District Overview: Student-Loan Debt in the District—Reasons behind the Recent Increase

The aggregate value of outstanding debt from student loans in the U.S. has grown to about $1 trillion and is now greater than both credit card debt ($670 billion) and auto debt ($810 billion). This amounts to about $3,185 per capita.1 Recent trends suggest that college-loan balances will continue to expand at a rapid pace. Over the past decade, the college tuition and fees component of the consumer price index increased by 6.4 percent per year, while the broader index increased by only 2.4 percent per year. Over the same period, college enrollment increased by 37 percent,2 and, according to the Project on Student Debt, about two out of every three college graduates had student-loan debt, with an average balance of about $27,000.3

Large student-loan balances may have long-term economic consequences, as new graduates saddled with debt may struggle to make payments, fail to save for down

payments on a home or be unable to get a loan to buy a car. On the other hand, the lifetime return on investment (ROI) for higher education tends to be significant,

typically measured as higher income and lower levels of unemployment. As long as an ROI for education exists, families may see a benefit in taking on debt to pay for college.4 However, college graduation and a higher-paying job are not guaranteed; as a result, the long-term economic impact of the growing debt for attending college

is somewhat unclear.

In this article, we look at the growth in student-loan debt in the states that constitute the Federal Reserve's Eighth District.5 We examine possible factors that may explain why the amount of student-loan debt has expanded, and we consider how differences in tuition growth and college-enrollment growth may cause variation across states.6

The table's three columns under "Debt Growth" indicate growth in debt per capita of individuals aged 25-34 in each of the Eighth District states, as well as in the United States, between 2005 and 2013.7 Between these two years, average debt per capita in the U.S. grew by 140 percent, to $9,894 as of the first quarter of 2013. On average, the increases in student debt since 2005 were larger for Eighth District states than for the nation. In Kentucky, debt per capita more than tripled, while Missouri experienced the slowest growth, at 120 percent. Debt balances are roughly 25 percent of per capita income in the corresponding states, ranging from $8,430 in Arkansas to $11,236 in Illinois.

The Margins

To better understand this rapid growth in student debt and the variation across states, we break the growth down along two lines (or margins): the extensive margin and the intensive margin. The extensive margin measures the effect of more people taking on debt, due to factors such as higher levels of college enrollment. The intensive margin assumes the same number of borrowers and measures the effect of people borrowing more money, which can be due to factors such as higher education costs.

Several other factors may cause student-debt balances to rise.8 Along the extensive margin—the number of borrowers with debt—there was a significant increase across all of the District's states in the share of those 24-35 who have student debt. This may be driven by a variety of factors, including population growth, more students going to college and a higher percentage of enrollees taking on debt. The nation overall witnessed a 13.7-percentage-point increase from the first quarter of 2005 to the first quarter of 2013. (See the third column under "Debt Growth.") With the exception of Missouri, all states witnessed larger percentage-point increases than the U.S. overall during the same time period. Indiana had the largest—an increase of 19 percentage points of those who had student debt on their credit reports.

A large proportion of the increase may be attributed to changes in enrollment (reported under the "Enrollment Growth" heading of the table). Enrollment has been on the rise in the Eighth District, as well as in the nation, according to the Integrated Postsecondary Education Data System (IPEDS), which is compiled by the National Center for Education Statistics (NCES). Between 2005 and 2010, U.S. enrollment at four-year public and private, nonprofit institutions increased by 14.1 percent and 12.7 percent, respectively. Enrollment growth in public two-year colleges was considerably higher, at 20.6 percent.

The states that make up the Eighth District also experienced significant increases. For public four-year colleges, Arkansas had the largest increase in enrollment (21.1 percent), and Illinois had the smallest increase (5.8 percent). As for enrollment at private, nonprofit four-year institutions, Tennessee reported the largest increase in enrollment (23 percent), and Indiana had the smallest (4.9 percent). At public two-year schools, Indiana had enrollment growth of 71.1 percent—higher than any other District state or the national average.

On the intensive margin, debt per borrower of those aged 25-34 has gone up in all of the District's states. With the exception of Missouri and Illinois, these states have seen larger increases in debt per borrower than the nation overall. (See the second column under "Debt Growth.") However, the debt per borrower in each of the states, except Illinois, was less than the national average. When comparing debt per borrower to debt per capita, the national debt per capita grew at almost three times the national debt per borrower. This suggests that the majority of debt growth (in nominal terms) is stemming from the extensive margin (or from more people borrowing), rather than from borrowers taking on more debt.

