Why ''Fixing'' China's Currency Is No Quick Fix

On net, the U.S. economy added zero jobs over the past decade: Eight million jobs gained from 2003-07 were countered with eight million jobs lost from 2008-09. The recent recession, despite its severity, cannot shoulder all blame for this outcome. Average job growth during the 2003-07 expansion was 60 percent slower than average job growth over previous economic expansions following World War II.

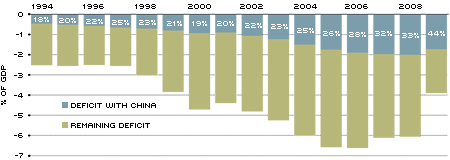

The sluggish growth was likely driven by a combination of internal factors (increased productivity) and external factors (job outsourcing and large sustained trade imbalances). For example, Figure 1 shows that from 1994 to 2006 the U.S. multilateral trade deficit in goods grew from 2.5 to 6.5 percent of GDP. To the extent that this trend reflects diminished U.S. competitiveness in international goods markets, some U.S. manufacturing jobs may have been lost to foreign competitors.

U.S. Balance of Trade in Goods

SOURCE: IMF Direction of Trade Statistics (DOTS) and Bureau of Economic Analysis.

Meanwhile, the U.S. Treasury is threatening to label China as a "currency manipulator" for allegedly using foreign exchange intervention and currency controls to fix the value of its currency (the renminbi) to the dollar in order to prevent appreciation of its currency and to gain a trade advantage through lower international prices for its exports. As revealed in Figure 1, the U.S. bilateral trade deficit with China accounts for a nontrivial (and growing) share of the U.S. total trade deficit. Does this mean that an increase in the value of the renminbi would reverse declines in U.S. trade competitiveness due to biased terms of trade and, in turn, create jobs in the United States? Unfortunately, the answer is "probably not to any meaningful degree."

It's Not Just U.S. vs. China

Assuming that the renminbi is undervalued,1 any effect its revaluation would have on U.S. labor markets depends entirely on its impact on the U.S. multilateral trade deficit with all countries, not on the bilateral trade deficit with China taken in isolation. Smaller U.S. trade deficits with China, offset by larger bilateral deficits with other countries, cannot be expected to provide material job growth.

A renminbi revaluation is unlikely to seriously impact the multilateral trade deficit for two reasons. First, multilateral trade balances are in part determined by domestic preferences that may not hinge on the exchange rate. For example, a country importing more than it exports must fund this spending with inflows of foreign capital. The magnitude of capital inflows is primarily determined by the gap between gross domestic investment and gross domestic savings. Revaluing the renminbi is unlikely to fundamentally shift U.S. domestic preferences for saving and investment. Second, regional specialization patterns in Asia suggest that a major component of the U.S. bilateral trade deficit with China is a persistent trade deficit with Asia. The price, and hence quantity, of Chinese exports may be surprisingly resilient to changes in the value of the renminbi.

In 2003, tension was equally high with respect to China's dollar peg, and the U.S. Congress was also considering retaliatory measures. The Congressional Budget Office (CBO), however, concluded that a revaluation of the renminbi would have little effect on U.S. manufacturing employment. In particular, China, owing to cheap labor costs, functioned primarily as a place of assembly for the Asian region. Intermediate

goods were exported to China from other Asian countries; these goods were then assembled and exported to the United States. As evidence of this emerging specialization pattern, the CBO reported that from 2000-2002 a large portion of the increase in imports from China was offset by declining imports from Japan. Among developing Asian countries (outside of China), nearly all showed declining exports to the United States during this period.

Accurately estimating the size of this regional trade effect over a longer period of time is essential for U.S. trade policy, but such estimation is not without obstacles. In particular, the CBO analysis benefited from looking at a period of U.S. recession. During times of economic expansion, imports from nearly all trading partners increase, making it hard to distinguish between the effects of increasing globalization and the potential redirection of exports within trading partners.

