Measuring Trends in Income Inequality

A central issue in economics concerns how output (equivalent to income) is distributed across economic agents (e.g., workers, entrepreneurs). A first step in addressing this issue is understanding how output (or income) is distributed in the United States and understanding how the distribution has changed over time.

Measuring income inequality, however, is not a trivial endeavor. Multiple sources of income—salary, capital gains income, employer-provided health insurance and other non-salaried compensation, etc.—make simply measuring income itself problematic. Nonetheless, using a number of different definitions of income and employing various metrics, researchers have attempted to quantify income inequality in the U.S.

Economists have identified two broad periods in income inequality over the post-World War II period—first in the 1970s and then, more recently, prior to the Great Recession. In the sections that follow, we describe how income inequality is measured and then how it changed over these two periods.

Income Inequality and How It's Measured

Assessing income inequality boils down in effect to measuring the income gaps between high and low earners. Income inequality implies that the lower-income population receives disproportionately less income than the higher-income population: The larger the disparity, the greater the degree of income inequality.

To measure inequality, economists often sort the population by income percentiles and measure the difference across these percentiles. For example, the top 10 percent of earners would be the 90th percentile. A related way of dividing the population is quintiles, which split the distribution into five even buckets (the bottom quintile is the 20th percentile); quintiles are commonly used percentiles for studying inequality except at the top of the income distribution, where the income difference between 98th and 99th percentiles is large. To summarize inequality across the entire distribution, economists use the Gini coefficient. The Gini coefficient measures income concentration at each percentile of the population and ranges from 0 (perfectly equal) to 1 (perfectly unequal).

In order to study income inequality, one needs income at an individual level. While gross domestic product is the usual aggregate indicator for income, there are many definitions of income and many data sources available at the individual level. Economists often use the Internal Revenue Service's Statistics of Income program (SOI) or the Census Bureau's Current Population Survey (CPS). Studies using different data sources reach various conclusions on income inequality, depending on the definition used for income.

For example, economists Thomas Piketty and Emmanuel Saez compiled a dataset using SOI data back to 1913. They focused on the share of income earned by the top percentiles to avoid poor data quality in the lower percentiles.1 The SOI definition of income is market income, the cash income reported on tax forms.2 The SOI data more accurately measure the top of the income distribution, but less accurately measure low-income statistics because low-income households are not always required to file income taxes.3

Another source of individual income data is the CPS. Every March, the CPS—a monthly survey of 75,000 households—provides the information used in the Annual Social and Economic Supplement, which is the primary source for census data on income and poverty. The CPS data are reported in money income—market income plus other cash income, excluding noncash benefits, such as employer-provided health insurance. While the CPS provides quality low- and middle-income data, incomes above a certain threshold are not reported to protect individual privacy. This makes it less ideal for high-income estimates.

The Congressional Budget Office (CBO) also constructed a dataset that merges the CPS and SOI and draws on each source's strengths—the CPS for low income and the SOI for high income. The CBO reports market income, both before-tax (market income plus government transfers) and after-tax income (before-tax income less federal taxes). Most studies find that more equality is seen in after-tax income, followed by before-tax income and then market income.4 Moreover, it is generally accepted that the U.S. economy is similar to other developed nations' in terms of pretax and transfer income inequality. In other words, U.S. income inequality is not intrinsically different from what is seen in other countries, and any differences are mainly driven by the lack of income-redistributing fiscal policies in the U.S.

Trends in Income Inequality

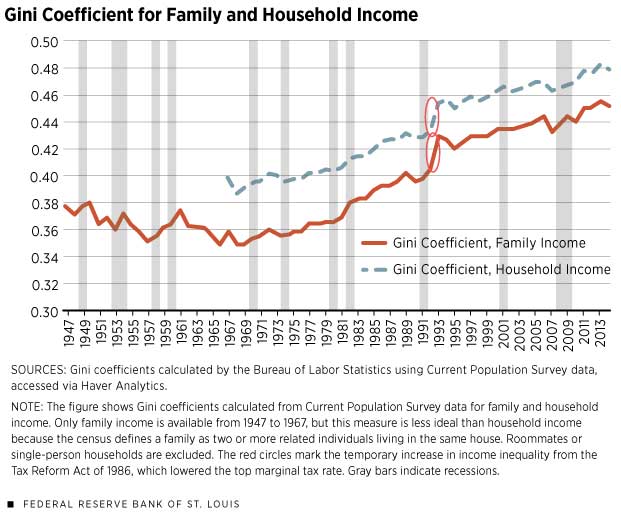

From the end of World War II to the early 1970s, income inequality in the U.S. was relatively low. The graph shows that from 1947 to 1970, the Gini coefficient was flat or declining.5 Piketty and Saez, using SOI data with a longer history, found that income inequality peaked in the 1920s, then decreased after the Great Depression, when top capital incomes fell and were unable to recover. Although the U.S. economy rebounded during World War II, wage controls prevented growth in top incomes. Once the war ended, a progressive tax structure and reforms such as Social Security and unionization kept low- and middle-income growth strong.

