District Overview: Prime-Mortgage Problems Escalate

The early stage of the ongoing mortgage crisis—marked by sharp rises in mortgage delinquencies and home foreclosures—was attributed largely to the poor quality of loans. The performance of subprime loans suffered as falling house prices and higher interest rates made interest payments unaffordable for subprime borrowers. But as the nation weathers the recession and as unemployment rises, prime borrowers are also finding it harder to make mortgage payments. While subprime mortgages constituted about 11.7 percent of mortgages serviced in 2008, the corresponding share for prime mortgages was 77.1 percent.1 Therefore, even a much smaller foreclosure rate among prime mortgages can have a larger potential impact on the total number of foreclosures.

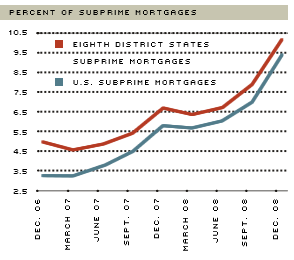

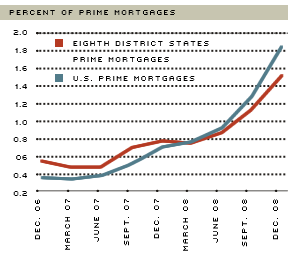

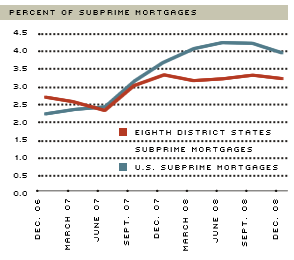

For the nation and the Eighth Federal Reserve District, data from the Mortgage Bankers Association (MBA) National Delinquency Survey indicate that a larger percentage of subprime mortgages are more than 90 days delinquent than are prime mortgages.2 Last year, 9.40 percent of subprime mortgages were delinquent, compared with only 1.86 percent of prime mortgages. Similarly, a larger percentage of subprime mortgages (16.53 percent) entered foreclosure procedures last year than did prime mortgages (2.45 percent).

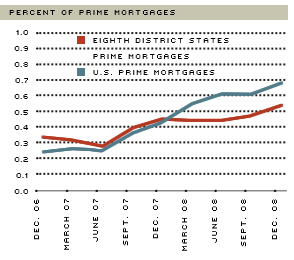

However, prime mortgages in distress were increasing throughout 2008. For mortgages serviced by reporting members of the MBA, the percentage of loans in which mortgage payments were more than 90 days past due in the prime category increased from 0.71 percent in the fourth quarter of 2007 to 1.86 percent in the fourth quarter of 2008. A similar pattern held for the District states, where the percent of past-due loans increased from an average of 0.78 percent in the fourth quarter of 2007 to an average of 1.52 percent in the fourth quarter of 2008. Also, the percentage of prime mortgage foreclosures started averaged 0.54 percent in District states during the fourth quarter of 2008, an increase from 0.45 percent during the same period a year before.

Delinquencies

The delinquency rate is defined here as the number of mortgages with payments past due greater than 90 days, but does not include mortgages in foreclosure. Broadly speaking, a mortgage is usually delinquent before a lender decides to initiate foreclosure procedures. Thus, the delinquency rate might be considered to be a leading indicator for the foreclosure rate.

Foreclosures of subprime mortgages continue to be high nationwide and in the District, and the subprime delinquency rate also continues to increase. However, the percentage of delinquent prime loans is also increasing and, for most states, is increasing faster than in the subprime market. For the U.S. as a whole, the percentage of prime mortgages 90 days or more past due reached 1.86 percent in the fourth quarter of 2008, compared with 0.71 percent in the fourth quarter of 2007. Figure 1 illustrates the sharp rise in the prime delinquency rate over the past year. Despite this increase in delinquencies, the most recent data show that the District states are below the national average for prime mortgages past due more than 90 days. Only Mississippi (2.04 percent) reported a higher delinquency rate than the national average.

