The Changing Relationship between Trade and America’s Gold Reserves

KEY TAKEAWAYS

- During the era of the classical gold standard, changes in a nation’s gold reserves were closely linked to changes in its trade balance.

- This relationship broke down as the gold standard struggled during times of crisis.

- After World War II, Bretton Woods tied the dollar to gold. But fear that the U.S. couldn’t meet its gold-dollar exchange rate ended this system in the 1970s.

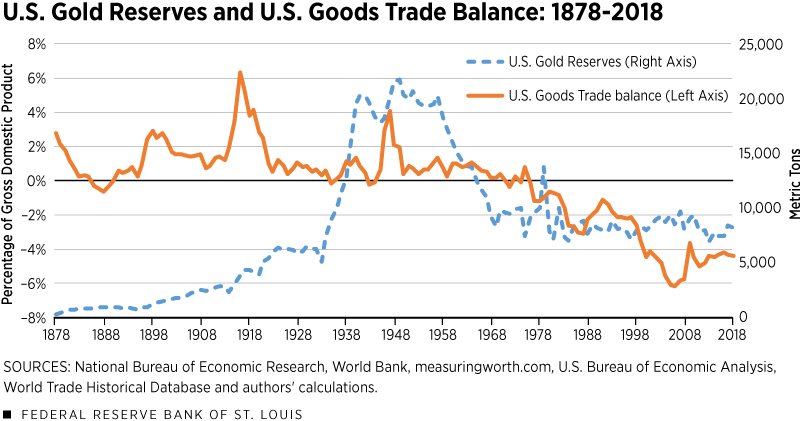

Throughout most of U.S. history, American currency was tied to the value of gold, requiring the country to maintain large gold reserves to be able to support a gold standard. The figure below estimates total U.S. official gold reserves from 1878 to 2018. We immediately see that there have been some significant changes to U.S. gold holdings over time. U.S. gold reserves doubled from 1900 to 1913, nearly doubled again from 1913 to 1933, quadrupled from 1933 to 1941, and then halved by 1970.

We also plot the U.S. goods trade balance as a percentage of gross domestic product (GDP) because, under a gold standard, we would expect the U.S. to accumulate gold when it runs trade surpluses and gold to flow out when the U.S. runs trade deficits. In general, we see the U.S. accumulating gold as it ran trade surpluses from 1878 until the early 1920s, but afterward this relationship was tenuous at best as the international payments system experienced heightened uncertainty and significant change.

Countries suspended gold convertibility during World War I, and the gold standard was in a state of flux after the Great War. Then the outbreak of the Great Depression would lead to the complete abandonment of the gold standard. At the end of World War II, the Bretton Woods system was formed in which only the U.S. dollar was directly linked to gold. Finally in the early 1970s, Bretton Woods ended, giving rise to the international system we have today—a system of fiat currencies and floating exchange rates. In this article, we explore this evolution of the international monetary system in more detail, as well as how it ties to U.S. gold holdings.

Pre-World War I: The Classical Gold Standard

The value of gold formed the basis of the international monetary system from around 1870 to the outbreak of World War I, and this period is referred to as the classical gold standard. In the classical gold standard, a nation’s currency can be exchanged at any time for a fixed quantity of gold. For example, one troy ounce of gold was officially worth $20.67 through much of the 19th and early 20th century. Maintaining parity between the currency and the value of gold required a nation to hold large quantities of gold reserves, and monetary policy would then focus on maintaining a ratio of gold reserves to currency notes. For example, if the nation’s gold holdings declined, then that country’s monetary authority could raise short-term interest rates to attract gold because people would be more willing to exchange their gold for currency to lock in a higher nominal return.

Since currencies are tied to gold, this also leads to a system of fixed exchange rates. Furthermore, balance of payments between nations are adjusted by gold flows to maintain these fixed exchange rates. For example, if a nation runs a trade surplus, that nation will then have a net inflow of gold; conversely, a trade deficit leads to a net outflow of gold.

