Inflation Expectations, the Phillips Curve, and the Fed’s Dual Mandate

— Jerome Powell, Chair of the Board of Governors of the Federal Reserve System See the transcript of Chair Powell's Press Conference (PDF), March 17, 2021.

Introduction

The Federal Reserve, the central bank of the United States, has a dual Congressional mandate—to promote maximum employment and price stability. While these goals were articulated in 1977, the strategy to meet these goals has changed over time. In fact, as recently as 2020, the Federal Open Market Committee (FOMC), the Federal Reserve’s monetary policymaking body, provided an updated statement on its strategy that included some adjustments in its plans to pursue price stability. Here we take a look at what pursuing stable prices means, how inflation has evolved over time, how the connection between inflation and the real economy has changed over time, and what the Federal Reserve (Fed) has said recently about its plan to meet this part of its mandate.

Price Stability: One Side of the Dual Mandate

Price stability does not mean that the optimal rate of inflation is zero. The Fed, for example, judges that a moderate, stable, and positive rate of inflation is most consistent with its price stability mandate. Many other central banks around the world also aim for moderate positive rates of inflation in their countries.

Why do central banks target positive rates of inflation? First, they want to avoid deflation, a general and persistent decline in the level of prices. Since inflation, even when fairly stable, inevitably fluctuates around some level (sometimes a bit higher and sometimes a bit lower), aiming for a moderate positive rate of price increases helps protect the economy from periods of deflation. Deflation is a phenomenon Americans last experienced during the Great Depression of the 1930s. At that time, deflation led households to delay making purchases in anticipation of lower prices in the future, and this action put pressure on producers to cut wages or jobs or both. These deflationary factors put severe strains on the economy and are a key reason the Fed aims for a positive rate of inflation.

Another reason central banks aim for positive rates of inflation is to help them conduct monetary policy effectively. When inflation is very low, interest rates also tend to be very low, even in good times. When an economy weakens, perhaps goes into a recession, a central bank will normally reduce interest rates to encourage spending and investment by households and businesses. But if interest rates are already very low going into the recession, the central bank does not have much room to reduce interest rates to help stimulate the economy. Though central banks have other tools to help with monetary policy, the raising and lowering of interest rates is a known and somewhat precise tool that has been used for decades.

Price stability does not mean any positive rate of inflation. As we just noted, inflation that is too low is close to deflation and may not allow a central bank to support a weakening economy. Conversely, inflation that is too high means that the purchasing power of the dollar erodes very quickly, which disproportionately affects lower-income families and older citizens on fixed incomes. Furthermore, both deflation and too-high inflation can lead to uncertainty and to spending and saving decisions that do not support the best economic outcomes.

Reflecting these tradeoffs, central banks have chosen target levels or target ranges for moderate and stable rates of inflation; this way, households and businesses can make informed saving and investment decisions without worrying about the possibility of sustained deflation or sustained high inflation.

In the United States, the FOMC aims for 2 percent inflation over time. In the FOMC’s judgment, 2 percent provides a healthy compromise—high enough to provide a meaningful buffer from deflation while minimizing the distortions that arise from high inflation.

Inflation Data

So how do we go about measuring inflation? The overall inflation rate is measured as the rate of increase in the average price level of a broad group of goods and services (called a “market basket”). As such, the reported inflation rate will be a function of the specific goods and services that are included in the market basket. So it follows that including a different set of goods and services in the market basket will result in a different overall inflation rate.

Probably the most often-discussed inflation measure in the United States is one based on the consumer price index (CPI). The CPI is widely used as a cost-of-living index to adjust Social Security and other payments. A second measure that is frequently watched is the personal consumption expenditures price index (PCEPI). In January 2012, when the FOMC announced for the first time a numeric inflation objective, it specified a 2 percent inflation target for the PCEPI as the inflation rate most consistent with its Congressional mandate of price stability and maximum employment. The FOMC chose the PCEPI over the CPI, in part, because it includes a broader set of goods and services in its market basket and is believed to better capture changes in consumer behavior.

As seen in Figure 1 below, the CPI and PCEPI inflation rates move up and down together. During the period known as the Great Inflation (1965-82), both inflation measures increased sharply. Since this period, the rate of inflation has been more moderate. Though similar, the two estimates differ slightly. Over the past 20 years, CPI inflation averaged 2.0 percent, while PCEPI inflation averaged 1.8 percent—a 0.2 percentage point difference. Some reasons the rates differ include somewhat different baskets of goods and services, different prices for some items, and different weights used to aggregate the items.