The New York Federal Reserve provides delinquency rates among all mortgages (both prime and subprime) at the county level. Within the District, Shelby County (which contains the city of Memphis), reported the highest fourth quarter 2008 delinquency rate at 4.59 percent for all mortgages. Other counties that are part of large metropolitan areas in the District reported much lower delinquency rates among all mortgages. Jefferson County, Ky., reported a 2.75 percent delinquency rate in the fourth quarter of 2008, followed by St. Louis County, Mo., (2.24 percent) and Pulaski County, Ark., (2.08 percent). These counties compare favorably with the national average of 3 percent.

Foreclosures

Most states in the District have experienced a higher rate of foreclosure relative to a year ago, even though foreclosures among subprime mortgages appear to be stabilizing. Similar to the spike in prime delinquencies, the foreclosure rate among prime mortgages has increased over the past year in the District and the U.S. Recent data, however, show that the District rates are lower than the overall U.S. average.

The foreclosure rate defined here considers the percentage of loans that enter or start the foreclosure process in a quarter, as opposed to the percentage of total mortgages in foreclosure (since it might take more than one quarter to finalize the foreclosure process). The U.S. average foreclosure rate in prime mortgages for the fourth quarter of 2008 was 0.68 percent, up from 0.43 percent in the fourth quarter of 2007. Among the District states, Indiana reported a higher prime foreclosure rate than the U.S. average at 0.70 percent and Arkansas reported the lowest foreclosure rate among prime mortgages at 0.44 percent. All District states, with the exception of Mississippi, saw an increase in the foreclosure rate of prime mortgages. Mississippi's rate declined slightly from 0.62 percent in the fourth quarter of 2007 to 0.60 percent in the fourth quarter of 2008. While these rates are not as high as that for the subprime segment of the market, their effect is significant, simply by virtue of the fact that prime loans constitute by far the largest share of mortgages.

Although the number of subprime foreclosures remains high in the U.S. and in the District, the rate of new subprime foreclosures appears to be stabilizing. The rate of subprime foreclosures started in the fourth quarter reached 3.96 for the U.S. as a whole, increasing only slightly from the previous year's 3.71 percent and declining from the peak of 4.26 percent in the second quarter of 2008. Among District states, Arkansas, Illinois and Tennessee saw an increase in the rate of subprime foreclosures over the same period, while Indiana, Kentucky, Missouri and Mississippi experienced a decline. Illinois experienced the largest increase (0.35 percentage points), while Indiana experienced the largest decline (−0.65 percentage points). Figure 2 illustrates that, overall, the subprime foreclosure rates changed only slightly throughout 2008, and, furthermore, that subprime foreclosures in the District states are below the national average.

Cause for Concern?

For the nation and the District, there was a dramatic spike in delinquencies of prime mortgages in 2008, while the number of subprime foreclosures started has been leveling off. In the past, more than 70 percent of subprime originations were refinances of existing loans, at least some of which were prime mortgages. Today, subprime originations have all but disappeared, and refinancing opportunities for prime mortgages have been sharply reduced. Given that a high delinquency rate may indicate the possibility of a larger number of future foreclosures, the increasing delinquency rates among prime mortgages in the U.S. and the District states are of concern. Recent data, however, show that both delinquency rates and foreclosure rates are lower on average for the District states compared with the U.S. as a whole.

Percent of Residential Mortgage Foreclosures Started

SOURCE: Mortgage Bankers Association's National Delinquency Survey

Endnotes

- Mortgages are composed of prime mortgages, subprime mortgages, Federal Housing Authority (FHA) originated mortgages and Veterans Administration (VA) originated mortgages. [back to text]

- It is important to note that this survey encompasses only mortgages serviced by reporting MBA members. Thus, figures reported from this survey do not summarize all mortgages. However, the MBA points out that the survey represents a significant portion of the mortgage market, covering 80 to 85 percent of all first-lien residential mortgage loans outstanding. [back to text]

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us