Looking for the Positives In Negative Interest Rates

The 2007 global financial collapse resulted in central banks around the world taking unprecedented action to combat weak aggregate demand in both consumption and investment. In the United States, the Federal Reserve implemented a zero-interest-rate policy, slashing the federal funds rate to the range of 0-0.25 percent beginning in late 2008. It was seven years later before the Fed raised rates—and then it was just by 25 basis points. Today, the target for the fed funds rate stands at a range of 1.25-1.50 percent.1

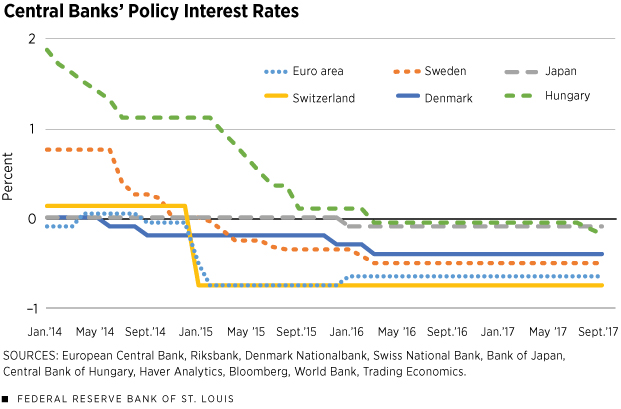

Although the U.S. has never used negative interest rates (NIR), many other industrial nations have implemented them to spur their economies and continue to use them. For example, Denmark, Japan, Hungary, Sweden, Switzerland and the entire euro area have implemented negative nominal interest rates. The nominal interest rate in the entire euro area has been negative since 2014. Among this group of countries, Switzerland has the lowest level, at 75 basis points below zero. (See the figure.)

The use of negative interest rates raises three important questions for monetary theory. First, given the widely held doctrine of the zero lower bound on nominal interest rates, how is a negative interest rate policy possible? Second, if an NIR is possible, will it effectively stimulate aggregate demand? Finally, is it desirable to keep the nominal interest rate very low for so long? This article addresses these questions.

Different Countries, Different Rates

In general, the overnight lending rate on loans and deposits from a central bank to commercial banks is called a policy rate.

In the U.S., this rate is the federal funds rate. This overnight lending rate is a key economic tool for central bankers as it can be used to adjust the cost of borrowing, which influences real economic activity. For example, since the Fed’s lending (or deposit) rate directly translates into short-term government bond yields (e.g., through open market operations), low interest rates incentivize others to shift investment from low-yielding government bonds to more-productive investments.2

The interest rate for the euro area, set by the European Central Bank (ECB), is the overnight deposit rate that banks receive.

In Sweden, the official policy rate is the repo rate, which is the rate of interest at which banks can borrow or deposit funds at the Riksbank for a period of seven days. Normally, the overnight deposit rate is 0.75 percentage points lower than the repo rate, and the overnight lending rate is 0.75 percentage points higher than the repo rate at the Riksbank. The monthly average is reported here.

Japan’s policy rate is the overnight deposit rate on excess reserve balances.

Switzerland’s central bank does not set a target interest rate but instead sets a target range based on the three-month Libor (London Interbank Offered Rate) for three-month interbank loans in Swiss francs. The reported policy rate in the figure is the midpoint of this range.

The policy rate set by Denmark’s central bank is the rate charged on certificates of deposit. The certificates of deposit are sold on the last banking day of the week and typically mature one week later.

The rate reported for Hungary is the overnight lending rate on deposits, analogous to the Federal Reserve’s policy rate, the fed funds rate.

Conventional Wisdom

Conventional monetary theory always assumed that the policy rate cannot go below zero because an individual would not pay, in theory, to lend out his or her own money. Instead, people would hoard cash to prevent nominal rates from falling below zero. Since the policy rate is closely linked to the rate of return on short-term government bonds, the bond yield is also assumed bounded below by zero—the nominal rate of return on cash.

When the zero lower bound is reached, this situation is referred to by economists as a liquidity trap, the point at which further monetary injections do not stimulate the economy because people opt to hoard all cash available instead of investing or spending it. So, further monetary injections by the government would only end up hoarded by people or the banking system instead of being lent out and circulated in the economy. In monetary theory, this situation of low circulation is also called zero velocity of money because money is not circulated in the economy.