Figure 1: Measures of U.S. Inflation

NOTE: The green line at 2 percent starts at January 2012, reflecting when the FOMC began aiming for 2 percent PCEPI inflation over the longer run.

SOURCE: FRED, Federal Reserve Bank of St. Louis, https://fred.stlouisfed.org/graph/?g=AIo2.

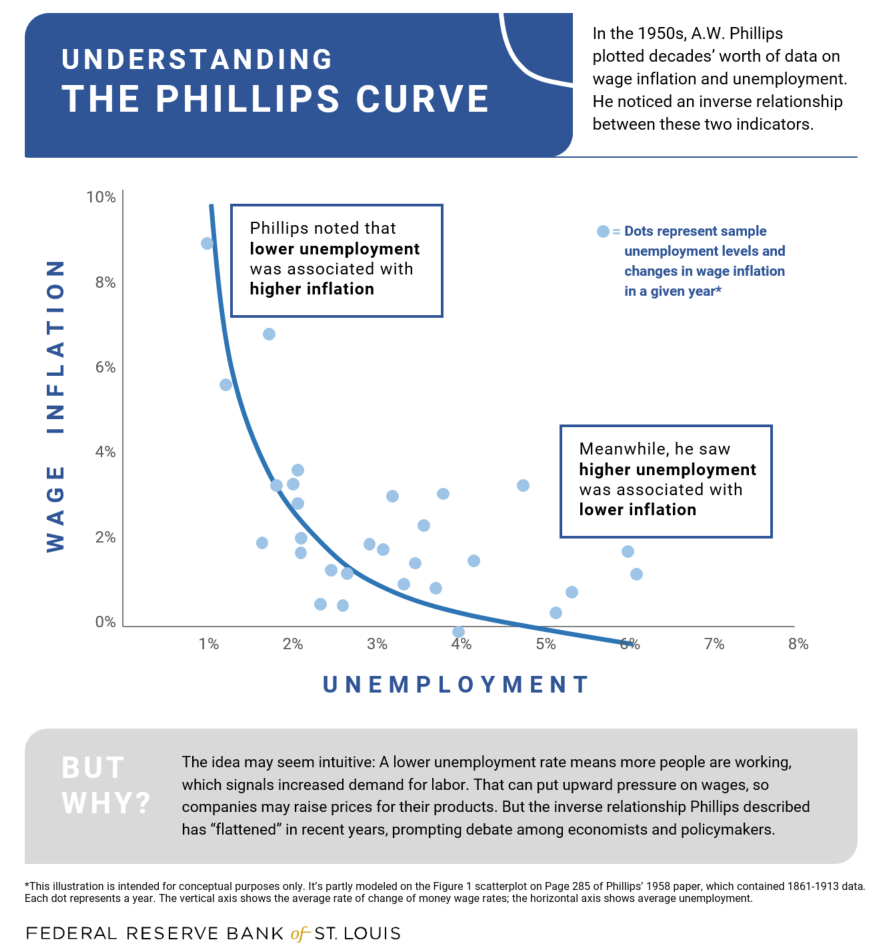

The Phillips Curve: The Changing Relationship Between Inflation and Employment

A key to understanding the Fed’s dual mandate is considering how inflation relates to economic activity. One frequently mentioned link is the tradeoff between inflation and unemployment. In the late 1950s, William Phillips documented a negative relationship between wage inflation and unemployment in the United Kingdom, as illustrated in Figure 2.

The bottom right of the curve captures data from a weak economy—when unemployment is high and wage inflation is low. This is most likely to occur during a recession. Here, resources such as labor are underutilized; you might say there is “slack” in the economy. In this situation, many workers are looking for jobs, and companies do not have incentives to raise wages much (if at all) to attract or keep workers.

Conversely, the top left of the curve—where wage inflation is high and unemployment is low—reflects an economy that is running hot, perhaps having been expanding for a number of years. Here the labor market may be considered tight, with most people having jobs. In such an economy, firms looking for more workers must compete with each other by significantly boosting wages or offering better benefits to lure them from other opportunities. This is a situation where unemployment is low and wage inflation is high.

Figure 2: The Traditional Phillips Curve

SOURCE: Federal Reserve Bank of St. Louis; Open Vault Blog, What Is the Phillips Curve and Why Has It Flattened?

