How Recent Recessions Have Affected Dual-Earner Couples

KEY TAKEAWAYS

- The labor outcomes for married couples with both spouses active in the labor market were markedly different in the COVID-19 recession versus those during the Great Recession.

- With the COVID-19 downturn, employment and hours worked among dual-earner couples fell sharply but rebounded quickly. And the impact was more severe for less-educated couples.

- In contrast, the Great Recession’s impact on these couples was more homogenous, and the recovery in employment and hours worked was much slower.

Both the Great Recession (2007-09) and the COVID-19 recession were large economic crises, but they affected U.S. labor markets quite differently. The Great Recession originated in financial markets, eventually creating negative and highly persistent outcomes such as lower employment and hours worked for almost all types of households in the labor market. On the other hand, the COVID-19 recession occurred due to a global pandemic, which led to partial shutdowns in the economy. Unlike the Great Recession, this recent economic crisis was relatively short-lived, and its negative effects have been disproportionately larger for low-income and less-educated people.

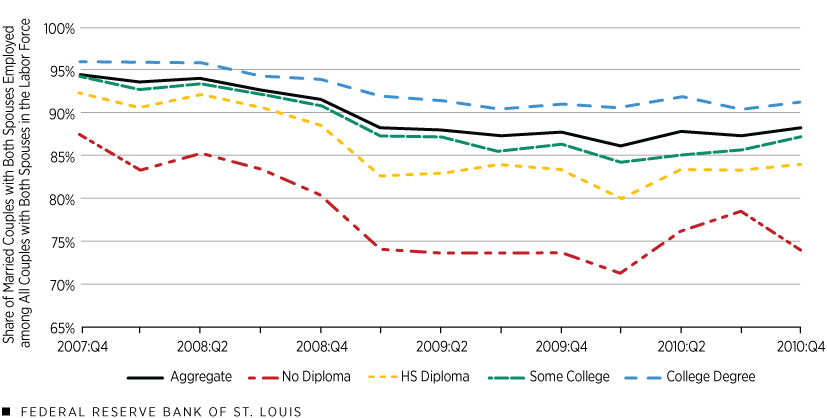

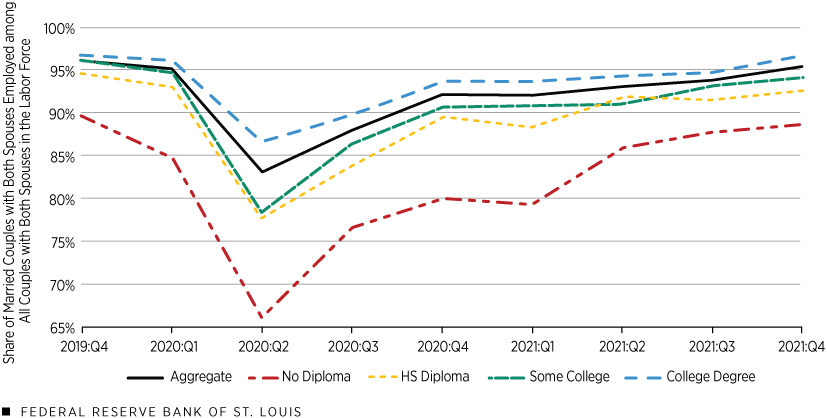

In this article, we contrast the effects of the two crises on U.S. labor markets. Specifically, we focus on the labor market outcomes of dual-earner couples, which are married couples in which both spouses are in the labor force, i.e., either employed or actively searching for a job. Understanding the outcomes for such couples is relevant because, as shown in the next two figures, at the onset of each of these two recessions, the percentage of couples in which both spouses were employed (i.e., dual-employed couples) was around 95% of couples in which both spouses are in the labor force (i.e., dual-earner couples). In the event of a job separation, these households can rely on a single spouse’s earnings, which gives them a safety net relative to single-earner households, in which only one spouse is in the labor force. Nonetheless, a significant decline in the earnings of individuals in these households can reduce their quality of life and aggregate U.S. spending.

To document labor market outcomes for such couples, we used monthly data from the Current Population Survey. We also analyzed outcomes across dual-earner couples with different education levels: college degree, some college, high school (HS) diploma and no diploma, based on the education level of the spouse with more years of schooling. We report quarterly averages to avoid noise in monthly movements.

