Terrorism: A Threat to Foreign Direct Investment

Terrorism around the world is a problem for foreign direct investment (FDI). For example, a multinational corporation based in the U.S. may find a location in India to be attractive for setting up a plant because of the abundance of cheap and well-trained labor there. However, if that area is also a potential location for insurgency and terrorism, the multinational will have to weigh the benefits from lower wage costs against the possibility of loss of plant, manpower and equipment from terrorist attacks. On aggregate, a higher incidence of terrorism (as perceived by potential investors) will tend to reduce their willingness to invest in a terrorism-infested area.1

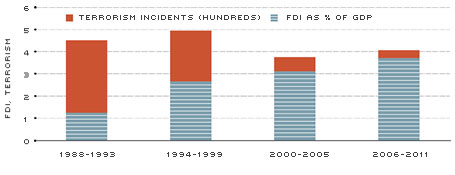

Let us consider the case of Colombia, which was notorious for drug violence and terrorism in the 1980s and 1990s. In more recent years, Colombia has seen significant declines on these fronts. The figure shows that as terrorism has fallen, FDI has risen. Without careful analysis, we cannot suggest this apparent relationship as causal; however, a link is possible. Fortunately, the literature in this area includes careful studies on the link between terrorism and FDI, studies that have employed rigorous economic theory and econometric methods. The rest of this article provides a sample of this research.

Foreign Direct Investment (FDI) and Terrorism in Colombia

NOTE: Data are averaged over six-year nonoverlapping periods from 1988 to 2011, which gives us four time periods. Terrorism incidents include domestic, transnational and other acts of terrorism that cannot be unambiguously assigned to either of these two categories.

SOURCES: FDI-World Development Indicators (2013); Terrorism-Global Terrorism Database, University of Maryland, College Park.

Impact in Spain, Greece

A 1996 study by economists Walter Enders and Todd Sandler is one of the first to quantify the effect of terrorism on FDI. Their study investigated how transnational terrorism had affected FDI flows into Spain and Greece.2 Using net annual foreign direct investment (NFDI) data from the mid-1970s through 1991, they found that terrorist incidents reduced NFDI in Spain by 13.5 percent and in Greece by 11.9 percent. The authors noted that these reductions amounted to 7.6 percent and 34.8 percent of annual gross fixed capital formation for Spain and Greece, respectively. Clearly, this means that terrorism had a major negative effect on capital formation in these nations and, in turn, on their potential for economic growth.

Impact on FDI from the U.S.

A large number of transnational terrorist attacks on the U.S. are conducted against U.S. interests in foreign nations. This is likely to raise the risks for U.S. corporations doing business abroad. In a 2006 study, Enders, Sandler and fellow economist Adolfo Sachsida investigated how terrorism in other nations may have affected FDI from the U.S. into these nations. They found that terrorist attacks lowered U.S. FDI by 1 percent in nations that belong to the Organization for Economic Cooperation and Development (OECD) but had no statistically significant effect in non-OECD nations. Greece and Turkey (OECD members) suffered relatively large damages, amounting to U.S. FDI reductions of 5.7 percent and 6.5 percent, respectively.

Diversion of FDI

Some studies have argued that terrorist attacks usually destroy only a small fraction of the capital stock of a nation and, therefore, are unlikely to cause major economic damage. A 2008 study by economists Alberto Abadie and Javier Gardeazabal found otherwise. They showed that even when the direct damage to a nation's capital stock is not large, the eventual, overall impact may be large because, for example, fearful foreign investors divert their money to other nations. This diversion can result in a large loss of investment. Using a cross-sectional study, the economists found that a one-standard-deviation increase in the intensity of terrorism in a particular nation can reduce the net FDI position of that nation by approximately 5 percent of its GDP, a large impact.

Threat to Developing Nations

FDI is considered to be a major source of foreign capital and technology to support economic growth in developing countries. If terrorism reduces FDI flows into these nations, their growth and development can be stymied. This poses a challenge for economists who provide policy advice to international donor agencies like U.S. Agency for International Development and the World Bank.