So it generally becomes difficult for a nation to sustain persistent trade deficits, as this leads to persistent net outflows of gold, which would then make it difficult to defend the gold parity. Ultimately, adhering to the gold standard prevents large gyrations in a nation’s balance of payments. In addition, fixed exchange rates make the cost of foreign goods more predictable, which can facilitate international trade.

During this time, the industrialized world experienced unprecedented peace, economic growth and stability, and trade openness, and the gold standard functioned well. However, the subsequent years would test the gold standard’s ability to endure economic crises.

Wartime Disruption

Although functioning well in the previous decades, the gold standard would struggle to last the calamity into which World War I threw the international payments system.World War I was from July 28, 1914, to Nov. 11, 1918. When the war started, European countries quickly suspended convertibility to gold so that they could more easily finance the war effort. The war was very costly, and tax revenue could not sufficiently fund the war effort, so nations resorted to inflationary financing of their debt, which could not easily be done when constrained by gold.

After the end of the war, the international payments system was also left in ruins. Especially for Europe, returning to the gold standard presented a formidable task after four years of inflation, price controls and exchange controls. It would require deflation to return to the prewar price level under the old parity.

Also, the exorbitant costs of the war led to huge trade imbalances that then led to large fluctuations in countries’ gold reserves: During World War I, the U.S. ran large trade surpluses and thus accumulated gold reserves, while many European countries ran trade deficits and saw their gold reserves decline. Therefore, a return to the gold standard under the old parity would have also required international adjustments in nations’ gold reserves.

The Roaring ’20s

After the war, Great Britain was determined to return to the gold standard. But the country had to wait before it allowed the British pound to be freely exchanged for gold because the imbalances could have led to a run on the U.K.’s gold reserves. Since the prewar pound sterling was considered a world reserve currency and essentially as good as gold, many nations waited for the U.K. to return to the gold standard before they followed suit. However, it would not be easy for Great Britain to reestablish the gold standard because it needed to lower the price level, wait for sterling appreciation and attract gold reserves to return to the old parity.

So Great Britain began to raise its Bank rate to as high as 7% by 1920 at the expense of the domestic economy, leading to an economic depression due to shrinking credit. Likewise, the U.S. was in a similar position as Great Britain: The Federal Reserve Banks raised the discount rate to as high as 7% by 1920 to fight mounting inflationary pressures and to defend the gold standard, which also led to an economic depression.

However, the competition between the U.K. and the U.S. to attract gold by raising rates actually made it more difficult to realign world gold reserves and exchange rates. The U.S. was more successful attracting gold reserves in the early 1920s, and this delayed the U.K.’s return to the gold standard until 1925, after the Fed lowered its discount rate and sold the British $200 million worth of gold.See Crabbe.

This episode of the U.K. and the U.S. competing to attract gold reserves also highlights a trade-off that monetary policy must make under a gold standard: Monetary policy can focus on its international responsibilities (i.e., maintaining fixed exchange rates and parity of notes with the value of gold) or focus on the domestic economy—but not both. At that time, both central banks focused on their international responsibilities in hopes of maintaining the gold standard, which was detrimental to their domestic economies.

Raising short-term interest rates shrank credit and resulted in high unemployment at a time when both economies could have greatly benefited from monetary stimulus. But a gold standard shackled policymakers, leading to counterproductive monetary policy.

In addition, the period’s international competition, instead of cooperation, exacerbated matters. Although most of the developed world had returned to the gold standard by the mid-1920s, systemic imbalances still existed; combined with Europe’s need to finance large debt burdens accumulated from the war, the imbalances left the international payments system fragile.

