The Role of Financing in International Trade during Good Times and Bad

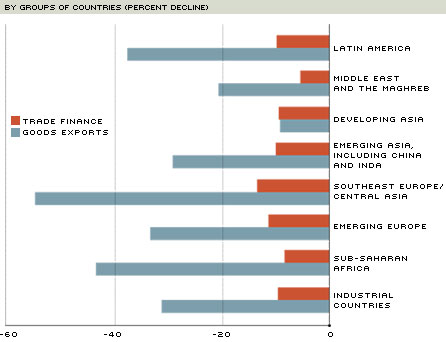

The peak of the global financial crisis and Great Recession witnessed the largest fall in international trade since the Great Depression, as imports and exports contracted by nearly 30 percent relative to GDP. The blue bars in Figure 1 show this drop for groups of countries during the peak of the crisis, between October 2008 and January 2009. The collapse of trade in those months is astonishing when compared with the decline during other recessions.

Changes in Exports and Trade Finance between October 2008 and January 2009

SOURCE: Asmondson et al.

Several factors are responsible for the plunge; a 2010 article in The Regional Economist discussed the likely culprits but concluded at that time that there was no one smoking gun.1 Today, there is some consensus among economists that demand for intermediate goods (such as machinery parts and food ingredients) and durable goods (such as cars and appliances) played a large role; purchases of these goods are relatively easy to postpone by households and firms during tough times. Research by economists Jonathan Eaton, Samuel Kortum, Brent Neiman and John Romalis attributes more than 70 percent of the decline in trade during the Great Recession to the large drop in demand and, particularly, to the collapse of expenditures on durable goods.2 This leaves room for other factors to explain the remaining 30 percent, and many economists agree that this share is explained, at least in part, by the collapse of trade finance during the crisis.

Why Do Exporters Need Trade Finance? What Is It?

Most firms rely on external capital (as opposed to their own capital, internal cash flows and reinvested earnings) to finance fixed costs—such as research and development, advertising, fixed capital equipment—and also to finance intermediate input purchases, inventories, payments to workers and other frequent costs before sales and payments of their output take place.

As explained by economists Davin Chor and Kalina Manova, export activities entail extra upfront expenditures that may force firms to rely on external finance.3 Extra money may be needed, for example, to research the profitability of new export markets; to make market-specific investments in capacity, product customization and regulatory compliance; and to set up and maintain foreign distribution networks.

Exporting activities may also generate additional variable trade costs due to shipping, duties and freight insurance, some of which are incurred before export revenue is realized. In addition, cross-border delivery can take longer to complete than domestic orders, increasing the need for working capital requirements relative to those of firms that sell only domestically. For example, ocean transit shipping times can be as long as several weeks, during which the exporting firm typically would be waiting for payment.4

Accordingly, financial institutions and governments have developed instruments to provide so-called trade finance, i.e., financial instruments that are used and sometimes tailored to satisfy exporters' needs. Most of these contracts require some form of collateral, e.g., tangible assets, including inventories. The role of trade finance in international trade is quantitatively important: Some estimates report that up to 90 percent of world trade relies on one or more trade finance instruments.5

Banks and other institutions provide trade finance for two purposes. First, trade finance serves as a source of working capital for individual traders and international companies in need of liquid assets. Second, trade finance provides credit insurance against the risks involved in international trade, such as price or currency fluctuations, or political risk. Each of these two functions is fulfilled by a certain set of credit instruments, provided mostly by financial institutions but sometimes also by government institutions.

Different Types of Trade Finance Instruments

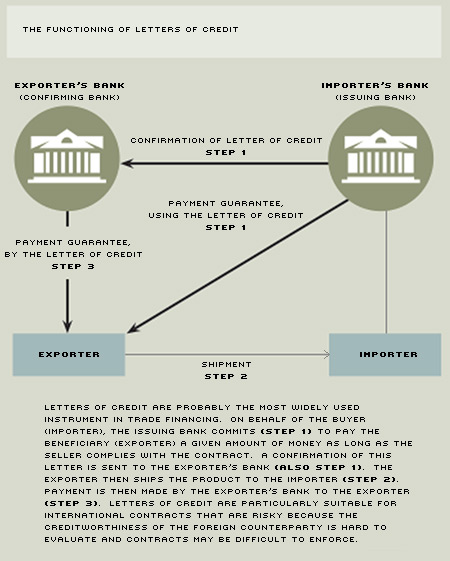

One of the most widely used ways exporters rely on trade finance is through documentary credit, which relies on commercial letters of credit. With this instrument, the issuing bank states its commitment to pay the beneficiary (exporter) a given amount of money on behalf of the buyer (importer) as long as the seller complies with the terms and conditions in the sale contract. The key steps in the use of letters of credit are represented in Figure 2. On the one hand, this instrument allows the importer to use his cash flow for alternative purposes rather than for paying the exporter for a certain period. On the other hand, the letter of credit ensures that the exporter will be paid in a timely manner. This instrument is particularly suitable for international contracts that are difficult to enforce and riskier than domestic contracts because the creditworthiness of the foreign counterparty is hard to evaluate.