Employment

The first figure plots the share of dual-employed couples among all dual-earner couples over the Great Recession period.We removed households from the sample in which at least one spouse is self-employed or in the armed forces.

Great Recession's Impact on Dual-Employed Couples: Breakdown by Education Level

SOURCES: Current Population Survey and authors’ calculations.

NOTES: Couples are grouped by the education level of the more highly educated spouse. The “College Degree” group refers to couples in which the most highly educated spouse has a four-year college degree or even higher education. The Great Recession began in December 2007 and ended in June 2009.

We highlight two important results. First, the percentage of dual-employed couples among dual-earner couples declined between the second quarter of 2008 and the first quarter of 2010 from 94% to 86%. Importantly, this percentage persistently remained lower than its pre-Great Recession level.

Second, while low-education dual-earner couples faced more negative employment effects, even dual-earner couples with the highest education suffered notable and persistent employment losses during the Great Recession. For instance, between the last quarter of 2007 and first quarter of 2010, the share of dual-earner couples in which both members were employed decreased 5 percentage points for the highest education group (i.e., those with a college degree) and decreased 16 percentage points for the lowest education group (i.e., those with no diploma). In summary, the Great Recession persistently reduced the share of dual-employed couples among all education levels.

The next figure plots the same series during the COVID-19 pandemic.

COVID-19’s Impact on Dual-Employed Couples: Breakdown by Education Level

SOURCES: Current Population Survey and authors’ calculations.

NOTES: Couples are grouped by the education level of the more highly educated spouse. The “College Degree” group refers to couples in which the most highly educated spouse has a four-year college degree or higher. The COVID-19 recession began in February 2020 and ended in April 2020.

We highlight two main differences between the episodes. First, the recovery from the COVID-19 recession was much quicker: most rates roughly returned to pre-pandemic levels around six quarters after the recession ended in April 2020, while rates remained diminished even 12 quarters after the Great Recession began in December 2007.

Second, the employment gap between low- and high-education couples increased more significantly in the COVID-19 pandemic. The share of dual-employed couples among dual-earner couples for the highest education group declined 10 percentage points between the fourth quarter of 2019 and the second quarter of 2020, while that of the lowest education group fell 24 percentage points over the same period.

