensitivity of gas prices to oil prices may vary across cities and over the seasons.

We reviewed some of the academic work measuring pass-through when gasoline prices were high relative to oil prices and vice versa, and we investigated whether oil price pass-through to national gasoline prices was different in these cases. We also considered how the pass-through changes across the seasons by assessing whether gasoline prices change more rapidly during certain months of the year. Finally, we considered how the pass-through varies across the country and whether location can alter the degree of asymmetry in gasoline's responsiveness to oil prices.

Asymmetric Pass-through

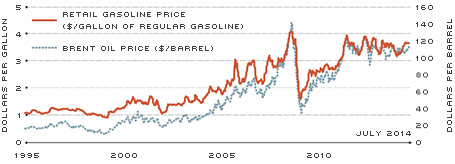

Crude oil—the main component of gasoline—makes up nearly 70 percent of the pump price of regular gasoline.2 Therefore, it is not surprising that the per gallon price of retail gasoline follows a similar pattern to the price of crude oil. Figure 1 shows the monthly national average price of regular unleaded gasoline per gallon in dollars (left axis) from January 1995 to July 2014, along with the price of oil per barrel in dollars (right axis). We plotted the price of Brent crude instead of the more familiar price of West Texas Intermediate (WTI) because the two series recently diverged (see sidebar) and gasoline prices—particularly, the national average—appear to have been more closely tied to Brent.

Oil and Gas Prices

SOURCE: U.S. Energy Information Administration and The Wall Street Journal.

Figure 1 demonstrates the co-movement between the two series. Fluctuations in oil prices are closely mimicked in the retail gasoline market with a common upward trend in both series, suggesting that the prices of oil and gas are related in the long run. Despite this long-run relationship, the two prices can independently move around their long-run ratio in the short run. We estimate that a $10 rise in the price of a barrel of oil is correlated with an approximately 25-cent increase in the price of a gallon of gasoline adjusted for taxes and markups, which are (relatively) constant over time. If the ratio between the adjusted price of gasoline to the crude oil price (25 cents per $10) falls too out of line with this long-run relationship, gasoline prices will tend to adjust to return to this ratio.

Although oil and gas prices appear to move together, the speed at which changes in the upstream price (oil) affects the downstream price (gasoline) can vary.3 The adjustment process back to the long-run relationship may depend on whether gasoline prices are above or below their long-run ratio with oil prices. Economists who have studied gasoline prices have generally found that gasoline prices adjust faster when they are low relative to oil prices than when they are high relative to oil prices. According to economists Severin Borenstein, A. Colin Cameron and Richard Gilbert, two major factors cause asymmetric pass-through: seller market power and supply chain shocks.

Seller market power implies that retail gasoline markets are not perfectly competitive: Opportunities exist for retailers to take advantage of price changes to maintain a higher overall profit. For example, Borenstein, Cameron and Gilbert noted that retailers increased gasoline prices as oil prices rose to keep a constant margin. When prices fell, retailers adjusted prices downward slower because consumers were already accustomed to the higher prices.

One factor that influences market power is market concentration: Gas stations that are physically close together have less market power than do gas stations that are farther apart. To illustrate, a 2008 study of the Southern California gasoline market by economist Jeremy A. Verlinda found that a rival gas station in "immediate proximity" reduced the difference in the size of the response of gas prices to positive vs. negative changes in oil prices. Economist Matthew Lewis suggested that asymmetric pass-through is possible because of consumers' slow processing of gasoline price information. Since people do not tend to observe gasoline prices until they are ready to refuel their gas tanks, consumer expectations may be slow to adjust to pricing changes, allowing prices to remain relatively high.

Supply chain disruptions, such as Hurricane Katrina's effect on refining in the Gulf of Mexico, can also affect oil price pass-through because refineries can use pricing to control their inventories. Because gasoline has a finite supply, refineries can accommodate anticipated gasoline shortages by raising prices in order to cut consumption. For example, in a 2011 study of weekly national data, economists Stanislav Radchenko and Dmitry Shapiro found that retail gasoline prices increased 0.52 percent within the first week of an anticipated increase of 1 percent in oil prices, while they fell 0.24 percent within the first week of an anticipated decrease of 1 percent in oil prices.4

We measured the asymmetric response of gasoline prices to fluctuations in the pass-through by considering separately the months in which the adjusted average national retail gasoline price to oil price ratio was either above or below 25 cents to $10. Consistent with much of the literature, we found a small difference in the speed at which gasoline prices were attracted to the long-run ratio depending on whether prices were above or below this ratio.

