Unconventional Oil Production: Stuck in a Rock and a Hard Place

Highly variable oil prices and increasing world demand for oil have led producers to look for alternative sources of transportation fuel. Two popular alternatives are oil sands (aka tar sands) and oil shale. However, obtaining usable oil from oil sands or oil shale is more capital-intensive and more expensive than obtaining oil from conventional reserves. At what price of oil do these alternatives become cost-effective?

Oil Sands

Oil sands are a mixture of sand, water, clay and heavy, viscous oil called bitumen. The largest known deposits of oil sands are in Alberta, Canada, and the Orinoco Oil Belt in Venezuela. As of 2005, the amount of oil in all oil sands deposits was estimated to be nearly 5.8 trillion barrels (about 2.4 trillion barrels located in each of Canada and Venezuela), with about 0.3 trillion barrels estimated to be recoverable.1 For comparison, an estimated 1.2 trillion barrels of conventional crude oil are recoverable.2

The process to obtain usable oil from oil sands is more complex than drilling the oil from the ground. For reserves close to the surface (e.g., about 20 percent of Canada's total reserves), the oil sands are extracted and transported to another location, where the bitumen is separated from the rest of the matter using a hot water process. Because most refineries are not capable of using bitumen directly, the bitumen then goes to an upgrading facility, where it is turned into a product that refineries can use (such as synthetic crude oil). For deposits more than 250 feet below the surface, the bitumen is extracted directly from the oil sands through various techniques, such as steam-assisted gravity drainage, which is the most common method used in Canada. In this process, producers drill two horizontal wells; the first is injected with steam to heat the bitumen, and the other pumps the heated oil to the surface. In Venezuela, the oil is warmer and less viscous, and, therefore, steam is not necessary. Producers commonly drill multiple horizontal wells and use pumps to send the oil to the surface. The oil obtained by these underground methods is also sent to an upgrading facility.3

Oil Shale

Oil shale is sedimentary rock that contains organic matter—called kerogen—and mineral matter. Kerogen is not actually oil, but it releases a substance similar to oil when heated. An estimated 2.8 trillion barrels of oil existed in known oil shale deposits at the end of 2005, although not all of the kerogen is recoverable. Seventy-four percent of the known deposits are in the United States, primarily the Green River Formation in Wyoming, Utah and Colorado, which is the largest deposit in the world.4

As with oil sands, obtaining usable oil from oil shale is not simple. For more-accessible deposits, the oil shale can be mined by either surface or underground methods. The mined oil shale then undergoes a process called surface retorting, in which it is crushed and heated to about 1,000 degrees F, releasing the oil-like liquid. Because this "oil" is unstable, it goes to an upgrading facility, where it is turned into a stable oil before being sent to refineries.

For less-accessible deposits, the oil shale may be heated where it is, and the liquid that is released is transported to a separate facility and upgraded to a stable oil. A process developed by Shell Oil called the In situ Conversion Process could potentially create stable oil directly and, thus, bypass the upgrading step. In this process, the oil shale is electrically heated for two to three years until it reaches about 700 degrees F, and the released liquid is collected. The company uses a "freeze wall" around the perimeter to keep out groundwater and to keep in the heated products. So far, Shell has successfully tested its process on only a small scale.5

High Cost and Other Issues

Because of the extra steps and capital needed to produce a usable product, the cost of producing a barrel of oil from oil sands and oil shale is higher than from crude oil reserves. Therefore, the unconventional oil requires a higher price per barrel to be cost-effective. Existing Canadian oil sands operations could continue even if the price of oil is less than $50 per barrel, according to a recent report. But for the Canadian oil sands industry to grow, oil must be at least $70 per barrel to make production economically feasible.6

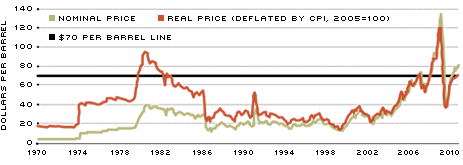

A 2005 study examined the possible development of an oil shale industry in the United States. For a new operation using the mining and surface retorting method, a barrel of oil must cost at least $70 to $95 (in 2005 dollars) for the business to be economically feasible.7 As shown in the chart, the real price of West Texas Intermediate crude oil has not regularly sustained a price of $70 over the past 10 years. Prices must consistently remain greater than the cost-effective threshold in order for an unconventional oil industry to be feasible.

