Regional vs. Global: How Are Countries' Business Cycles Moving Together These Days?

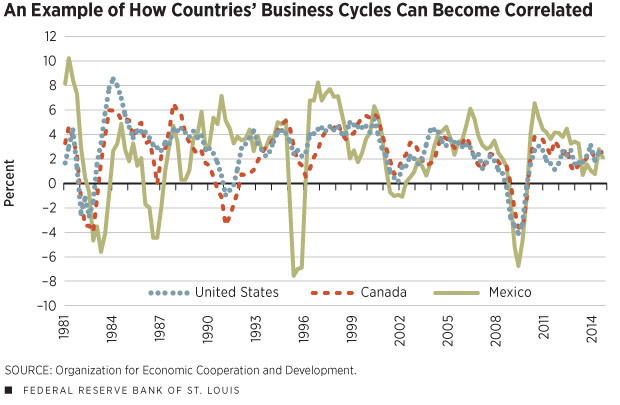

An economy moves between extended periods of positive output growth (expansions) and shorter periods of negative growth (recessions). Shifting between these phases is typically referred to as the business cycle. This cycle is a prominent feature in economies—both advanced and developing—and can be correlated across countries. The correlation of business cycles implies that groups of countries are in the same phase for stretches of time. An example of this can be seen in the figure, which shows the annual gross domestic product (GDP) growth rates in the United States, Canada and Mexico from 1981 through 2014. Notice that U.S. and Canadian data moved similarly over the past 30 or so years. In the past decade, the Mexican economy also fell into sync: The correlation between U.S. and Mexico increased by over 100 percent.1

Business cycle synchronicity might occur because countries experience shocks common to all countries (e.g., oil price shocks that increase or decrease the price of oil for everyone) or shocks common to countries in the same region (e.g., weather disruptions or regional conflicts). Alternatively, shocks could occur in one country and propagate rapidly to nearby countries. The degree to which business cycles synchronize across countries might depend on, among other things, physical distance, the amount of bilateral trade, similarities in institutions or language, or historical trade routes.2

One way to think about business cycle synchronicity is to imagine each country's business cycle as having a global component, a regional component and a country component. The global component captures the common movements in all countries' business cycles and represents global synchronicity. The regional component captures the common movements with a country's (possibly geographic) neighbors and represents regional synchronicity. A country component captures the movements in the business cycle that are unique to that country and lead to a more independent business cycle.

The strength of the correlation of countries' business cycles depends on the relative importance of these components. For example, if the regional component of a country's cycle is larger than the global and country components, the country may appear more synchronized with its neighbors than with the world as a whole. In a 2003 article, economists Ayhan Kose, Christopher Otrok and Charles Whiteman assessed the relative importance of the global, regional and country components of business cycles in 60 countries. In their initial sample (1960 to 1990), they found that the global and country components explained a substantial portion of the cyclical movements for most countries; regional components explained far less.

Over time, determinants of business cycle synchronicity—institutions, trade patterns, etc.—can change. For example, the formation of the European Union and the ratification of the North American Free Trade Agreement enabled goods to flow more easily across borders. Declines in transportation costs and the ability of more ports to off-load large shipping containers also may have increased bilateral trade between countries that previously may not have traded. In the past, more openness in trade led to globalization; more recently, regional trade agreements may have shifted the landscape toward more regionalized—rather than globalized—business cycle synchronicity.

In a more recent paper, economists Hideaki Hirata, Kose and Otrok found that the importance of regional cycles—especially in Europe and Asia—had risen substantially. Understanding synchronicity—and, in particular, which countries are synchronized—can be an important component for implementing countercyclical policy. Downturns in other countries that have synchronous cycles can forecast domestic downturns, leading to more timely policy. Understanding synchronicity can also provide insight into the impact of trade diversification, of the increase in financial flows and of regional trade agreements, all of which have helped to define the global economy in the 21st century.

In this article, we document some facts about business cycle synchronicity—in particular for countries in the Organization for Economic Cooperation and Development (OECD). We focus on the global and regional components, which indicate cross-country comovement, rather than the country components, which indicate how data within the country move. We first consider the importance of these components for each country's cycle over a 30-year period beginning in 1960. Countries are sorted into seven "continental" regions based on geographic proximity.3 We then consider whether geographically defined regions are optimal and provide some evidence for using economic institutions, in addition to physical distance, as a measure of forming regions. Finally, we document whether the regional component of countries' cycles has become more important.

Documenting International Business Cycles

Although business cycles are most commonly used to describe the state of a single country's economy, globalization and the proliferation of regional trade agreements have prompted economists to study common movements of these cycles across multiple countries. The eurozone, for example, is an economic and monetary union consisting of 19 European countries. These countries are in close geographic proximity, have adopted the euro as their form of currency and are members of the European Union, which facilitates freer flow of trade among member countries. Changes in the European Central Bank's monetary policy, then, can affect all of the countries in the monetary union and make their business cycles move together. This interconnectedness means that shocks—good or bad—will be experienced by all member countries. The European Central Bank's quantitative easing has already played a role in increasing forecasts of GDP growth across all member countries. On the other hand, the uncertainty surrounding the rumored exit by Greece from the eurozone could destabilize the European economy.