In their 2014 study on this issue, economists Subhayu Bandyopadhyay, Javed Younas and the aforementioned Sandler focused on 78 developing countries over the period 1984-2008. The authors found that both domestic and transnational terrorism significantly depressed FDI in developing countries. A one-standard-deviation increase in domestic terrorist incidents per 100,000 people reduced net FDI between approximately $324 million and $513 million for the average sample country, whose GDP totaled $70 billion. A one-standard-deviation increase in transnational terrorist incidents per 100,000 people reduced net FDI between approximately $296 million and $736 million at the same level of GDP. The loss of FDI, however, was much smaller when it was calculated at the median value of GDP ($10.4 billion) in the sample.

Many of the terrorism-afflicted nations are poor and lack vital resources that can be used for counterterrorism. This problem can be partly alleviated by foreign aid. Bandyopadhyay et al. found in their study earlier this year that foreign aid can help in this regard and that the evidence suggests significant terror-mitigating effects on FDI.

For example, the aforementioned lower estimate of FDI loss from domestic terrorism of $324 million is reduced to about $113 million for the average aid-receiving nation, while the lower estimate for transnational terrorism is reduced to about $45 million from $296 million.3

As the World Shrinks

In an integrated global economy, terrorism presents policy challenges both at home and abroad. The July 2014 downing over Ukraine of a Malaysian jet carrying Dutch passengers (for the most part) was a stark reminder of this interconnectedness. Accordingly, U.S. policymakers involved with counterterrorism remain vigilant about terrorism in the U.S. and abroad. By focusing on the existing literature on FDI and terrorism, we can see that policy efforts targeted at reducing terrorism can provide substantial economic benefits to the terrorism-afflicted nations.

The literature also points to the important role that foreign aid may play in terms of containing terrorism and boosting the growth potential of developing nations. The literature on foreign aid has increasingly focused on security concerns rather than on a recipient nation's economic need as a motive behind giving foreign aid.4 Along similar lines, the aforementioned 2014 study by Bandyopadhyay et al. suggests that foreign aid may be motivated by, among other things, substantial economic benefits in terms of greater FDI flows to nations with reduced terrorism.

Endnotes

- Among others, a 2008 paper by economists Abadie and Gardeazabal shows that a greater intensity of terrorism increases the variance of the return to investment while reducing its mean. Clearly, a lower average rate of return to investment in a nation will tend to reduce potential FDI into that nation. [back to text]

- When a terrorist incident in a certain country involves citizens or property of another country, it is considered to be transnational terrorism. [back to text]

- The Bandyopadhyay et al. analysis presents a theoretical model in which aggregate aid has unconditional aid and aid tied to counterterrorism as its two components. The theoretical analysis shows that tied aid can reduce the adverse effect of terrorism on FDI. The econometric analysis motivated by this model finds significant benefits of foreign aid in terms of reducing the damages to FDI from terrorism. [back to text]

- For details on security concerns as a donor motive, see the 2013 study by Bandyopadhyay and Vermann. [back to text]

References

Abadie, Alberto; and Gardeazabal, Javier. "Terrorism and the World Economy," European Economic Review, January 2008, Vol. 52, No. 1, pp. 1-27.

Bandyopadhyay, Subhayu; Sandler, Todd; and Younas, Javed. "Foreign Direct Investment, Aid, and Terrorism," Oxford Economic Papers, January 2014, Vol. 66, No.1, pp. 25-50.

Bandyopadhyay, Subhayu; Vermann, E. Katarina. "Donor Motives for Foreign Aid," Federal Reserve Bank of St. Louis Review, July/August 2013, Vol. 95, No. 4, pp. 327-36.

Enders, Walter; Sachsida, Adolfo; and Sandler, Todd. "The Impact of Transnational Terrorism on U.S. Foreign Direct Investment," Political Research Quarterly, December 2006, Vol. 59, No. 4, pp. 517-31.

Enders, Walter; and Sandler, Todd. "Terrorism and Foreign Direct Investment in Spain and Greece," Kyklos, August 1996, Vol. 49, No. 3, pp. 331-52.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us