Pass-through during Different Seasons

Gasoline prices vary seasonally. Anecdotal evidence suggests gasoline prices in the United States rise during the spring, up until Memorial Day weekend. After that point, they remain higher throughout the summer, typically spike again before Labor Day weekend and then retreat in the fall. For example, between 1995 and 2014, retail gasoline prices rose, on average, 0.4 percent (1 cent per gallon) during the two weeks prior to Memorial Day and 1.6 percent (3 cents per gallon) during the two weeks prior to Labor Day.

While much of these price changes can be attributed to increased demand from summer driving, gasoline prices may exhibit some seasonality because of a change in the cost of production due to changes in composition: The gasoline used in many areas is cheaper in the winter because it is, essentially, a different product. Average winter and summer temperatures dictate some of the changes in gasoline formulation; environmental regulation is another determinant. Some areas allow alternative ingredients in the winter that are cheaper to produce, but contribute more to pollution. During the summer, the use of these alternative ingredients is more restricted. During the summer in warmer areas, gasoline sometimes requires additives that reduce the vapor pressure and make the gasoline less volatile, as well as less susceptible to evaporation in the gas tank. Because summer gasoline is more costly to produce, the prices during the spring and summer, when these products are used, will naturally be higher.5

We examined whether the pass-through asymmetry varies over the seasons. To this end, we separated the data into observations occurring during the months of October to March and observations occurring during the months of April to September.6 We calculated asymmetry for each sample, thus letting the asymmetry differ both when gas was above/below the long-run ratio and across seasons.

By splitting the sample into summer and winter months, we found more evidence of asymmetry. During the winter, the rate at which gas prices are pulled down by oil prices appeared to be higher than it was during the summer. Moreover, splitting the sample by season appeared to amplify the asymmetry, which appeared to be higher during the high-demand summer season and when the cost of gasoline production was higher.

Pass-through across Cities

Gasoline prices differ by location for a number of reasons. Variation in taxes accounts for a substantial portion of the difference. Differences in supply can vary because of the costs of moving gasoline from the refinery to the retail location. Demand can vary because of commuting patterns, a city's population density, the quality and use of public transportation, total population, and other factors. We suggested above that production costs can cause pricing differentials; thus, variations in weather—in particular, average summer and winter temperatures—across cities can cause differences in the price of gasoline.

In a 2012 paper, economist Matthew Chesnes studied 27 cities and confirmed the existence of asymmetric pass-through in the gasoline market. He found that the type of fuel used in each city was important for determining the magnitude of the asymmetry: Cities selling predominantly conventional gasoline (St. Louis and Louisville, Ky., for example) were less asymmetric in adjusting to the long-run ratio than were other cities where reformulated gasoline was sold.

The sensitivity of gas prices to oil prices may also vary across cities depending on market power (or concentration). In a 2008 study, economist George Deltas argued that states with higher average seller margins on gasoline (which implies fewer sellers) had more asymmetric pass-through in levels and a slower speed of adjustment to the long-run ratio.

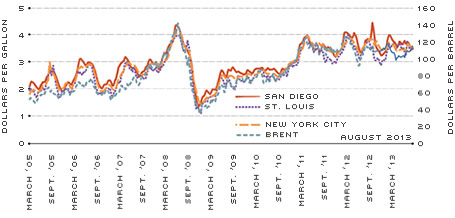

We calculated pass-through across 162 cities using weekly pretax retail gasoline prices and the Brent oil price from 2005-2013. Because taxes are often assumed to be the principal source of the variation in gasoline prices across cities, we constructed the pretax retail price of gasoline to measure pass-through at the city level. Thus, our local retail gasoline price series excludes national, state and local gasoline-specific excise taxes, as well as local environmental regulation fees and sales taxes imposed on gasoline. Figure 2 shows the time series of pretax gasoline prices for three cities in our sample: New York, San Diego and St. Louis.7 The cities were chosen to highlight the regional differences in gasoline price dynamics. As one might expect, the gasoline prices in different cities had similar fluctuations, induced, for the most part, by fluctuations in oil prices. However, there were also notable differences: Even after adjusting for taxes, San Diego and New York had higher prices than cities in the Midwest (e.g., St. Louis) possibly due to differences in proximity to Cushing, Okla., (the source for WTI crude oil) or due to differences in gasoline composition.