Tracking Hours to Gauge Impact

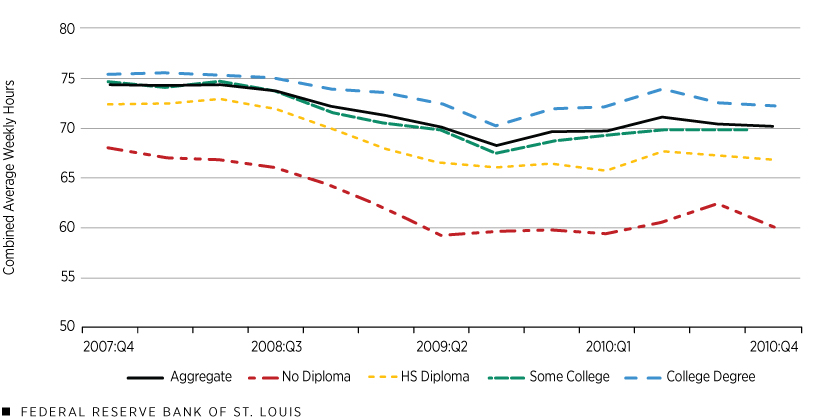

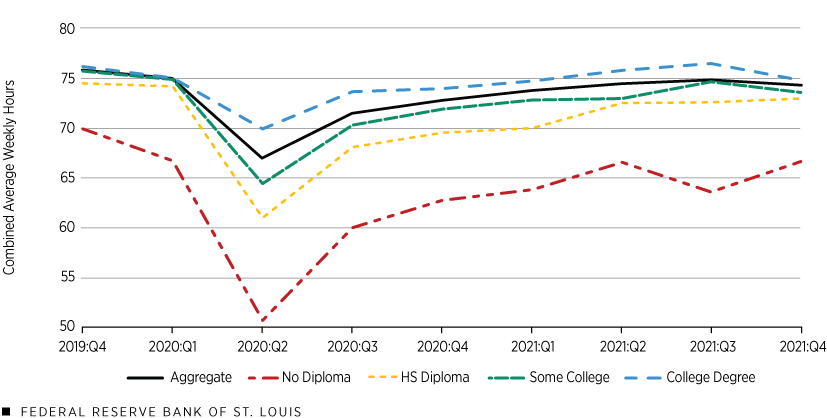

Tracking the average combined weekly hours worked in these households gives us more insight into the effects of economic downturns among job keepers, i.e., the employed. As we previously mentioned, one advantage of dual-earner couples is that one’s spouse may be able to make up for lost earnings by working additional hours. At least one of the spouses remains employed in most dual-earner couples, even during recessions.In unreported results, we also measured the percentage of households with at least one spouse employed and found that this measure never dropped below 97% in either economic downturn. Conversely, even if one or both spouses remain employed during an economic downturn, it is possible that those who remain employed are working reduced hours because of adverse economic conditions.

The next figures plot the average hours worked across dual-earner couples during the Great Recession period (the top) and the COVID-19 recession period (the bottom). The former persistently reduced the average hours worked among dual-earner couples, while the COVID-19 crisis produced especially large but transitory effects for the lowest education group.

Great Recession's Impact on Hours Worked by Dual-Earner Married Couples: Breakdown by Education Level

COVID-19’s Impact on Hours Worked by Dual-Earner Married Couples: Breakdown by Education Level

SOURCES FOR BOTH FIGURES: Current Population Survey and authors’ calculations.

NOTES FOR BOTH FIGURES: Couples are grouped by the education level of the more highly educated spouse.

Specifically, during and immediately after the Great Recession, the average hours worked (black line) decreased by six hours between third quarter of 2008 and third quarter of 2009, moving from 74 hours to 68 hours. By the fourth quarter of 2010, it had recovered only slightly to an average of 70 hours. These negative effects manifested across dual-earner couples with different education levels. Furthermore, the average hours worked remained lower than the pre-Great Recession level even 12 quarters after the start of the Great Recession across all education groups, implying that the negative effects of the Great Recession on hours worked were also highly persistent across different groups.

During the COVID-19 recession, dual-earner couples were working 67 hours in the second quarter of 2020 as opposed to the 75 hours they were working in the preceding quarter. However, this sharp decline in hours was followed by a fast “Nike swoosh” recovery, with hours worked largely returning to pre-pandemic levels by the fourth quarter of 2021. Furthermore, the average hours worked declined more sharply for those in lower education groups. While the average hours worked for couples in the highest education group declined by six hours only (from 76 to 70 hours) from the fourth quarter of 2019 to the second quarter of 2020, they declined by 19 hours for couples in the lowest education group.

Potential Reasons for the Differences between the Recessions

What explains the different behavior of employment and hours worked of married couples in the aggregate and across education groups during these two economic downturns? The COVID-19 pandemic and the resulting economic shutdown mostly affected jobs in the service sector that typically pay lower salaries and hire less-educated individuals, while other sectors were less affected given the possibility of working from home.

For this reason, the negative effects of the COVID-19 recession on employment and hours were especially large for less-educated workers. However, after the economy largely reopened, the rise in demand for services led to a quick rebound in employment and hours worked for these workers. Thus, the negative effects of the COVID-19 recession on the labor market have been short-lived.

On the other hand, the Great Recession caused large disruptions to employers’ balance sheets and consequently affected vacancy creation and hiring persistently across the economy. As a result, the Great Recession caused persistently negative effects on labor markets across different types of workers.

Conclusion

The Great Recession and COVID-19 recession reduced employment and average hours worked of dual-earner couples. The former downturn was characterized by a slow and steady decrease in employment and hours worked with largely persistent effects across different education levels. In the COVID-19 period, however, dual-earner couples experienced a sharp decline in their employment and hours worked at the onset of the pandemic, but both measures rebounded quickly. In addition, the negative effects from both recessions were disproportionately larger for couples with low levels of education—especially in the COVID-19 recession, during which existing gaps in employment and hours worked deepened to a much greater extent than they did in the Great Recession.

Endnotes

- We removed households from the sample in which at least one spouse is self-employed or in the armed forces.

- In unreported results, we also measured the percentage of households with at least one spouse employed and found that this measure never dropped below 97% in either economic downturn.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us