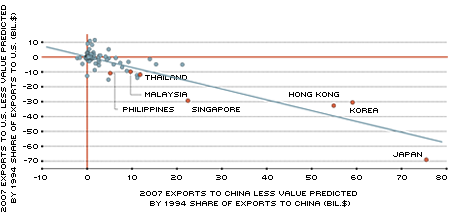

To help disentangle the two effects, consider what bilateral exports would be, had countries' export growth been evenly distributed across all trading partners. Specifically, we compute for 174 countries what exports to the United States and China would have been in 2007 had each shipped the same fraction of its total exports to the United States and China as it did in 1994. We then compare this hypothetical number to actual exports and plot the differences in Figure 2.

Asian Exports Have Shifted Toward China, Away from U.S.

SOURCE: IMF Direction of Trade Statistics (DOTS) and authors' calculations.

NOTE: This figure compares reported 2007 bilateral exports to the United States and China with what they would have been had countries maintained their 1994 export shares with each trading partner. Asian countries stand out as increasing their share of exports to China while decreasing their shares of exports to the United States. One plausible explanation is that these countries moved final assembly of their domestically produced intermediate goods to China.

Interestingly, the countries that stick out with the largest unpredicted increases in exports to China (and correspondingly largest unpredicted decreases in exports to the United States) are, in fact, the Asian countries implicated by the CBO as moving their assembly to China. This is in stark contrast to the high density of points centered at zero-zero, revealing that most countries' trade shares with the United States and China remained roughly constant. Incidentally, a simple linear regression reveals that the relationship between greater-than-predicted exports to China and less-than-predicted exports to the United States is strongly statistically significant.

To the extent that Chinese exports to the United States originate beyond China's borders, such trade flows are generally insensitive to the value of the renminbi: Most of the value of the goods is added in other countries and denominated in other currencies. Specifically, the 2003 CBO report cites estimates that only 20-30 percent of the total value added of Chinese exports occurs in China. Hence, only 20-30 percent of the value of Chinese exports is subject to the effects of a renminbi revaluation. The dollar value of the remaining 70-80 percent of the goods would remain unaffected. Chinese manufacturers could import intermediate inputs for less money following a renminbi revaluation and pass the cost savings directly through to the final price, largely offsetting any increase in the price due to the higher value of the renminbi. Such results confirm that persistent global trade imbalances will require multilateral solutions.

Revaluation May Be Inevitable

China will probably have to revalue its currency in the near future even without the threat of U.S. retaliation. The true relative purchasing power of two countriesis determined not by the nominal exchange rate (the price of one currency in terms of another as reported on a currency exchange), but by the real exchange rate, which takes into account relative changes in domestic price levels. When China sells renminbi for U.S. dollars in order to affect the exchange rate, it adds currency to its domestic money supply. All else equal, the increase in the currency base increases domestic prices, canceling out any change in the real exchange rate due to nominal depreciation of the renminbi.2 Countries can absorb some of the additional liquidity through "sterilization," i.e., buying back the currency by selling bonds, but only to a point. The dependence between monetary and foreign exchange policy will ultimately force China's hand, but the United States cannot expect any quick labor market fixes due to Chinese currency revaluation. Instead, the United States would be best advised to follow China's suit in identifying and exploiting its own comparative advantages.

Endnotes

- Consensus estimates are that the renminbi is undervalued by 25-40 percent, but there are reasons (like a still developing Chinese banking sector) why even if allowed to float, the renminbi could depreciate, rather than appreciate. [back to text]

- If the renminbi loses half of its value against the dollar, but domestic prices in China double, the cost of a Chinese good, in U.S. dollars, remains the same. No effect on trade would be expected from the nominal depreciation. [back to text]

References

Holtz-Eakin, Douglas. "The Chinese Exchange Rate and U.S. Manufacturing Employment." Congressional Budget Office testimony before the Committee on Ways and Means, U.S. House of Representatives, October 2003.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us