What Is the Balance of Payments?

A lot of attention is paid to the importing and exporting of goods and services, but there are other types of economic transactions between countries that trade with each other. Countries need a way to record not just the movement of goods and services between trading partners, but also the debit and credit of other financial transactions and investments.

Enter the Balance of Payments

The balance of payments is an accounting system; it is a summary of all the transactions involving goods, services, and investment between one country and all other countries over a given time. Any transaction that causes money to flow into a country is a credit to balance payments accounts, and any transaction that causes money to flow out is a debit.

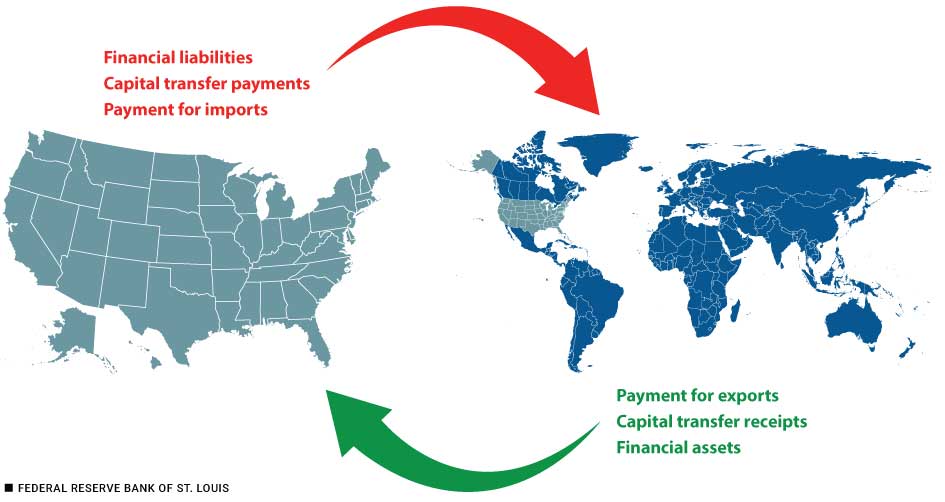

Trade involves the movement of goods and services, but there are also many other transactions recorded in balance of payments accounts. Transactions between countries can be divided into three general categories: exports and imports, capital transfer receipts and payments, and financial assets and liabilities, as shown in the graphic below.

When money is received by the U.S. it is recorded as a credit in the balance of payments. When money leaves the U.S. as payment it is recorded as a debit in the balance of payments.

Capital transfer receipts and payments are capital (money or assets) that are transferred from one country to another. For example, a capital transfer can be the interest you receive on a savings account balance at a foreign bank or the money sent to someone in another country as a gift. Financial assets and liabilities refer to borrowing and lending in foreign markets. For example, you purchase stock on a foreign stock exchange or take out a loan from a foreign bank.

| Current account | Capital and financial account | |

|---|---|---|

| Exports | Capital transfer receipts | Financial assets |

| Resources, goods, and services produced domestically but sold abroad |

|

|

| Imports | Capital transfer payments | Financial liabilities |

| Resources, goods, and services produced abroad but sold domestically |

|

|

Is Balance of Trade Different from Balance of Payments?

While the balance of payments is a record of the flow of money used to make all international sales and purchases, the balance of trade refers to “net exports,” or the amount of goods and services sold abroad minus the purchases of goods and services from other countries. The balance of trade is just one part of the balance of payments. In the table above, the balance of trade would be the total of only the first column, while the balance of payments would include all three columns.

The transaction categories in the table are divided into two broad accounts: the current account and the capital and financial account. The current account is the section of a country’s balance of payments that records its exports and imports of goods and services, its net investment income, and its net transfers. (Note that the table is a sample of the types of transactions recorded in the balance of payments and is not a complete list.) The capital and financial account is the section of a country’s balance of payments that records movements of capital into and out of a country. Balance of payments is a form of double-entry accounting, meaning every credit has a corresponding debit. In other words, current account + capital and financial account = 0.

To learn more about the balance of trade and how it is recorded in balance of payments accounts, read this Page One Economics article on international trade.

Why Does the Balance of Payments Equal Zero?

As an accounting principle, a buy (debit) for one country is a sell (credit) for another. In a closed system, as shown in the above graphic, the money must be accounted for as either a credit or a debit. There is no money “leakage” between trading partners. This is an extension of the circular flow model in which an expenditure for one person becomes income for the other person.

Let’s look at an example. Country A purchases a good from Country B. Country B must now decide what to do with the currency it receives for the sale of the good to Country A. Country B could do one of the following:

- Hold the currency as a cash reserve.

- Use the currency to purchase something from Country A or invest in a financial asset in Country A.

- Exchange the currency on the foreign exchange market for a different currency.

Most of the time, a country will choose the above option 2 and use the foreign currency it receives to make investments or other purchases from the original country. In our example, this would mean Country B receives funds for a good it sells to Country A but then uses the same currency to purchase a financial asset, such as a bond, from Country A. When this is done, there is an inflow in financial capital to Country A. So, while you might have a trade deficit in goods and services (current account), it is often offset by a surplus in financial transactions (capital and financial account). In our example, this would mean Country A has a debit for the purchase of a good from Country B, but then has a credit when Country B invests in a financial asset in Country A.

We can see this play out when we look at the U.S. balance of payments in the FRED graph below. You’ll notice that the total financial inflows—everything above the zero line—is mirrored in the financial outflows—everything below the zero line. While not all catagories of transactions are perfectly mirrored, the totals are generally symmetrical.

U.S. Balance of Payments

SOURCE: U.S. Balance of Payments, U.S. Bureau of Economic Analysis via FRED, Federal Reserve Bank of St. Louis, accessed August 26, 2025.

To learn more about the U.S. balance of payments, read this FRED Blog from July 2025.

Conclusion

Balance of payments is a valuable tool used to assess how a country interacts in world markets. By exploring the different categories of transactions, we can learn a lot about a country’s economy and its relationships with trading partners. The balance of payments may be a challenging concept at first, but if we keep in mind that an expenditure for one person becomes income for someone else, it is much easier to understand how this accounting system attempts to track a country’s global transactions as a series of credits and debits.

Balance of payments: A summary of all the transactions involving goods and services and investment that all individuals, firms, and the government of one nation makes with all of those in all other nations in a given time period.

Balance of trade: The difference between a country’s total exports and total imports. Also known as “net exports.”

Circular flow model: An economic model illustrating the exchange of resources, goods, and money in an economy.

“The US balance of payments.” Federal Reserve Bank of St. Louis FRED Blog, July 28, 2025.

Wolla, Scott. “International Trade: Making Sense of the Trade Deficit.” Federal Reserve Bank of St. Louis Page One Economics, November 2016.

Citation

Amanda Geiger, ldquoWhat Is the Balance of Payments?,rdquo Federal Reserve Bank of St. Louis Page One Economics, Oct. 1, 2025.

These essays from our education specialists cover economic and personal finance basics. Special versions are available for classroom use. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us