The Liquidity Trap: An Alternative Explanation for Today's Low Inflation

From January 2009 to December 2013, the Federal Reserve's balance sheet grew by approximately $3.5 trillion due to the large-scale asset purchase (LSAP) policies implemented to aid the ailing economy after the Great Recession. These unconventional monetary policies, also known as quantitative easing (QE), increased credit availability in the private lending markets and put downward pressure on real interest rates.

During normal times, for each 1 percent increase in the growth of money, inflation increases by 0.54 percent, based on a linear regression of the inflation rate on money growth for the precrisis period.[1] Money supply (M0) increased 40.29 percent between December 2008 and December 2013, or about 8 percent per year on average. Under this pace of annual money growth, we would have seen inflation of 4.3 percent per year, or a price level increase of at least 40 percent in 2013 compared with the price level in 2008.[2] But this did not happen.

Thus, in contrast with many people's expectations, the injection of $3.5 trillion into the economy has not caused any significant inflation or increases in the price level. Why?

Inflation Expectations

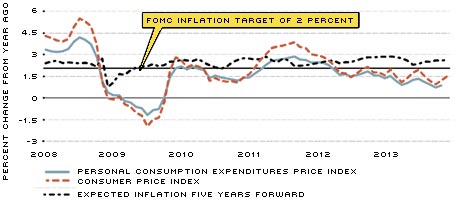

From their first implementation, LSAPs were declared by the Fed's Federal Open Market Committee (FOMC) to be a new policy tool to boost the economy after the target federal funds rate had already been reduced to a range between 0 and 25 basis points. The media and some Fed officials expressed concern about inflation becoming rampant because of the large amount of money that was being injected into the economy. But those fears have not materialized. On the contrary, it wasn't long before policymakers' anxiety focused on the possibility of falling into a Japanese-style deflation.[3] (See figure.)

Headline Inflation

SOURCES: Bureau of Economic Analysis, Bureau of Labor Statistics, Federal Reserve Board and Haver Analytics.

Several reasons have been provided for the persistently low inflation. For example, Fed Chair Janet Yellen said in 2009 when she was still president of the Federal Reserve Bank of San Francisco that inflation would not take hold during a recession because of little pressure for prices and wages to increase given that resources through the economy were underused.[4] Others say the unusually low inflation stems from the weakening of the money multiplier, as banks continue to hold excess reserves instead of extending more credit through loans.[5] Still others point to the FOMC's increased communications and forward guidance in anchoring future inflation expectations, as well as to the knowledge that the LSAPs will eventually be reversed.[6]

There also exists an alternative explanation for the generally unanticipated disinflation or low inflation levels—the liquidity trap.[7]

Excess Liquidity

Conventionally, the expansion of the money supply will generate inflation as more money is chasing after the same amount of goods available. During a liquidity trap, however, increases in money supply are fully absorbed by excess demand for money (liquidity); investors hoard the increased money instead of spending it because the opportunity cost of holding cash—the forgone earnings from interest—is zero when the nominal interest rate is zero. Even worse, if the increased money supply is through LSAPs on long-term debts (as is the case under QE), investors are prompted to further shift their portfolio holdings from interest-bearing assets to cash.

On one hand, if the increase in money demand is proportional to the increase in money supply, inflation remains stable. On the other hand, if money demand increases more than proportionally to the change in money supply due to the downward pressure LSAPs exert on the interest rate, the price level must fall to absorb the difference between the supply and demand of money. That is, the increase in aggregate demand for real money balances then has to be accommodated by an overall decrease in the price level for any given money supply in the goods market. Therefore, the lower the interest rate through LSAPs, the lower the price level (due to the disproportionately higher money demand). The Fed's policy to pay positive interest rates on reserves can only reinforce the problem by making cash more attractive as a store of value.[8]

Economist Yi Wen (the co-author of this article) showed last year that large-scale asset purchases by the Fed at the current pace could reduce the real interest rate by 2 percentage points, but would have an insignificant effect on aggregate employment and fixed capital investment, would reduce the aggregate price level significantly, and would put severe downward pressure on the inflation rate—thanks to firms' portfolio adjustments between cash and financial assets in a liquidity trap.[9]

Risks of Declining Inflation

Not only high inflation, but low inflation can be bad for the economy. Low inflation makes cash more attractive to investors as a store of value, everything else equal.

This makes the liquidity trap easier to occur and gives the Fed less room to reduce the real interest rate as desired during a recession. Furthermore, quantitative easing through LSAPs can reinforce the liquidity trap by further reducing the long-term interest rate. In other words, more monetary injections during a liquidity trap can only reinforce the liquidity trap by keeping the inflation rate low (or the real return to money high).

