What the Rates of Workers Switching Employers or Holding Multiple Jobs Can Tell Us

The unemployment rate and payroll growth are two indicators people most commonly look at to gauge the state of the labor market.

But looking at additional labor market indicators can give economists insights about inflation, the strength of the labor market and signs of productivity growth.

I spoke with Serdar Birinci, a senior economic policy advisor in the St. Louis Fed’s Research division, about two indicators he studies: the employer-to-employer transition rate, also known as the job-to-job transition rate; and the fraction of multiple jobholders, or overemployment.

Workers making employer-to-employer transitions are those who are switching from one employer to another without having a period of unemployment in between. Multiple jobholders are those workers who have more than one job at the same time.

- The employer-to-employer transition rate can give a sense of inflationary pressures from the labor market as well as potential productivity growth.

- The fraction of multiple jobholders can reflect the amount of labor market tightness.

How Do Employer-to-Employer Transitions Give Insights into Inflation?

Understanding more about the labor market—e.g., how costly it is for firms to hire workers, what employers’ hiring processes are, and how much they’re paying their workers—helps economists understand whether the labor market might be a source of inflationary pressure, Birinci explained.

“If firms are paying higher salaries, if there’s high competition, they are likely to pass this to consumers,” he said. “That would create higher inflation or inflationary pressures coming from the labor market.”

What’s the best indicator for evaluating whether workers are going to make higher salaries and employer costs are going to increase soon? The employer-to-employer transition rate (or the share of workers who transition from one employer to another in a given month), Birinci said.

“Why is that? Well, the intuition is actually quite simple: When individuals change jobs, they are often changing jobs to higher salaries, better compensation. So that means they are getting higher wages,” he explained.

Even though it can lead to wage growth, a higher employer-to-employer transition rate isn’t always inflationary overall, Birinci noted. When trying to assess the total impact of a higher employer-to-employer transition rate on inflation, it’s also important to look at the effect on productivity growth.

How Can Employer-to-Employer Transitions Affect Productivity Growth?

When people change jobs, they ideally go to ones that better fit their skillset and are potentially more productive for them, Birinci said.

Employer-to-employer transitions, therefore, can give people opportunities to better use their skills, which contributes to productivity growth. “So, a higher employer-to-employer transition rate is a sign of productivity growth as well,” he said.

Thus, a higher employer-to-employer transition rate can increase wages and also productivity. Higher wages are inflationary because they increase an employer’s marginal cost of production, while higher productivity is deflationary because it leads to more production, Birinci explained.

“So, whether a higher employer-to-employer transition rate turns out to create more or less inflation depends on whether the wage increase or productivity increase dominates,” he said.

What Can the Percentage of Multiple Jobholders Tell Us about the Labor Market?

A common measure of labor market tightness is the number of vacancies available per unemployed worker, or V/U.

A low number means there aren’t many job openings per unemployed person, suggesting those who are unemployed would have a more difficult time finding a job, Birinci explained. Conversely, a higher V/U would mean unemployed workers would have a relatively easier time finding a job.

He noted that sometimes the number is high, but the vacancies are filled not by unemployed individuals but by people who are already employed and looking for a second job.

These workers could be seeking to improve their skills for a potential career change, he said. He gave as an example a teacher trying to learn data science skills by taking a secondary job with the goal of eventually changing careers. Alternatively, people might need a secondary job to earn more and increase their purchasing power, he said.

“Regardless of any reason, if you have a lot of workers holding secondary jobs, that means unemployed workers will have a more difficult time finding a job,” he said.

That’s because they’ll be competing not only with other unemployed people, but also with employed workers who are looking for another opportunity.

“That’s why, in order to understand the strength of the labor market or tightness of the labor market, we would also look at what fraction of employed workers are holding second jobs,” Birinci said.

Trends in the Employer-to-Employer Transition Rate

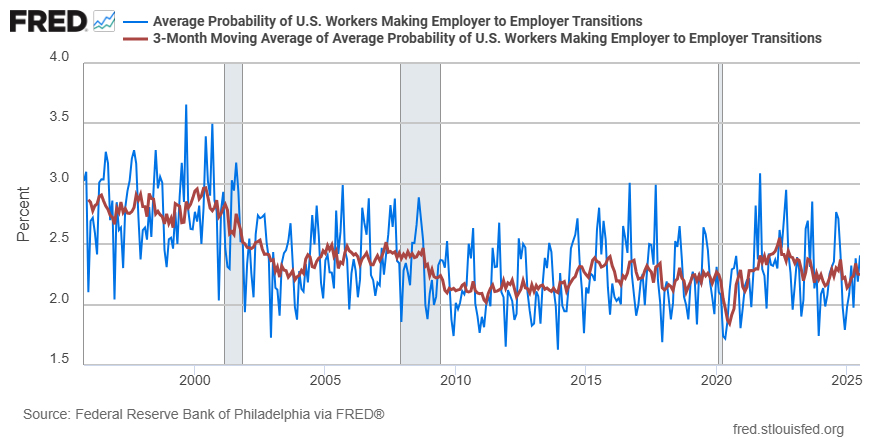

So, what share of employed workers change jobs in a given month? The employer-to-employer transition rate in the United States has averaged about 2.2% over the past 15 years. The FRED graph below shows the probability of such transitions using data from the Federal Reserve Bank of Philadelphia, which reports the series calculated by Shigeru Fujita, Giuseppe Moscarini and Fabien Postel-Vinay.

