After a Start That Was Lackluster, the Economy Improves

U.S. economic conditions have improved since our last report in July. Paced by healthy job growth, solid increases in household consumption expenditures, further gains in the housing and commercial real estate sectors, and continued low inflation, there is a high probability that real gross domestic product (GDP) growth in the third quarter will be much stronger than its average over the first half of this year. Indeed, professional forecasters see solid growth, low inflation and healthy labor markets carrying into the fourth quarter of 2016 and the first half of 2017. But, as with any forward-looking view of the economy, one must attempt to determine—as much as possible—whether the evolving data suggest either stronger or weaker outcomes than the forecast consensus.

What We Know—or Think We Know

Over the first half of the year, real GDP increased at a tepid 1 percent annual rate, and the all-items (headline) personal consumption expenditures price index (PCEPI) rate rose at a 0.3 percent annual rate. These increases were substantially smaller than forecasters were expecting in late 2015. Weaker-than-expected real GDP growth over the first half of the year largely reflected unexpected weakness in real business and residential fixed investment and a sizable inventory correction, while lower inflation reflected declines in food prices and the lagged effects of the sharp decline in crude oil prices from June 2015 to February 2016.

Although third-quarter data are incomplete at the time of this writing, the available evidence suggests a high probability that real GDP growth in the third quarter will be appreciably stronger than over the first half of the year. Part of this acceleration reflects the likely end of the inventory correction that has been underway for more than a year. Briefly, the demand for goods was weaker than expected, so firms slowed production and used available inventory stocks to help meet existing demand. The net effect was a decline in inventory investment and weaker real GDP growth. Over the first half of 2016, real private inventory investment subtracted 0.8 percentage points from real GDP growth.

As the U.S. economy transitioned to the second half of the year, the economic landscape importantly suggested that consumer spending would remain vibrant. This vibrancy reflects many factors, including the likelihood of continued healthy job gains, faster growth of nominal wages and salaries, and an expectation of weaker gasoline prices that helps to boost consumer purchasing power.

Of course, there are risks to any forecast, and the unexpected weakness in August retail sales was worrisome. With sentiment among homebuilders and potential homebuyers remaining elevated, it is likely that real residential fixed investment will also strengthen over the near term. Indeed, housing starts and new-home sales in 2016 are on pace to be the strongest since 2007. Similarly, business fixed investment should rebound. However, surveys of business executives suggest that the boost to capital spending will be modest because a large percentage of firms remain reluctant to expand in the face of higher-than-average levels of uncertainty about the health of the global economy and the near-term direction of economic policy.

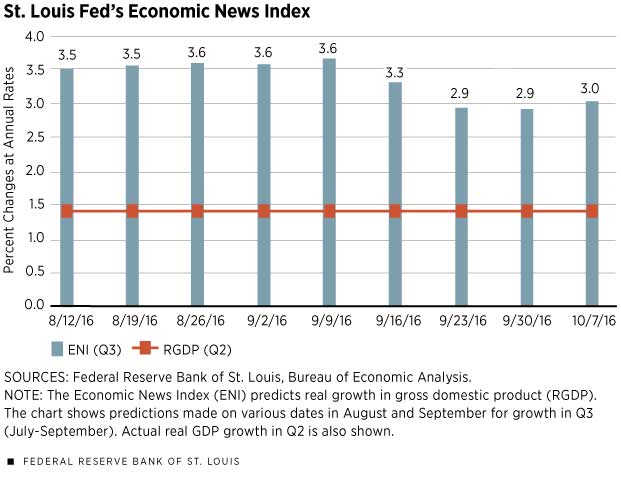

The St. Louis Fed has developed a new tool that uses these and other monthly data flows to forecast the growth of real GDP during the current quarter for which the official estimate is not yet available. This new tool is termed the Economic News Index (ENI).1 As of early October, the ENI predicts that real GDP growth will be about 3 percent in the third quarter. But even with this surge in growth, real GDP over the past year will have increased by only 1.5 percent. Unless labor productivity begins to accelerate, real GDP growth is likely to remain about 2 percent for the foreseeable future, which is consistent with the St. Louis Fed’s new characterization of the economic outlook and the latest economic projections of the Federal Open Market Committee.2

Inflation, Where Art Thou Inflation?

Inflation pressures rebounded in August after easing in July. Still, with the PCEPI up by only 1.0 percent over the past year, inflation is likely to be only modestly higher than last year’s 0.6 percent increase. This outcome reflects three key factors. First, despite higher-than-average inventories of crude oil and gasoline, oil prices have drifted higher and could boost inflation pressures over the second half of the year. Second, food prices have declined thus far in 2016 and show few signs of rebounding. Finally, inflation expectations remain low and stable. The St. Louis Fed’s inflation prediction model indicates a 52 percent probability that inflation will be between zero and 1.5 percent over the next 12 months.

Endnotes

- For more information on the ENI, see an article in the April 2016 Regional Economist at https://www.stlouisfed.org/publications/regional-economist/april-2016/tracking-the-us-economy-with-nowcasts. [back to text]

- See https://www.stlouisfed.org/~/media/Files/PDFs/Bullard/papers/Regime-Switching-Forecasts-17June2016.pdf. [back to text]

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us