The Great Depression and World War II

The Great DepressionThe Great Depression was from August 1929 to March 1933. saw unprecedented international deflation that would finally destroy any remnants of the classical gold standard. In the U.S., wholesale prices fell 37%, and farm prices dropped 65% from October 1929 to March 1933.See Crabbe. Furthermore, deflation raised the real value of debt, making it nearly impossible for European countries to service their large debt loads resulting from the Great War. This spelled doom for the gold standard, and Great Britain abandoned the system in 1931.

This left the U.S. in a predicament similar to what it faced at the end of World War I: Focus on its international standards by tightening credit to demonstrate its commitment to the gold standard, or focus on the domestic economy by expanding credit to combat persistent deflation and high unemployment. Under President Franklin Roosevelt, however, the U.S. prioritized domestic objectives.

In 1933, the U.S. suspended gold convertibility and gold exports. In the following year, the U.S. dollar was devalued when the gold price was fixed at $35 per troy ounce. After the U.S. dollar devaluation, so much gold began to flow into the United States that the country’s gold reserves quadrupled within eight years. Notice that this is several years before the outbreak of World War II and predates a large trade surplus in the late 1940s. (See figure above.) Furthermore, the average U.S. trade surplus was only 0.6% of GDP during this period, highlighting the complete breakdown of fundamentals of the classical gold standard.

In 1930, the U.S. controlled about 40% of the world’s gold reserves, but by 1950, the U.S. controlled nearly two-thirds of the world’s gold reserves.See Green. The large U.S. gold stockpile would prevent any concern over the country’s ability to meet its commitment to the gold-dollar exchange rate, but this large world imbalance would completely prevent other nations from returning to the gold standard under the old parities.

Conclusion

After World War II,World War II was from Sept. 1, 1939, to Sept. 2, 1945. it became obvious that the world needed a new international payments system that incorporated the lessons learned from the previous three decades, and thus the Bretton Woods system was born. The hope was to still have a system with the discipline of gold built in but not too constraining to induce unnecessary economic hardship that nations experienced trying to salvage the gold standard after World War I. Under Bretton Woods, only the U.S. dollar was tied to gold, while other currencies were tied to the value of the U.S. dollar, thereby creating a system of fixed exchange rates. This gold exchange standard indirectly linked other currencies’ value to gold.

However, eventually fear mounted that the U.S. would not be able to meet its commitment to the gold-dollar exchange rate after persistent balance-of-payments deficits led to too many dollars in circulation, so there was a run on U.S. gold reserves in which they were halved by 1970. From 1957 to 1970, the U.S. actually ran slight trade surpluses (about 0.7% of GDP), yet gold flowed out of the U.S. in droves. Although gold indirectly backed the international payments system during Bretton Woods, the mechanism to balance trade flows through the exchange of gold did not function as we saw under the classical gold standard.

President Richard Nixon ultimately ended gold-dollar convertibility in 1971,See Ghizoni. effectively ending the Bretton Woods system; the result was a new system of fiat currency and floating exchange rates. Despite increasing U.S. trade deficits since the end of Bretton Woods, the country’s gold reserves have remained relatively stable (as seen in the figure above ), underscoring the present weak (and possibly nonexistent) link between gold and trade flows.

Endnotes

- World War I was from July 28, 1914, to Nov. 11, 1918.

- See Crabbe.

- The Great Depression was from August 1929 to March 1933.

- See Crabbe.

- See Green.

- World War II was from Sept. 1, 1939, to Sept. 2, 1945.

- See Ghizoni.

References

Ahamed, Liaquat. Lords of Finance: The Bankers Who Broke the World. New York: Penguin Press, 2009.

Crabbe, Leland. “The International Gold Standard and U.S. Monetary Policy from World War I to the New Deal.” Federal Reserve Bulletin, June 1989.

Ghizoni, Sandra Kollen. “Creation of the Bretton Woods System.” Federal Reserve History, Nov. 22, 2013.

Green, Timothy. “Central Bank Gold Reserves: An Historical Perspective since 1845,” World Gold Council, Research Study No. 23, November 1999.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us