National Overview: Economy Still Growing albeit at a Tepid Pace

The U.S. economy continued to grow in the second quarter of 2012, but its growth remained lackluster. After increasing at a 2 percent annual rate in the first quarter, real (inflation-adjusted) GDP rose at an anemic 1.7 percent rate in the second. This slowdown affected labor markets. In the second quarter, job growth slowed considerably, and the unemployment rate began to inch upward after falling to a three-year low of 8.1 percent in April. But there are pockets of good news. Housing is on the mend, stock prices are rising, employment gains in July and August are tracking above their second-quarter average, and inflation is easing. On net, though, forecasters generally expect relatively weak real GDP growth and a stubbornly high unemployment rate to persist for the remainder of this year and into most of next year.

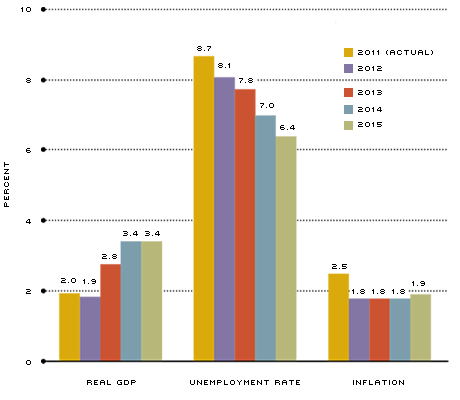

FOMC Sept. 2012 Economic Projections for 2012-2015

NOTE: Projections are the midpoints of the central tendencies. The unemployment rate is the average for the fourth quarter of the year indicated.

Reading the Tea Leaves

When attempting to gauge the direction of the economy over the next few quarters, economists often perform three assessments. First, is the economy's momentum slowing or accelerating? Second, how are current developments affecting this momentum, and how long might they persist? Finally, what are the risks to the outlook, that is, what could happen to produce either faster- or slower-than-expected growth or inflation? Based on this exercise, what is the near-term outlook for the economy?

Slo-mo

The economy's momentum has been fairly weak during this expansion. Since the beginning of the recovery in the third quarter of 2009, real GDP growth has averaged about 2.25 percent per quarter. The current expansion is the weakest during the post-World War II period. This performance is perhaps even more remarkable given the ultra-expansionary monetary and fiscal policies enacted over the past few years. Extended periods of weakness raise questions about the economy's underlying growth. In response, businesses can become more reluctant to expand operations.

Similarly, consumers become more cautious—a product of weak growth of real incomes and elevated uncertainty about future job prospects. A myriad of other effects occur. Loan demand becomes sluggish, and banks worry more about the creditworthiness of borrowers. Finally, government expenditures on income-transfer payments remain elevated and tax revenue lags, exacerbating government finances. Eventually, though, the economy will return to its natural (or underlying) rate of growth.1

Recent Developments

Ongoing developments in the economy can keep the economy growing either above or below its underlying trend. Over the past two years, Europe's sovereign debt crisis and, more recently, a sluggish Chinese economy have triggered considerable volatility in U.S. and global stock markets and have tempered the outlook for the global economy. Rising crude oil prices from 2009 to early 2012 have also been a drag on growth. More recently, as noted in minutes of meetings of the Federal Open Market Committee (FOMC), uncertainty about future tax and regulatory policies may have also caused businesses to delay investment projects.

Despite these hiccups, there are parts of the economy that look decent. First, manufacturing growth has been relatively strong during this expansion—particularly in the Midwest. Second, exceptionally low interest rates and a modest upward drift in home prices have pushed many buyers off the fence. In September 2012, homebuilder confidence was at its highest level in more than six years. Finally, inflation pressures have eased over the past few months because of the sharp drop in crude oil prices from early May to late June. They have since rebounded modestly.

The retreat of inflation was a silver lining of the recent slowing in the U.S. and global economy. From July 2011 to July 2012, the Consumer Price Index increased by only

1.4 percent. Although faster U.S. and global growth will likely begin to put upward pressure on oil prices and, thus, inflation, forecasters still generally see inflation coming in about 2 percent in 2013.

Risks to the Outlook

Forecasters regularly attempt to identify threats to their forecasts. In the current environment, a few come to mind. The first is if the European crisis drags on or worsens. A second risk is the possibility of a huge tax increase on Jan. 1, 2013; this would occur if numerous tax cuts are allowed to expire Dec. 31, 2012. Some forecasters believe that this would trigger a U.S. recession in 2013. A third risk concerns the possibility of higher food price inflation because of the U.S. drought.

Finally, an opposite risk is that the economy begins to accelerate rapidly. While welcome, this might lead to a rise in inflation and inflation expectations because of the extremely large amount of monetary stimulus currently in place. Of course, the FOMC would be expected to prevent such an outcome by normalizing the stance of monetary policy in a timely fashion.

Endnotes

- An online-only article accompanying this issue describes the economy's growth process in more detail and offers some explanation for the economy's relatively weak growth during the current expansion. [back to text]

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us