Contract Enforcement, Corruption Controls and Other Institutions Affect Trade, Too

The role of institutions in international trade has been getting increasing attention from economists. While traditional theories have focused on differences in labor, land, capital and other factor endowments in explaining international trade patterns, recent research has highlighted the role of institutions. Well-established and high-quality institutions that lay down the rules, procedures and guidelines for trade in a clear and transparent manner, as well as institutions that protect traders from predation, are now viewed to be essential requirements for prosperous trade. For example, a 2003 study by economists James Anderson and Eric van Wincoop showed that higher trading costs due to weak institutions quantitatively affected trade more than barriers such as tariffs, quotas and natural impediments like the distance between the trade partners.

A number of private institutions and think tanks—such as the Political Risk Services Group, Transparency International and the World Bank—have constructed indicators of institutional quality that are used to assess the relative risk of carrying out businesses in different countries. These institutional-quality indices use measures of contract enforcement, control of corruption and the rule of law, among other indicators. To sharpen the focus of our discussion, the rest of this article discusses two of the indicators, namely the contract enforcement and corruption indicators. We do this first by explaining how each of these institutional factors may affect trade and then by discussing an empirical study that relates to each factor, respectively.

Absence of contract enforcement can hinder trade in situations in which exporters are likely to incur substantial fixed costs before they get paid by importers. Exporters who are unable to recover these costs due to weak contract enforcement in the importers' nations will not enter into trade at all.

A similar problem can afflict investments by upstream producers who are needed to supply customized products to the downstream producers, products that otherwise have no value outside the relationship between the two parties. Researchers have found that institutions that promote contract enforcement, for example, international treaties like the New York Convention on the Recognition and Enforcement of Foreign Arbitral Awards, are able to mitigate such costs and promote trade.

In addition to hindering the overall volume of trade, international differences in contracting institutions have an important bearing on the "pattern of trade"—that is, which countries export which types of goods. One would expect that nations which have superior institutions to enforce contracts should have a comparative advantage in goods that are more "contract intensive," and, therefore, export these goods in exchange for less contract-intensive goods.

Contract Intensity

One way to think about contract intensity is the following. Some goods require widely available intermediate inputs that may be available from a variety of suppliers. These goods are not contract-intensive. On the other hand, some other goods may require some special intermediate inputs in their production (e.g., some specialized parts for a high-end luxury car), the terms for the delivery of which may have to be negotiated in a contract between the final good producer and the intermediate input supplier. In this case, satisfaction of the terms of the contract becomes important in ensuring timely and efficient production of the final good.

If a nation's judicial system is weak, such contracts may not be properly enforced and, hence, the costs of producing such contract-intensive goods will be higher. Accordingly, nations with weak judicial systems will have a comparative disadvantage in producing such contract-intensive goods and will end up importing these goods, while exporting other goods.

Following this line of logic, a 2007 study by Harvard economist Nathan Nunn analyzed judicial quality's impact on the global trading patterns and found that countries with high contract-enforcement quality have a comparative advantage in industries in which relationship-specific investments are important. The author designed a variable to measure the relationship-specific investments needed in goods produced in 182 industries. Combining this relationship investment ratio with trade volume and contract-enforcement quality, the author found that countries with good contract enforcement specialize in the production (and export) of goods for which relationship-specific investments are most important. The author also found that differences in contract-enforcement abilities of nations affect the global trade pattern to a greater extent than differences in physical and human capital.

Along similar lines, a 2014 study by economists Nunn and Daniel Trefler showed that advanced countries, which usually have better institutions, undertake production and exports of sophisticated, high-quality products (which are more contract-intensive by their very nature) to a greater extent compared with low-income countries. Moreover, the high-income countries with similar institutional structures were found to trade disproportionately more with one another than with low-income countries.

Corruption

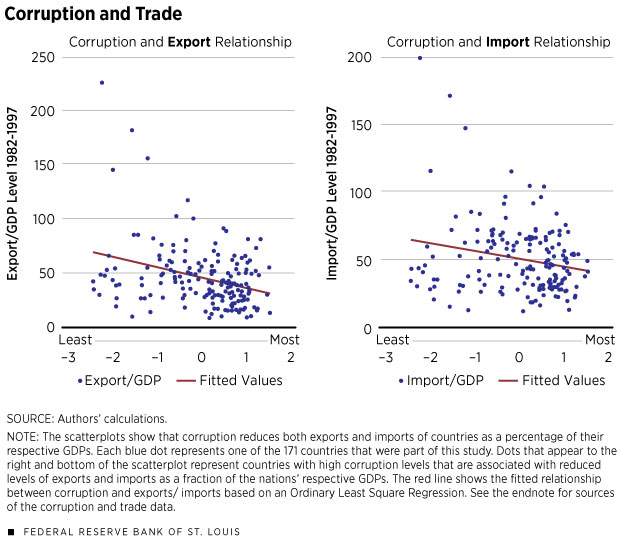

Turning to corruption, countries with high levels of it are characterized by burdensome regulations, which are exploited by dishonest officials to extract bribes from traders, thereby driving up the costs of trade. Among other studies, a 2007 study by economists Subhayu Bandyopadhyay and Suryadipta Roy investigated the effect of corruption in impeding trade. Using time-series and cross-section data for a group of 88 countries over the period 1982-1997, they found that greater corruption significantly increased import duties and other related taxes, while reducing the trade-gross domestic product (GDP) ratios of the respective nations. Using their dataset, we constructed two graphs (above); they show the relationship between an index of corruption and the level of exports/imports across 171 countries during the period 1982-1997.1 The graphs indicate a negative relationship between corruption and export/GDP and import/GDP ratios, suggesting that corruption is an impediment to trade.

What is clear from our discussion is that the literature in international trade has reached a consensus that improved institutions facilitate trade and that production of more-sophisticated products requires better institutions. Keeping these two issues in mind, developing nations have to find ways to improve their institutions. This is a complex problem, especially for developing nations facing resource constraints.

Reforming policy through measures like relaxation of licensing requirements or reductions in import taxes is one way to improve on the current situation. For example, if there is no import restriction on a certain good, there is also no possibility for a corrupt customs official to take a bribe to allow its importation. In other words, streamlining rules and liberalizing trade will likely reduce incentives for corruption. In turn, this should help increase the volume of trade.

On the other hand, improving the quality of judicial institutions in a nation is a much more difficult proposition and will depend on a variety of factors, including but not limited to the political systems in these nations.

Endnote

- Corruption measure is obtained from the International Country Risk Guide, and the level of exports and imports from the World Bank's World Development Indicators. [back to text]

References

Anderson, James E.; and van Wincoop, Eric. "Gravity with Gravitas: A Solution to the Border Puzzle," American Economic Review, March 2003, Vol. 93, No. 1, pp. 170-92.

Bandyopadhyay, Subhayu; and Roy, Suryadipta. "Corruption and Trade Protection: Evidence from Panel Data," Federal Reserve Bank of St. Louis Working Paper 2007-022A, May 2007. See http://research.stlouisfed.org/wp/2007/2007-022.pdf.

Nunn, Nathan. "Relationship-Specificity, Incomplete Contracts and the Pattern of Trade," The Quarterly Journal of Economics, May 2007, Vol. 122, No. 2, pp. 569-600.

Nunn, Nathan; and Trefler, Daniel. "Domestic Institutions as a Source of Comparative Advantage" in Gopinath, Gita; Helpman, Elhanan; Rogoff, Kenneth (eds.), Handbook of International Economics, April 2014, Vol. 4, pp. 263-315, North Holland.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us