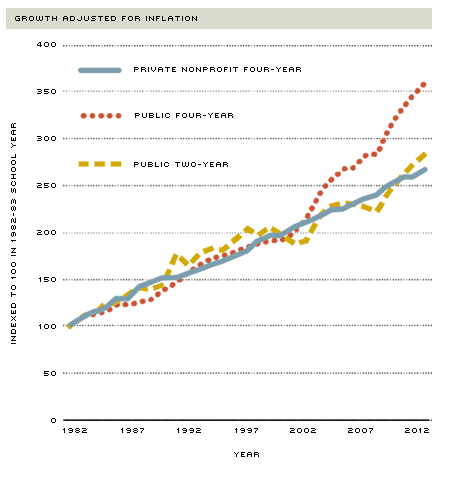

While additional borrowing can be driven by many factors, such as lower incomes or the loss of home equity, higher tuition rates are commonly cited. The chart shows the real (adjusted for inflation) growth in U.S. enrollment-weighted tuition and fees since 1982. Tuition growth has outpaced the rate of inflation by a significant amount over that time period for both public and private institutions; tuition costs have gone up particularly fast at public four-year institutions since 2002. While the debt data in our sample do not identify the state where a borrower attended school, data from the Digest of Education Statistics indicate that 81 percent of students in our sample of states remain in-state for their college education. This indicates that we may expect to see some relationship between tuition growth and amount borrowed.

The right three columns of the table include the enrollment-weighted tuition growth between the 2004-2005 school year and the 2012-2013 school year for various classifications of college institutions. Missouri had the smallest increase—25 percent—in public four-year tuition, according to College Board data. Kentucky had the largest increase at 47.1 percent. On an absolute level (not reported), Mississippi had the lowest tuition levels for both public four-year and private four-year nonprofit universities. The data suggest a positive relationship between the growth in debt per borrower and tuition growth. Kentucky had the fastest debt growth per borrower at 66.6 percent, as well as the fastest growth in public and private four-year tuition rates. On the other hand, Missouri had the slowest debt growth per borrower at 45.3 percent, as well as the slowest growth in public two- and four-year tuition rates. This evidence is not conclusive, but does suggest that differences in growth in the public-tuition rate can explain some of the differences in student-debt growth across states in the Eighth District.

Changes in the composition of enrollment also interact with tuition to explain the disparities in debt growth per borrower. If a larger proportion of new students are attending private schools, this may have the effect of increasing the average debt per borrower. Holding enrollment constant, an increase in the relative number of students going to more-expensive schools will increase the total amount of tuition paid. This, of course, assumes that financing patterns are similar between public and private university students, which may not be the case.

Other Factors Affecting Student-Debt Levels

Other reasons abound for increases along both margins. For example, decreased access to other forms of credit may be driving some of the student-debt increases. With the collapse of other forms of debt, college students and their families may be substituting student loans for other forms of debt. Additionally, tough economic times and high rates of unemployment among young adults have pushed many borrowers into varying degrees of forbearance, deferment and delinquency. Since previous vintages of loans are not being paid back as quickly, this can have the effect of increasing the aggregate balance of loans.

Conclusion

Student debt has been increasing in the Eighth District as a whole. We have documented a few of the factors that have been driving these increases, as well as the heterogeneity across the District's states in terms of tuition and enrollment dynamics. Further disentangling what has altered these factors requires thoughtful analysis. Tuition and enrollment are likely driven by factors such as the college-wage premium, availability of alternatives, state funding and access to credit. Grasping the interplay among these factors should lead to better-informed policy decisions in the future.

U.S. Tuition Changes since 1982

SOURCES: Trends In College Pricing (2012) based on The College Board, Annual Survey of Colleges; NCES, IPEDS.

Endnotes

- For every person (16 and older) in the U.S. Be aware that some figures later in this article are per borrower; they are marked as such. [back to text]

- From 2000-2011. See http://nces.ed.gov/programs/digest/d12/tables/dt12_223.asp. [back to text]

- The Project on Student Debt. See http://ticas.org/sites/default/files/pub_files/classof2011.pdf. [back to text]

- See Canon and Gascon for more on the returns to higher education and the associated risks. [back to text]

- Throughout the article, we report results at the state level, not just the portion of the state located in the Eighth District. [back to text]

- Among our sample of states, about 81 percent of students attend college in their home state; so, conclusions linking residents' debt growth to state education statistics hinge on the assumption that students are being educated in their home state. [back to text]

- The per capita estimates are based on only those individuals with a credit report. [back to text]

- Cross-dataset comparisons are incompatible in several ways. The Equifax data are based on the current location of the individual, which may or may not be in the same state as the institution he or she attended. Conversely, the IPEDS and College Board data are by the location of the reporting institution. [back to text]

References

Canon, Maria; and Gascon, Charles. "College Degrees: Why Aren't More People Making the Investment?" The Federal Reserve Bank of St. Louis' The Regional Economist, Vol. 20, No. 2, April 2012, pp. 4-9.

College Board, "Trends in College Pricing." 2012. College Board Advocacy and Policy Center. See http://trends.collegeboard.org/sites/default/files/college-pricing-2012-full-report-121203.pdf.

Federal Reserve Bank of New York, "Quarterly Report on Household Debt and Credit." May 2013. See https://www.newyorkfed.org/medialibrary/media/research/

national_economy/householdcredit/DistrictReport_Q12013.pdf.

National Center for Education Statistics, "Digest of Education Statistics 2011." Table 232. See http://nces.ed.gov/programs/digest/d11.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us