Since labor costs represent about two-thirds of firms’ total cost of production, they are very important for firms’ pricing decisions. By the mid-1960s, economists Paul Samuelson and Robert Solow had noted a similar relationship in the United States between price inflation and unemployment that we now typically refer to as the traditional “price Phillips curve” or simply the “Phillips curve.”

As seen in Figure 3A below, U.S. data from the 1960s illustrate the standard price inflation-unemployment curve well. Thus, the Phillips curve captured a tradeoff that policymakers considered when setting monetary policy: They could pursue an economy with lower unemployment if they were willing to accept higher inflation. Conversely, if policymakers wanted to pursue lower inflation, they would have to accept higher unemployment and lower economic activity.

However, this tradeoff has weakened. As recently noted by Fed Chair Powell, “Inflation has been much lower and more stable over the past three decades than in earlier times.”Powell, Jerome. Getting Back to a Strong Labor Market, at the Economic Club of New York. Board of Governors of the Federal Reserve System, February 10, 2021. This fact has occurred despite big fluctuations in unemployment. As shown in Figure 3B, over the past 20 years, there has not been a strong relationship between inflation and unemployment. This evidence has led economists to say that the Phillips curve has flattened.

Policymakers recognize this flat Phillips curve, which allows them to pursue lower unemployment without having to accept higher inflation. That is, the long-standing presumption that monetary policy should be tightened as unemployment falls to low levels to head off high inflation is no longer how policymakers necessarily think and act. Today, policymakers are willing to allow employment to expand as long as inflation expectations are anchored around the FOMC’s 2 percent target.If households anticipate that policymakers are attempting to achieve persistently lower unemployment by being willing to accept potentially higher inflation, households may begin to expect higher inflation. In this case, they will build these expectations into wage and price decisions. This, in turn, will lead to higher inflation for any rate of unemployment. How this would actually play out in today's environment with the weakened tradeoff is uncertain, but this is an issue that policymakers must evaluate as they determine optimal policy. In light of these issues, the Fed has adjusted its strategy for achieving price stability.

Inflation Expectations

Inflation expectations are just what they sound like—expectations that households and businesses have about future inflation. Inflation expectations are important because they influence peoples’ decisionmaking today, which then impacts future inflation.

For example, if a firm expects 2 percent inflation this year and going forward, it will feel comfortable raising the price of its products by about 2 percent, be willing to increase the wages of its workers by about 2 percent to compensate for higher prices (all else equal), and contemplate investment and hiring decisions based on these expectations. Consumers will anticipate prices and wages to increase by about 2 percent and will make their spending and savings decisions accordingly. And if households and businesses expect 2 percent inflation, and make decisions based on those expectations, their actions contribute to the realization of a 2 percent inflation.

With these situations in mind, the FOMC has stated that it aims to “anchor” inflation expectations at its 2 percent longer-run inflation goal. That way, the Fed’s monetary policies and the expectations of households and firms can reinforce each other. The Fed monitors inflation expectations using data from a wide variety of surveys and from financial instruments. These data differ along several key dimensions, including the horizon of the expectation and the associated measure of inflation.

Recently, economists at the Fed constructed an index of common inflation expectations using 21 of these measures. The index captures the general trajectory of many of the long-horizon inflation expectation indicators. A summary of the index of common inflation expectations is found here. Updates can be found here: Index of Common Inflation Expectations.

Fed’s Actions To Achieve Stable Prices

Each year the FOMC releases a Statement on Longer-Run Goals and Monetary Policy Strategy. This statement is intended to help the public understand how the Committee aims to achieve its Congressional mandate of price stability and maximum employment. Three important points regarding price stability in the statement include the following:

- The Committee’s longer-run goal for inflation, as measured by the annual change in the PCEPI, is 2 percent.

- Longer-term inflation expectations that are well anchored at 2 percent are desired to achieve the Committee's Congressional mandate of maximum employment and price stability.

- To anchor longer-term inflation expectations at 2 percent, the FOMC will seek to achieve inflation that averages 2 percent over time.

The first of these points reiterates to the public that the explicit price measure the FOMC uses to measure inflation is the PCEPI and that it plans to achieve inflation that averages 2 percent over time. The second point is not only that the FOMC cares about current inflation, but also that the public has expectations for inflation consistent with the FOMC’s 2 percent inflation goal. The FOMC believes that inflation expectations anchored at 2 percent will help it achieve its dual mandate.