NOTE: The blue line is not seasonally adjusted; the red line is seasonally adjusted.

The employer-to-employer transition rate was low for many years following the Great Recession of the late 2000s—a period that was characterized by a slow labor market recovery, Birinci pointed out.

In contrast, the rate increased substantially in the years following the COVID-19 pandemic recession. The labor market during that time was very strong, with a low unemployment rate and a lot of workers having the opportunity to change jobs, he explained.

How did this impact U.S. inflation, which surged for multiple reasons following the pandemic recession? About 15% of the increase in inflation between 2021 and 2022 was due to the elevated employer-to-employer transition rate, Birinci said. This means the inflationary wage effects of employer-to-employer transitions dominated the deflationary productivity effects during this period, he added. He cited his working paper with Fatih Karahan, Yusuf Mercan and Kurt See, “Labor Market Shocks and Monetary Policy,” which was revised in July 2025.

(For more information, see the Feb. 6, 2025, FRED Blog post “The implications of employer-to-employer transitions on inflation dynamics,” suggested by Birinci.)

Trends in the Fraction of Multiple Jobholders

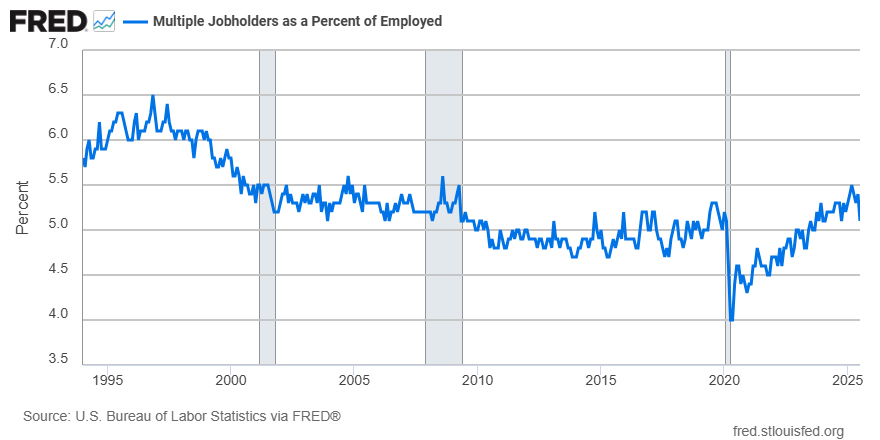

The fraction of employed workers in the U.S. with multiple jobs in a given month hovered around 5% between the Great Recession and the COVID-19 recession. You can see this labor market indicator in the next FRED graph.

The share of multiple jobholders declined to 4% during the COVID-19 recession and then slowly increased. It reached 5.5% in March 2025 but has since come down a bit.

Want to know more about trends for multiple jobholders?

- The Jan. 25, 2024, FRED Blog post compares how common “moonlighting” is for men versus women. (“Moonlighting” is another term for holding multiple jobs.) The post shows that the fraction of women holding multiple jobs is higher than the fraction of men holding multiple jobs.

- The March 3, 2025, On the Economy blog post “Beyond the 9 to 5: Decoding the Overemployment Trend” by Birinci and Carlos Garriga, the St. Louis Fed’s research director, has additional analysis on multiple jobholders.

What These Indicators Can Tell Us about the Labor Market in General

Higher rates of employer-to-employer transitions and multiple jobholders suggest unemployed people may have a harder time finding a job due to increased competition.

But what do these indicators tell us about the status of the labor market in general?

When the employer-to-employer transition rate is going up, it suggests a strong labor market where employed workers are finding it easier to change jobs or careers, Birinci said. This creates cost pressures for employers but leads to higher productivity as well, he added.

A higher percentage of people with multiple jobs also suggests a strong labor market. “If a lot of people have secondary jobs, that means there are abundant opportunities in the labor market for people to do an additional job on top of their full-time work,” he explained.

Conversely, lower rates of employer-to-employer transitions and multiple jobholders would suggest a weaker labor market. In that case, employed workers might find it more difficult to switch jobs or to take on a second one.

As these two examples show, looking at labor market indicators beyond the unemployment rate and payroll growth can give valuable insights about the economy.

This blog explains everyday economics and the Fed, while also spotlighting St. Louis Fed people and programs. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us