In the aforementioned 2003 article, Kose, Otrok and Whiteman examined how 60 countries' business cycles were related. The countries and their continental regions are shown in the accompanying table. In particular, they considered whether the countries moved together as a whole, whether countries on the same continent moved together or whether each country moved independently of the others. Using the growth rates of output, consumption and investment, they measured the fraction of each country's business cycle attributable to global, regional and country components. Although each of these components is unobserved, they can be inferred from the data, and the sum of these components is a proxy for the business cycle.

The relative importance of each component suggests the degree of that country's interconnectedness. The comovement of all 60 countries is significant, indicating that there is a world business cycle: Fifteen percent of the deviation in world output growth away from the norm was experienced by all 60 countries in the sample. Similarly, 9 percent and 7 percent of deviation in world consumption and investment growth, respectively, were commonly experienced by all countries. However, the importance of the global component varies across countries, indicating that some countries are more interconnected than others. The global component is more important for explaining economic activity of advanced, industrialized countries than of developing nations. When considering only the countries in the so-called Group of 7, the share of the fluctuations in output growth explained by the global component more than doubles and the share of the fluctuations in consumption growth explained by the global component more than quadruples.4

The importance of the global component suggests some interconnectedness across all of the countries during world economic downturns. The regional components, however, appear to explain only a small percentage of business cycle fluctuations, suggesting that regional interconnectedness is very limited for most countries. In particular, the regional component for (pre-European Union) Europe explains only 2 percent of the variation in the three economic variables (output, consumption and investment). The regional component for North American countries, on the other hand, explains a larger proportion of output variation than that for Europe, roughly equal to the contribution of the global component.

The business cycles of most African and Asian (developed and developing) countries do not appear to comove with either their regional neighbors or the rest of the world. In these regions, the country component plays the dominant role in explaining movements in the economic variables; the contributions from both the global and regional components are small. This lack of synchronicity may result from these countries' having relatively small international trade sectors or from the compositions of their economies. For example, many of the African countries in the sample have relatively large agricultural sectors.

What Is a Region?

It is puzzling why the regional component's contribution to the business cycle is small compared with the contributions of the other components. If trade is a substantial determinant of interconnectedness, low regional correlation may suggest that intraregional trade is not important compared with overall trade. If true, this finding confounds the notion that iceberg costs—transportation costs that increase over geographic distance—decrease the propensity to trade.5 (See sidebar.) Instead, other factors—e.g., language or institutions—may play a more important role.

In a 2012 paper, economists Neville Francis, Michael Owyang and Ozge Savascin found that the regional component is more important when the "region" is defined differently from simple geography. Regions based solely on geographic distance may mute the regional comovement, especially if iceberg costs are not the primary determinant of trade. Rather than choose the regions based on location, regions are created based on country-specific factors, such as the degree of economic openness to trade, the investment share of real gross domestic product, the method of conflict resolution, the legal system, language, and composition of trade and production.

The data suggest that the countries can be sorted into three groups. The accompanying table highlights the differences in the geographic regions of Kose, Otrok and Whiteman and the alternative regions of Francis, Owyang and Savascin. The latter regions are organized by color. The first group consists of the many industrialized nations, including Japan and most of Europe. The second group consists of the United Kingdom and many of its former British Commonwealth countries: Australia, Canada, India, New Zealand, South Africa and the United States. A few other countries in Africa and Asia are included in this second group. The final cluster consists of South American countries, along with Mexico, Morocco, Senegal and the Philippines. Consistent with the findings of Kose, Otrok and Whiteman, African countries' business cycles were primarily driven by the country-level component and not assigned to any region with any level of confidence.

Analysis of the formation of groups of countries into regions highlights the important features of international business cycles. While there is a role for a geographic component of regional business cycle synchronization—most European countries were grouped together, and most South American countries were grouped together—other country-specific characteristics appear to also determine business cycle synchronization within regions. Countries with common cultures—especially, languages—and common legal systems tend to have similar business cycles. Thus, Mexico is grouped with its shared-language South American neighbors, and the United States and the United Kingdom are grouped together.

Regions defined in this manner increase the share of output growth fluctuations attributable to the regional component, raising its importance relative to the global and country-specific components. Defining regions based solely on location, the regional component explains just over 2 percent of the fluctuations in output growth; these new regional components explain over 22 percent of the fluctuations in output growth. This dramatic increase in the significance of the regional component indicates that the importance of the regional factor may be misrepresented when countries are sorted into purely geographic regions. National policy is less effective if the nature of economic linkages between countries is misunderstood; thus, classification of countries into "regions" continues to evolve to match trends in trade and financial flows.

A Rise in Regionalization?