Spot Price of West Texas Intermediate Crude Oil

SOURCES: The Wall Street Journal (oil price) and Bureau of Labor Statistics (Consumer Price Index—CPI).

In addition to high production costs, environmental issues pose a potential problem for these alternative oil production methods, as discussed in two studies from 2005. Concerns about the effects on air, water and land quality have been raised. For example, the greenhouse gas emissions for oil sands production are three times higher than for conventional oil production in Canada. Additionally, Alberta produces more air pollution than any other Canadian province, and the amount is expected to rise as oil sands production increases. Much of the water used in the oil sands operations comes from Canada's Athabasca River. Some of the water—along with other matter from oil sands—ends up in designated ponds, where pollutants may harm aquatic life and seep into the groundwater. Oil sands production can also change the ecosystem. For example, Canada requires that once operations are finished, companies must return the land to usable form, but the before-and-after uses need not—and likely will not—be exactly the same.8

Some of the same types of environmental issues have been raised with oil shale. Greenhouse gas emissions are higher than for conventional oil production because of the extra steps needed to obtain usable oil. Water quality may worsen because of the disposal of processed oil shale, which contains higher salt levels than the raw oil shale and also some toxic substances that could come in contact with water sources. As with oil sands production, the habitat for plants and animals would likely change permanently. For instance, the oil shale that is left after retorting might be placed back at the original site, but the processed oil shale would take up 15 to 25 percent more space than the raw oil shale.9

Increased environmental regulations could lead to higher costs for unconventional oil production and, thus, a higher price for which production would be cost-effective.

Future Predictions

A report from last year predicts that demand for liquid energy will increase by 25 percent between 2006 and 2030. During roughly the same period, the per-barrel price of light, sweet crude oil is expected to more than double ($61 in 2009 and $130 in 2030, in 2007 dollars). At these higher prices, oil production from the unconventional sources becomes more feasible. As a result, the report notes that total world production from oil sands should increase from about 1.8 million to 5.4 million barrels per day, and total world production from oil shale should increase from a small amount to about 200,000 barrels per day.10

Endnotes

- See World Energy Council for definitions and information on resources and production. In Canada, the viscous oil is called natural bitumen; in Venezuela, where the oil is less viscous, it is called extra-heavy oil. [back to text]

- The estimate was calculated from the table "World Proved Reserves of Oil and Natural Gas, Most Recent Estimates" from the Energy Information Administration (EIA); original data sources were the EIA and the Oil & Gas Journal. [back to text]

- For information on oil sands production methods in Canada, see the Oil Sands Discovery Centre's fact sheet. For information on Venezuela's methods, see World Energy Council. [back to text]

- See World Energy Council. [back to text]

- See Bartis et al. for oil shale processes. [back to text]

- See McColl. [back to text]

- See Bartis et al. [back to text]

- See Woynillowicz et al. for potential environmental issues for production from oil sands. [back to text]

- See Bartis et al. for potential environmental issues for production from oil shale. [back to text]

- See the Energy Information Administration's outlook report. [back to text]

References

Bartis, James T.; LaTourrette, Tom; Dixon, Lloyd; Peterson, D.J.; and Cecchine, Gary. Oil Shale Development in the United States: Prospects and Policy Issues. Santa Monica, Calif.: The RAND Corp., 2005.

Energy Information Administration. International Energy Outlook 2009. Washington, D.C.: Energy Information Administration, May 2009.

McColl, David. "The Eye of the Beholder: Oil Sands Calamity or Golden Opportunity?" Canadian Energy Research Institute, Oil Sands Briefing, February 2009.

Oil Sands Discovery Centre. Facts about Alberta's Oil Sands and Its Industry. Alberta, Canada: Oil Sands Discovery Centre, 2009. See www.oilsandsdiscovery.com/oil_sands_story/pdfs/facts_sheets09.pdf

World Energy Council. 2007 Survey of Energy Resources. London: World Energy Council, 2007.

Woynillowicz, Dan; Severson-Baker, Chris; and Raynolds, Marlo. Oil Sands Fever: The Environmental Implications of Canada's Oil Sands Rush. Alberta, Canada: The Pembina Institute, November 2005.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us