Some exporters also rely on bill avalisation, whereby the buyer's bank guarantees payment to the seller in case the buyer will not pay. Other examples of documentary credit are advance payment guarantees, customs bonds (which allow for the postponement of tax payments until the goods are sold) and customs bonds for temporary transit (which waive payment of duties if goods are imported with the intent of being exported).

In other cases, trade finance is part of generic credit to buyer or supplier. Credit counters the off-balance-sheet financing provided by documentary credit and represents the more traditional form of lending. It may happen in the form of providing working capital, overdraft facilities or term loan facilities.

Another group of instruments includes countertrade arrangements, which are used in situations and countries in which a shortage of foreign exchange reserves or liquid assets may prevent exchange of goods for money. Under such arrangements, buyer and seller agree that goods will be traded at a fixed value without involving the use of cash or credit terms; instead, barter-exchange, counterpurchase or buyback promises will be used. For example, countertrade emerged as an important instrument after the breakup of the USSR.

With forfeiting, the exporter remits guaranteed debt from a sale on credit to a third party (financial firm) that pays the seller in cash upfront the face value of debt minus a discount. The seller is then no longer liable for default of the importer when debt comes to maturity. The discount is essentially the price the exporter is willing to pay in order to transfer the risk of default to the financial firm.

Other instruments carry out an insurance function against the risks involved in international and domestic trade, chiefly price or currency fluctuations. Examples of such contracts are options, forward contracts, futures, swaps and spot contracts. They offer the exporter and the importer the possibility to insure against the risk of fluctuations in exchange rates or prices, which would cause them a loss.

Finally, there are many situations in which instruments are provided by governments and government-related institutions; these types of support should also be considered part of trade finance. One such institution is the export credit insurance agency, also known as an investment insurance agency. These organizations act as intermediaries between national governments and exporters, offering financial and insurance services to protect trade partners against various types of risks, ranging from currency fluctuations to riots and other political distress. These agencies may provide short (for up to 180 days) or long (for up to three years) term insurance to exporters, providing exporters with the necessary credit to cover production and transportation costs. Certain central banks provide refinancing schemes through which they discount the commercial bills of exporters at preferential rates; these refinancing schemes work in a way similar to forfeiting. Finally, specialized financial agencies, such as the Export-Import Bank in the U.S., specifically target exporters' and importers' needs.

Data on these instruments are hard to come by.6 Nevertheless, a growing body of economic research has started to provide evidence on the collective impact of these instruments on export activities. Some of this evidence precedes the recent financial crisis. Some other evidence refers to large crises, such as the recent global recession.

What's the Evidence?

Trade economists are particularly interested in explaining why only a small percentage of firms in a country export (the economists call the number of exporters

the extensive margin), in addition to explaining how much each firm exports (they call the size of individual exports the intensive margin). Trade finance influences firms' export status in two ways. First, it may affect the probability of a business becoming an exporter in the first place if that business needs financing to pay fixed and sunk costs in order to start exporting. Second, trade finance may affect the magnitude of foreign sales because financing variable export costs may also require external finance.

To understand how finance affects the number of exporters and the size of their sales, economist Kalina Manova exploits the fact that (i) different industries tend to rely with different intensity on external finance, and (ii) the cost and availability of credit vary across countries.7 The researcher shows that countries in which credit is either more difficult or more expensive to obtain tend to export less, especially in industries that rely more heavily on external finance. Economists Nicolas Berman and Jérôme Héricourt study the relationship between trade and finance using firm-level survey data from nine emerging and developing countries from the World Bank.8 They show that firms' financial health raises neither the probability of remaining an exporter once the firm has entered international markets nor the size of exports. However, access to finance affects the probability of becoming an exporter. They also show that the level of financial development of a country—not just an individual firm's access to credit—can affect the probability of starting to export.

In addition to these two studies, there are many recent contributions confirming the important role of trade finance in influencing the number of exporters and how much they export. One major challenge of these studies is to avoid confusing the role of finance with the role of changes in demand for exporters' products. This distinction is important: If banks reduce the supply of trade finance to exporters (for example, during a financial crisis), appropriate policy interventions can restore firms' access to credit and allow exporters to continue selling abroad.

A recent analysis by economists Mary Amiti and David Weinstein sheds light on the relationship between banks' health and firms' export performance in Japan. The Japanese banking system underwent a credit crunch in the 1990s and 2000s. Many banks had a sizable amount of bad loans on their balance sheets and had a hard time extending new loans to their customers. Amiti and Weinstein matched Japanese exporters to the Japanese banks from which they borrowed and constructed a measure of market-to-book value for all large Japanese banks. In general, as the market value of a bank fell, it had a harder time extending new loans or rolling over existing loans. The researchers showed that there was a large disparity across Japanese banks in these measures and that such large differences can be exploited to estimate the effect of bank health on exports. In particular, Japanese firms that borrowed from distressed banks contracted their exports much more than businesses that were borrowing from healthy banks.