However, if there are costs for people or institutions to hoard cash, then it is possible for banks to charge depositors by offering a negative interest rate. This means that depositors need to pay to have banks hold cash for them, or commercial banks must pay to have the central bank keep their deposits. In this case, the nominal deposit rate can go negative without getting into the liquidity trap. Of course, how negative the nominal interest rate can go depends on the costs of holding cash in hand.

In other words, negative nominal interest rates are possible because there are costs to holding cash, especially for large corporations.3 The central bank can also require (by law) large corporations to keep their cash, savings and loans in the banking system when a negative interest rate policy is implemented. The same argument applies to commercial banks that deposit their cash in the central bank. If the effective returns to cash go negative, then short-term yields of government bonds can also go negative, suggesting that there is still demand for government-issued debt even if it pays a negative interest rate.

This means that the lower bound of the nominal interest rate is not zero, but lower than zero, if there are costs of holding (hoarding) cash. So long as the negative interest rate falls short of reaching its lower bound determined by the cost of holding cash, conventional monetary policies remain as effective as in the case of positive interest rates.

What the Model Shows

Researchers Feng Dong and Yi Wen recently created a theoretical model with costs of holding cash to capture the negative interest rate phenomenon as seen in the figure. They showed that when aggregate demand for investment and consumption is extremely weak, it is optimal for central banks to implement negative interest rates.4 This policy would potentially reduce the cost of borrowing and stimulate investment spending.

In addition, these authors showed that the competitive interest rate on bank loans may move more than one-for-one with changes in the expected inflation rate, in contrast to the conventional wisdom. The conventional wisdom holds that given total bank deposits, a 1 percent increase in the expected inflation rate would induce a one-for-one increase in the nominal interest rate on bank loans to keep the lender indifferent between lending and not lending.

However, this conventional wisdom fails to take into account the adverse general-equilibrium effect of inflation on total deposits. If total deposits decline as a result of the inflation increase, the competitive nominal interest rate would increase more than the increase in the expected inflation rate to keep the lender just as well off.

Indeed, we know that people opt to hold less cash when the inflation rate is expected to be high. This implies that there is less money to be deposited into the banking system. So the nominal interest rate on bank loans has to increase more than the anticipated increase in inflation for profit-maximizing banks to break even. In this case, the correct definition of the real interest rate is no longer the difference between the nominal interest rate and the expected inflation rate, but something else. This means that under negative-interest-rate policy, the conventionally defined real interest rate (by the Fisherian relationship, Nominal Interest Rate ≈ Real Interest Rate + Inflation) tends to overestimate the level of the real interest rate (namely, the real interest rate may be more negative than the conventional Fisherian principle suggests).

Not So Far-Fetched, After All

Negative interest rates may seem ludicrous since why would an individual buy a government bond with a negative yield, but this is what a central bank would like you to think. The central bank’s goal is to incentivize agents to shift investments away from government bonds to something more productive economically, thus stimulating the economy.

Yi Wen is an economist at the Federal Reserve Bank of St. Louis, and Brian Reinbold is a research associate there. For more on Wen’s work, see https://research.stlouisfed.org/econ/wen.

Endnotes

- As of Federal Open Market Committee meeting in December 2017. [back to text]

- The overnight rate is the interest rate at which a depository institution lends funds to another depository institution (short term), or the interest rate the central bank charges a financial institution to borrow money overnight. The rate increases when liquidity decreases (when loans are more difficult to come by) and decreases when liquidity increases (when loans are more readily available). The Federal Reserve influences the overnight rate in the United States through its open-market operations. For example, selling government bonds can increase the bond yield and the overnight rate because these sales reduce the money supply to the economy. Hence, the overnight rate and bond yield move together. [back to text]

- For example, it is costly to build and secure a large private vault by private individuals or corporations, and such facilities yield no gains in normal times. [back to text]

- See Dong and Wen. [back to text]

Reference

Dong, Feng; and Wen, Yi. Optimal Monetary Policy under Negative Interest Rate. Working Paper No. 019A, Federal Reserve Bank of St. Louis, May 2017.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us