Gas Prices across Select Cities

SOURCES: The Wall Street Journal, Gas Buddy and author's calculations.

When we analyzed the relationship between retail gasoline prices and crude oil prices at the city level, we found two main differences. First, the long-run relationship between gasoline and oil could vary across cities. Second, the effect of changes in oil prices on gasoline could vary across cities. As to the former, we found relatively similar long-run relationships between gasoline and oil across cities. The main difference across cities was in how gasoline prices were adjusted for different taxes in the long-run ratio. Cities exhibited a variety of degrees of asymmetry; among the most asymmetric were Anchorage, Alaska; Bakersfield, Calif.; and Colorado Springs, Colo. In addition, the responsiveness of gas prices in the various cities differed. For example, Sacramento, Calif., was about three times faster to adjust to the long-run ratio than was Boise, Idaho.

Conclusion

The market for gasoline is local, with variations in market concentration, demand, regulation and taxation. Thus, it may not be surprising that we found more asymmetry at the local level than at the national level.

What does the presence of the asymmetry mean for consumers and policymakers? Awareness of the apparent asymmetry can help consumers better forecast (and budget for) gasoline expenditures. Further study is needed to understand the origin of the asymmetry and its consequences for the overall welfare of the economy.

Endnotes

- See www.eia.gov/todayinenergy/detail.cfm?id=9831. [back to text]

- See www.eia.gov/petroleum/gasdiesel. [back to text]

- The total effect of oil price fluctuations on gasoline prices cannot vary lest the long-run relationship between the two prices breaks down. [back to text]

- The evidence for asymmetry is by no means conclusive. In two studies, one by economists Lance J. Bachmeier and James M. Griffen and the other by economist Christopher C. Douglas, no evidence was found that gasoline prices adjust back to the long-run relationship asymmetrically. [back to text]

- See http://blog.gasbuddy.com/posts/A-crash-course-on-seasonal-gasoline/1715-401024-239.aspx for a good summary of the differences in the composition of gasoline across the seasons. [back to text]

- These cutoffs are fairly arbitrary and may not reflect the true differences in the seasonality. [back to text]

- The St. Louis metro area includes parts of Southern Illinois. As such, taxes have been removed using a weighted average of the tax rates across the states and local municipalities. [back to text]

References

Bachmeier, Lance J.; and Griffen, James M. "New Evidence on Asymmetric Gasoline Price Responses." The Review of Economics and Statistics, August 2003, Vol. 85, No. 3, pp. 772-76.

Borenstein, Severin; Cameron, A. Colin; and Gilbert, Richard. "Do Gasoline Prices Respond Asymmetrically to Crude Oil Price Changes?" The Quarterly Journal of Economics, February 1997, Vol. 112, No. 1, pp. 305-99.

Chesnes, Matthew. "Asymmetric Pass-through in U.S. Gasoline Prices." U.S. Federal Trade Commission Bureau of Economics Working Paper No. 302, September 2012.

Deltas, George. "Retail Gasoline Price Dynamics and Local Market Power." The Journal of Industrial Economics, September 2008, Vol. 56, No. 3, pp. 613-28.

Douglas, Christopher C. "Do Gasoline Prices Exhibit Asymmetry? Not Usually!" Energy Economics, July 2010, Vol. 32, No. 4, pp. 918-25.

Lewis, Matthew S. "Asymmetric Price Adjustment and Consumer Search: An Examination of the Retail Gasoline Market." Journal of Economics and Management Strategy, Summer 2011, Vol. 20, No. 2, pp. 409-49.

Radchenko, Stanislav; and Shapiro, Dmitry. "Anticipated and Unanticipated Effects of Crude Oil Prices and Gasoline Inventory Changes on Gasoline Prices." Energy Economics, July 2011, Vol. 33, No. 5, pp. 758-69.

Verlinda, Jeremy A. "Do Rockets Rise Faster and Feathers Fall Slower in an Atmosphere of Local Market Power? Evidence from the Retail Gasoline Market." The Journal of Industrial Economics, September 2008, Vol. 56, No. 3, pp. 581-612.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us