Trade Finance during the Crisis

The conjecture in the aftermath of the crisis was that the tightening of credit to firms had depressed the intensive margin of exports (how much each firm can export), especially in the sectors more exposed to financial shocks arising from the financial crisis because they tend to rely more on external finance. For example, several studies have shown that industries such as drugs and pharmaceuticals or plastic and computing tend to use much more external finance than industries such as tobacco or pottery.

There is consensus among economists that the financial crisis led to tightened financial conditions. How much of these tightened credit conditions is specifically reflected in trade finance is difficult to assess because of the absence of data. However, a survey jointly administered by the International Monetary Fund and the BAFT-IFSA provides some insight.9 According to a recent IMF study of this survey's confidential data, changes in trade finance conditions were particularly pronounced among large banks that suffered most from the financial crisis and, consequently, were in greater need to quickly deleverage.10 The survey also shows that, at the same time, banks increased the cost of borrowers. The IMF/BAFT-IFSA Trade Finance Survey provides evidence that, particularly in the case of letters of credit and trade-related lending, the terms of credit offered by large banks worsened.

The drop in trade at the peak of the crisis, between October 2008 and January 2009, is shown in Figure 1. The trade collapse was visibly much larger than the contraction in trade finance, seen in the red bars. At the onset of the crisis (2007:Q4-2008:Q4), trade finance actually increased; even during the peak of the crisis (2008:Q4-2009:Q1), trade finance fell by only one-third relative to the collapse in the export of goods. There was much geographic variation, but the largest drops occurred in Central Asia and Southeastern Europe. The situation remained negative but stable in the second quarter of 2009 and started to recover by the end of 2009 when Maghreb countries (in North Africa) and Middle Eastern countries (Emerging Asia) experienced the largest increase in goods exports worldwide.

When interviewed about the perceived causes of the contraction of trade finance, the surveyed banks returned answers surprisingly similar to the consensus emerging among economists. Respondents identified the fall in the demand for trade activities as the major source of decline in the value of trade finance but attributed about 30 percent of the fall to the reduced credit availability at either their own institutions or counterparty bank.

Conclusion

Two of the major difficulties regarding policymaking in the area of trade finance are the lack of reliable quantitative information and the limited evidence on the relationship between international trade and trade finance. Recent research and efforts in data collection, however, are fostering the understanding of this relationship and, ultimately, of the potential impact of different policies that may limit the negative effects of financial crises in the future.

Endnotes

- See Contessi and El-Ghazaly. [back to text]

- See Eaton et al. [back to text]

- See Chor and Manova. [back to text]

- See Hummels and Schaur. [back to text]

- See Auboin. [back to text]

- Bank trade finance is based on idiosyncratic relationships with specific clients so that its availability and even its cost depend on a complicated relationship among client, counterparty and counterparty banks. As there is much proprietary information about bank-client relationships, this information is rarely disclosed. [back to text]

- See Manova. [back to text]

- See Berman and Héricourt. [back to text]

- BAFT-IFSA is the global financial services association formed by the merger of the Bankers' Association for Finance and Trade (BAFT) and the International Financial Services Association (IFSA). [back to text]

- See Asmondson et al. [back to text]

References

Amiti, Mary; and Weinstein, David E. "Exports and Financial Shocks." National Bureau of Economic Research Working Paper No. 15556, December 2009.

Asmondson, Irena; Dorsey, Thomas; Khachatryan, Armine; Niculcea, Ioana; and Saito, Mika. "Trade and Trade Finance in the 2008-09 Financial Crisis." International Monetary Fund Working Paper 11/16, January 2011.

Auboin, Marc. "Restoring Trade Finance during a Period of Financial Crisis: Stock-Taking of Recent Initiatives." WTO Staff Working Paper ERSD-2009-16, December 2009.

Berman, Nicolas; and Héricourt, Jérôme. "Financial Factors and the Margins of Trade: Evidence from Cross-Country Firm-level Data." Journal of Development Economics, November 2010, Vol. 93, No. 2, pp. 206-17.

Chor, Davin; and Manova, Kalina. "Off the Cliff and Back? Credit Conditions and International Trade during the Global Financial Crisis." Journal of International Economics, forthcoming in 2012.

Contessi, Silvio; and El-Ghazaly, Hoda S. "The Trade Collapse: Lining Up the Suspects." The Federal Reserve Bank of St. Louis' The Regional Economist, April 2010, Vol. 18, No. 2, pp. 10-11.

Eaton, Jonathan; Kortum, Samuel; Neiman, Brent; and Romalis, John. "Trade and the Global Recession." NBER Working Paper No. 16666, January 2011.

Hummels, David L.; and Schaur, Georg. "Hedging Price Volatility Using Fast Transport." Journal of International Economics, September 2010, Vol. 82, No. 1, pp. 15-25.

Manova, Kalina. "Credit Constraints, Equity Market Liberalizations, and International Trade." Journal of International Economics, September 2008, Vol. 76, No. 1, pp. 33-47.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us