Finally, given that inflation tends to move up and down over time, in 2020 the FOMC adjusted its statement on longer-run goals to emphasize that it’s looking for inflation that averages 2 percent over time. The Committee believes that “by seeking inflation that averages 2 percent over time this will help ensure longer-run inflation expectations do not drift down and remain well anchored at 2 percent.”Board of Governors of the Federal Reserve System. Q&As: Has the Federal Reserve's inflation objective changed? Why is the Federal Reserve interested in achieving inflation that averages 2 percent over time?

This approach has been referred to as a flexible average inflation target (FAIT) policy. FAIT means the inflation goal is symmetric around 2 percent, which means that sometimes inflation may be a bit above 2 percent and at other times may be a bit below 2 percent. But, on average, it should be 2 percent.

Going Forward

After running persistently below 2 percent for nearly a decade, inflation moved up above 2 percent in the first half of 2021. In response, the FOMC stated that it believed these price increases were reflecting transitory factors (see below). The FOMC also indicated that it is aiming to achieve inflation moderately above 2 percent for a bit of time so that inflation averages 2 percent over time, consistent with its FAIT policy. In addition, given that the Phillips curve is quite flat, there does not seem to be a strong “tradeoff” between raising inflation and overheating the labor market. This means that policymakers can aim for both further improvements in the labor market and moving inflation above 2 percent, so long as inflation expectations are consistent with the long-run 2 percent objective.

What Is “Transitory” Inflation?

Monetary policymakers have a mandate to promote price stability in the economy, which the FOMC defines as inflation that averages 2 percent over time. This definition means the Fed won’t react to every bump or dip in inflation. Rather, the Fed wants to see if a given change in the price level signals transitory or persistently higher or lower future inflation.

Transitory inflation is a short-lived, or temporary, increase in inflation with the expectation that inflation will return to a lower level not too far in the future. This might occur for a couple of reasons.

First, inflation is often measured as a 12-month change, so it’s calculated as a percent change between two index number that are 12 months apart. If the price index fell 12 months ago, as it did in Spring 2020 when the COVID-19 outbreak halted many activities, the calculations a year later would show extra inflation because the level a year ago was temporarily low. This is what’s often called base effects. Of course, that low level will “fall out” of the calculation window as time moves on. Hence, the higher inflation readings will be (all else equal) short-lived, not a sign of persistently high inflation.

Another example is a bottleneck, which is a temporary blockage or restriction in the supply chain. Think of the supply chain disruptions that can result from an event like a storm or pandemic. These events might cause an increase in the prices of key goods and services that show up in the inflation numbers, but it will likely be short lived as workers and businesses recover and adapt. The important point to remember is that the Fed intends to adjust the stance of monetary policy in response to persistently high or low inflation, especially inflation that moves inflation expectations away from 2 percent.

Deflation: A general, sustained downward movement of prices for goods and services in an economy.

Federal Open Market Committee (FOMC): A Committee created by law that consists of the seven members of the Board of Governors; the president of the Federal Reserve Bank of New York; and, on a rotating basis, the presidents of four other Reserve Banks. Nonvoting Reserve Bank presidents also participate in Committee deliberations and discussion.

Inflation: A general, sustained upward movement of prices for goods and services in an economy.

Inflation rate: The percentage increase in the average price level of goods and services over a period of time.

Wage inflation: A general, sustained upward movement in the average level of wages.

- See the transcript of Chair Powell's Press Conference (PDF), March 17, 2021.

- Powell, Jerome. Getting Back to a Strong Labor Market, at the Economic Club of New York. Board of Governors of the Federal Reserve System, February 10, 2021.

- If households anticipate that policymakers are attempting to achieve persistently lower unemployment by being willing to accept potentially higher inflation, households may begin to expect higher inflation. In this case, they will build these expectations into wage and price decisions. This, in turn, will lead to higher inflation for any rate of unemployment. How this would actually play out in today's environment with the weakened tradeoff is uncertain, but this is an issue that policymakers must evaluate as they determine optimal policy.

- Board of Governors of the Federal Reserve System. Q&As: Has the Federal Reserve's inflation objective changed? Why is the Federal Reserve interested in achieving inflation that averages 2 percent over time?

Citation

Scott A. Wolla, Ekaterina Peneva and Jane E. Ihrig, ldquoInflation Expectations, the Phillips Curve, and the Fed’s Dual Mandate,rdquo Federal Reserve Bank of St. Louis Page One Economics, July 15, 2021.

These essays from our education specialists cover economic and personal finance basics. Special versions are available for classroom use. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us