Starting in the 1970s, wage growth at the top of the income distribution outpaced the rest of the distribution, and inequality began to rise. The Gini coefficient grew from 0.394 in 1970 to 0.482 in 2013. The CBO estimates that between 1979 and 2011 market income grew 56 percent in the 81st through 99th percentiles and 174 percent in the 99th percentile. In contrast, market income growth averaged 16 percent in the bottom four quintiles.

Government transfers and federal taxes did have a redistributive effect during this period, but income inequality in after-tax income grew substantially. The 1970s increase in inequality was different from the increase during the 1920s. During the period from 1940 to 1970, top-income composition shifted from capital income to wage income. In the top 0.01 percent, the total income share from capital income fell from 70 percent in 1929 to just above 20 percent in 1998. Wage income rose over the same period, from 10 percent to about 45 percent. High growth in top wages is partly explained by the Tax Reform Act of 1986, which lowered the top marginal-income tax rates. The short-term impact of tax reform is circled in red on the graph. Longer-lasting wage growth came from the reporting of stock options and other forms of income as wages on tax returns.

After the increase in the 1970s, inequality continued to rise. In the 2001 and 2007-09 recessions, top incomes fell sharply as stock market crashes decreased the value of capital gains and stock options. However, losses to top incomes were temporary. During the recovery period from 2002 through 2007, for example, the top 1 percent captured about two-thirds of overall income growth, Piketty and Saez estimated. Further, even though top incomes fell 36.3 percent in the 2007-09 recession, the incomes of the bottom 99 percent also decreased 11.6 percent. This decrease is the largest two-year fall in the incomes of the bottom 99 percent since the Great Depression.

So far, the top 1 percent has captured 58 percent of income gains from 2009 to 2014. The newest data on income show that growth from 2013 to 2014 was more equal. The incomes of the bottom 99 percent grew 3.3 percent, the best rate in more than 10 years, and the Gini coefficient on household income decreased slightly, marking the first nonrecession decrease since 1998.

Conclusion

Economists use Gini coefficients, percentiles and detailed survey data to study trends in income inequality. They find that inequality has been rising in the U.S. since World War II, reaching its highest level in 2013 since the 1920s. This result is robust for the definition of income and the chosen measure of inequality.

Understanding the facts about inequality is the first step in assessing what can and should be done. While there is a general consensus that some reallocative transfers from the top of the income distribution to the bottom are desirable, the optimal amount of these redistributions is still up in the air.

Endnotes

- Piketty and Saez also estimate the portion of lower income tax units that are excluded in the SOI data and add these estimated values into their measure of total income. [back to text]

- Market income consists of before-tax income from wages and salaries; profits from businesses; capital income, such as dividends, interest and rents; realized capital gains; and income from past services. Other forms of income include cash and in-kind payments from programs like Social Security, food stamps and private benefits (e.g., health insurance). [back to text]

- The SOI data also exclude noncash benefits like health insurance, which are a growing portion of middle-class income. [back to text]

- The differences in inequality by income concept are largely due to a progressive tax structure and social safety nets, such as food stamps, that benefit individuals at the bottom of the distribution. [back to text]

- Family income is defined as that of two or more related persons living in a household. It may exclude single-person households and households with multiple residents who are all not related. Family income is available in the CPS from 1947 to 2011, while household income was not collected until 1967. [back to text]

References

DeNavas-Walt, Carmen; and Proctor, Bernadette D. "Income and Poverty in the United States: 2014." Current Population Reports. September 2015. See www.census.gov/content/dam/Census/library/publications/2015/demo/p60-252.pdf.

"The Distribution of Household Income and Federal Taxes, 2011." Congress of the United States: Congressional Budget Office. November 2014. See www.cbo.gov/sites/default/files/113th-congress-2013-2014/reports/49440-Distribution-of-Income-and-Taxes.pdf.

Piketty, Thomas; and Saez, Emmanuel. "Income Inequality in the United States, 1913-1998." The Quarterly Journal of Economics, Vol. 118, No. 1, 2003, pp. 1-39. See http://eml.berkeley.edu/~saez/pikettyqje.pdf.

Saez, Emmanuel. "Striking It Richer: The Evolution of Top Incomes in the United States," updated with 2014 preliminary estimates. University of California, Berkeley. June 2015. See http://eml.berkeley.edu/~saez/saez-UStopincomes-2014.pdf.

Stone, Chad; Trisi, Danilo; Sherman, Arloc; and DeBot, Brandon. "A Guide to Statistics on Historical Trends in Income Inequality." Center on Budget and Policy Priorities. October 2015. See www.cbpp.org/sites/default/files/atoms/files/11-28-11pov_0.pdf.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us