Therefore, the correct monetary policy during a liquidity trap is not to further increase money supply or reduce the interest rate but to raise inflation expectations by raising the nominal interest rate. If LSAP policies are reversed and the money supply decreases as the Fed sells assets in the marketplace, the nominal interest rate will increase and investors will be more likely to shift their portfolios away from cash toward interest-bearing assets. If demand for money decreases more than proportional to the decrease in money supply due to upward pressure on the interest rate, inflation will increase. In other words, only when financial assets become more attractive than cash can the aggregate price level increase.

Of course, this type of policy-reinforced liquidity trap would take place only if the economy is in a deep recession in the first place. If the economy is not in a recession, monetary injections should lead to more inflation instead of less inflation because a lower interest rate generally reduces people's incentive to save and increases their incentive to spend.

The irony is that expansionary monetary policy is often called for only when the economy is in a recession. This policy dilemma makes economics a dismal science. One way to escape from it is to use expansionary fiscal policy (as suggested by the economist John Maynard Keynes). However, with the already high level of government debt across industrial countries, it takes courage and vision to implement bold expansionary fiscal policies.[10]

Inflation Expectations and LSAPs

Inflation started declining in early 2012 and was significantly below FOMC members' forecasts in 2013. Since the beginning of this year, the committee has slowed the pace of LSAPs as broad economic activity has improved, but the target federal funds rate will remain near the zero lower bound for a longer period. Inflation is expected to continue being stable and move toward the 2 percent target rate of the FOMC as the economy improves, but it will not increase much until the demand for money decreases and the effects of the liquidity trap wane.

Endnotes

- "Normal times" refers to the postwar period prior to the Great Recession (1960-2007). The effect of changes in the money supply (M0) on headline consumer price index (CPI) inflation during this time frame was calculated using a linear regression model. [back to text]

- The implications are similar if we use the total monetary base (M0 + bank reserves) instead of M0. During normal times, inflation increases 0.26 percent for every 1 percent increase in money base growth. So, since the money base grew 123 percent during the five-year period from December 2008 to December 2013, inflation would have been 6.3 percent per year on average. [back to text]

- See Bullard. [back to text]

- See Yellen. [back to text]

- See Fawley and Wen on the decline of the money multiplier and monetary aggregates. [back to text]

- As Andolfatto and Li note when describing the effect of QE in Japan during the 2000s, "even large changes in the monetary base are not likely to have any inflationary consequences if people generally believe the program will be reversed at some future date." [back to text]

- For related discussion on this alternative, see Haltom and Krugman. [back to text]

- Ricketts and Waller describe the Fed's policy tools to avoid runaway inflation, including paying a positive interest rate on excess reserves. [back to text]

- See Wen. [back to text]

- See Wen and Wu for an empirical study of the powerful effects of fiscal policies in China that helped China to escape the Great Recession after the financial crisis in 2007-08. [back to text]

References

Andolfatto, David; and Li, Li. "Quantitative Easing in Japan: Past and Present." Federal Reserve Bank of St. Louis Economic Synopses, 2014, No. 1, Jan. 10, 2014. See http://research.stlouisfed.org/publications/es/article/10024.

Bullard, James. "Seven Faces of 'The Peril.' " Federal Reserve Bank of St. Louis Review, September/October 2010, Vol. 92, No. 5, pp. 339-52.

Fawley, Brett; and Wen, Yi. "Low Inflation in a World of Securitization." Federal Reserve Bank of St. Louis Economic Synopses, 2013, No. 15, May 31, 2013. See http://research.stlouisfed.org/publications/es/article/9801.

Haltom, Renee. "Liquidity Trap." Federal Reserve Bank of Richmond Region Focus, First Quarter 2012, p. 10. See www.richmondfed.org/publications/research/region_focus/2012/q1/pdf/jargon_alert.pdf.

Krugman, Paul. "Monetary Policy in a Liquidity Trap." The New York Times, Opinion Pages, April 11, 2013. Blog post. See http://nyti.ms/19ONWJZ.

Ricketts, Lowell R.; and Waller, Christopher J. "The Rise and (Eventual) Fall in the Fed's Balance Sheet." Federal Reserve Bank of St. Louis The Regional Economist, January 2014, Vol. 22, No. 1. See www.stlouisfed.org/publications/regional-economist/january-2014/the-rise-and-eventual-fall-in-the-feds-balance-sheet.

Wen, Yi. "Evaluating Unconventional Monetary Policies—Why Aren't They More Effective?" Working Paper 2013-028B, Federal Reserve Bank of St. Louis, 2013. See http://research.stlouisfed.org/wp/2013/2013-028.pdf.

Wen, Yi; and Wu, Jing. "Withstanding Great Recession like China." Federal Reserve Bank of St. Louis Working Paper 2014-007A.

Yellen, Janet. "A View of the Economic Crisis and the Federal Reserve's Response." Presentation to The Commonwealth Club of California in San Francisco on June 30, 2009.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us