In the past 30 years, regional linkages and trade agreements have increased substantially. If trade and financial flows across countries are becoming increasingly regional, the regional component may also find a rise in importance. In a 2013 article, Hirata, Kose and Otrok studied whether economic linkages are becoming increasingly global or increasingly regional. Globalization of trade and finance might lead to stronger economic linkages among all countries, regardless of regions. But the resilience of the Asian economy during the 2008-2009 financial crisis suggests a potential increase in regional versus global linkages.

In order to assess whether the regional components of business cycles have increased in importance, the sample can be split into two periods, 1960-1984 and 1985- 2010, during which the number of regional trade agreements increased from five to 200 and during which global and financial flows increased substantially. When the sample is split, more importance is found in the regional component in the second period. For example, the average contribution of the global component to fluctuations in the output growth rate fell from 13 percent in 1960-1984 to 9 percent in 1985-2010. On the other hand, the average contribution of the regional component to fluctuations in the output growth rate rose from 11 percent in 1960-1984 to 19 percent in 1985-2010.

The proliferation of regional trade agreements over the past 30 years might help explain the increasing significance of economic linkages. For example, Canada, Mexico and the United States implemented the North American Free Trade Agreement in 1994 to eliminate barriers to trade and investment. Subsequently, intraregional trade flows in North America accounted for nearly 55 percent of total trade during the past decade. Similarly, the establishment of the European Union and the creation of the eurozone increased intraregional trade flows in Europe to roughly 75 percent of total trade during the past decade.

The increase in regional synchronization might be attributed to the diversification of industry and the acceleration of trade in the second period. For example, the diversification of trade increases the degree of sectoral similarity across countries, increasing the likelihood that countries are exposed to similar shocks and contributing to the convergence of business cycles.

Business cycles track movements in the economy. With the rise in openness to trade, business cycles have become increasingly interconnected. Understanding the nature of comovement of business cycles is important for the formulation of domestic policies to stabilize business cycles. If business cycles are largely global in nature, then domestic policy within one country will have little impact on the nation's economy, unless accompanied by global economic reform. If business cycles are largely regional in response to trade agreements, one should consider coordinating macroeconomic stabilization policies as part of the formulation of a free-trade zone. Lastly, domestic policy should focus on smoothing business cycle fluctuations that are primarily determined by the country-specific cycle rather than those determined by the global and regional components.

Endnotes

- Correlation coefficients between the U.S and Canada, the U.S. and Mexico, and Canada and Mexico from 1984:Q3 to 2014:Q3 were 0.80, 0.42 and 0.33, respectively. Correlation coefficients between the U.S and Canada, the U.S. and Mexico, and Canada and Mexico from 2004:Q3 to 2014:Q3 were 0.90, 0.86 and 0.90, respectively. [back to text]

- Business cycle synchronization is often attributed to the prevalence of bilateral trade between the two countries. Bilateral trade was often thought to be higher the shorter the physical distance between two countries. More recent theories have conjectured that distance can also measure culture and institutional similarity. [back to text]

- Kose, Otrok and Whiteman define seven regions based on geography. The seven regions are Africa, developing Asia, developed Asia, Europe, Latin America, North America and Oceania. They split the Asian countries into two regions consisting of (1) Bangladesh, India, Indonesia, Pakistan, the Philippines and Sri Lanka and (2) Hong Kong, Japan, Malaysia, Singapore, South Korea and Thailand. [back to text]

- The Group of 7 (also known as the G7) consists of Canada, France, Germany, Italy, Japan, the United Kingdom and the United States. [back to text]

- In the iceberg transport cost model, the cost of transporting a good is in the depletion of the good itself, rather than in the use of other resources. This idea is based on floating an iceberg; there is no cost as the distance between the origin and destination locations increases, except for in the amount of the iceberg that melts. [back to text]

- See Levchenko for further discussion of institutional differences as a determinant in trade flows and Melitz for the influence of common language in bilateral trade. [back to text]

References

Francis, Neville; Owyang, Michael T.; and Savascin, Ozge. "An Endogenously Clustered Factor Approach to International Business Cycles," Working Paper 2012-014A, Federal Reserve Bank of St. Louis, 2012.

Hirata, Hideaki; Kose, M.A.; and Otrok, Christopher. "Closer to Home," Finance and Development, International Monetary Fund, September 2013, Vol. 50, No. 3, pp. 40-43.

Kose, M.A.; Otrok, Christopher; and Whiteman, Charles H. "International Business Cycles: World, Region, and Country-Specific Factors," The American Economic Review, September 2003, Vol. 93, No. 4, pp. 1,216-39.

Levchenko, Andrei A. "Institutional Quality and International Trade," The Review of Economic Studies, 2007, Vol. 74, No. 3, pp. 791-819.

Melitz, Jacques. "Language and Foreign Trade," European Economic Review, May 2008, Vol. 52, No. 4, pp. 667-99.

Samuelson, Paul A. "The Transfer Problem and Transport Costs, II: Analysis of Effects of Trade Impediments," Economic Journal, 1954, Vol. 64, pp. 264-89.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us