Amplifying Small-Business Voices

The Federal Reserve’s national Small Business Credit Survey provides timely insights on small business financial needs, business performance and emerging issues.

The annual survey is conducted online and distributed through a network of local, regional and national partners such as chambers of commerce, nonprofits and Small Business Development Centers. Through our partners we are able to reach various segments of the small business market including startups, women- and minority-owned firms, rural businesses and microbusinesses.

As one of the largest data sets of its kind, the survey provides valuable information on small businesses to policymakers, service providers and lenders. The 2021 survey, which gathered over 17,000 responses, illustrated the impact on small businesses from a litany of challenges:

- The COVID-19 pandemic

- Racial unrest

- Growing wealth gaps

- Supply chain disruptions

- Labor shortages

- Growing inflation

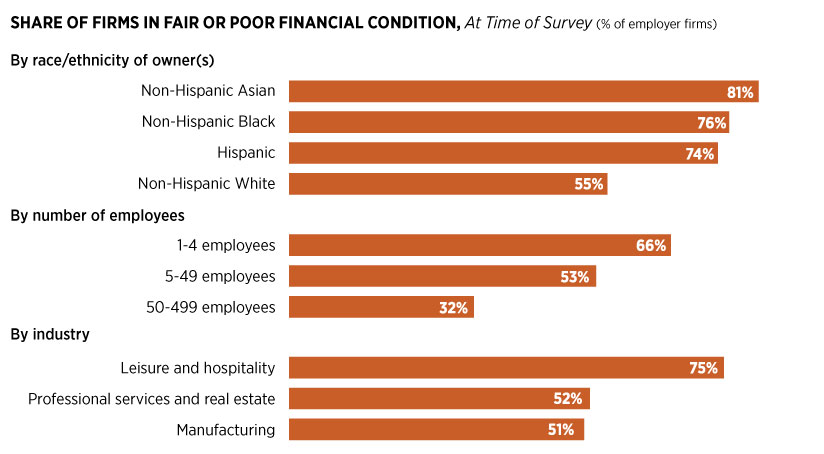

For instance, small businesses owned by people of color, smaller businesses and businesses in the leisure and hospitality industries were most likely to be in a fair or poor financial condition.

Financial Condition Varied across Firm Categories

SOURCE: Small Business Credit Survey conducted Sept. 8 through Nov. 19, 2021.

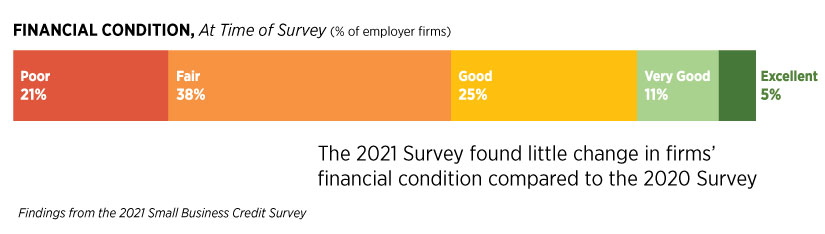

More than Half of Employer Firms Were in Fair or Poor Financial Condition

SOURCE: Small Business Credit Survey conducted Sept. 8 through Nov. 19, 2021.

Other key findings from the 2021 survey include:

- The pandemic continued to have a significant impact on small businesses, with 77% reporting negative effects at the time of the survey, which was conducted Sept. 8 through Nov. 19, 2021.

- Hiring or retaining qualified staff and navigating supply-chain issues were the top operational challenges that firms faced.

- In 2021, 66% of employer firms received pandemic-related financial assistance, down from 87% in 2020.

- The share of applicants receiving all the traditional financing they sought fell from 51% in 2019, to 36% in 2020, to 31% in 2021.

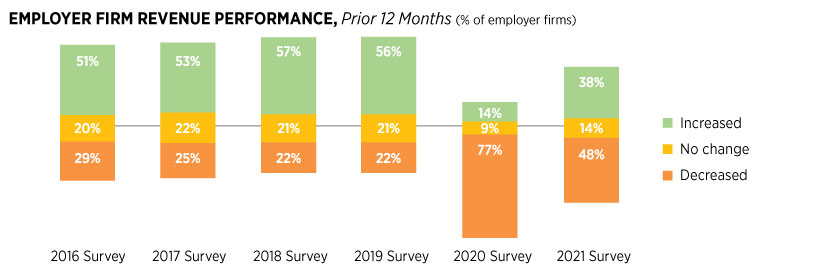

Revenue Performance Improved in 2021, but Lagged Pre-pandemic Levels

SOURCE: Small Business Credit Survey conducted Sept. 8 through Nov. 19, 2021.

The Federal Reserve invites nonprofit organizations that work with or assist small businesses to become distribution partners for the Small Business Credit Survey. Your partnership makes a difference in amplifying the voices of small businesses. By becoming a partner:

- You help yourself—all partners that get at least 50 responses will receive a customized report that can compare businesses in your network to a national sample

- You help small businesses—the survey enables us to reach businesses that tend to be under-represented in other surveys—startups, rural businesses, and women and minority owned firms

- You help the U.S. economy—feedback from the survey provides small business stakeholders insight, allowing them to make informed decisions that can benefit the economy.

The 2022 Small Business Credit Survey will run Sept. 8 through Nov. 18.

Sign up to become a partner or to take the survey. To learn more, please feel free to contact me at lisa.locke@stls.frb.org.

This blog explains everyday economics and the Fed, while also spotlighting St. Louis Fed people and programs. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us