Slow Economic Recovery for LMI Communities in the Eighth District

What is the status of the recovery from the COVID-19 pandemic in the low- to moderate-income (LMI) communities in the St. Louis Fed’s District?

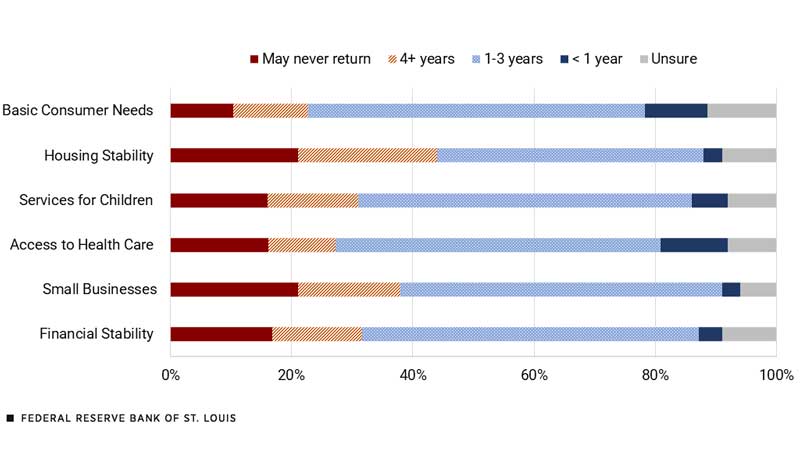

While economic disruption in LMI communities had abated, more than 80% of community service providers reported their communities needing at least one year to return to pre-COVID conditions, according to the Federal Reserve’s Community Impact Survey conducted in August 2021.

This blog post summarizes the main findings, such as the one above, for the Eighth Federal Reserve District from the latest nationwide COVID survey. Conducted by eight national partners and the Federal Reserve System’s community development function, the survey provides a snapshot of how COVID-19 was affecting LMI communities and the entities serving them in August 2021. Based on discussions with the entities serving LMI communities, the survey results remain indicative of the current situation in the Eighth District.

The Eighth District’s results rely on 480 observations from entities with headquarters within the District’s seven states. Overall, the St. Louis Fed’s District—which includes the entire state of Arkansas as well as parts of Illinois, Indiana, Kentucky, Mississippi, Missouri, and Tennessee—does not have major differences with national level results.

Most Respondents: Recovery Will Take 1 to 3 Years

Disruption generated by COVID-19 was still present, though peak disruption was somewhat left behind. Recovery will take between one to three years for most LMI communities.

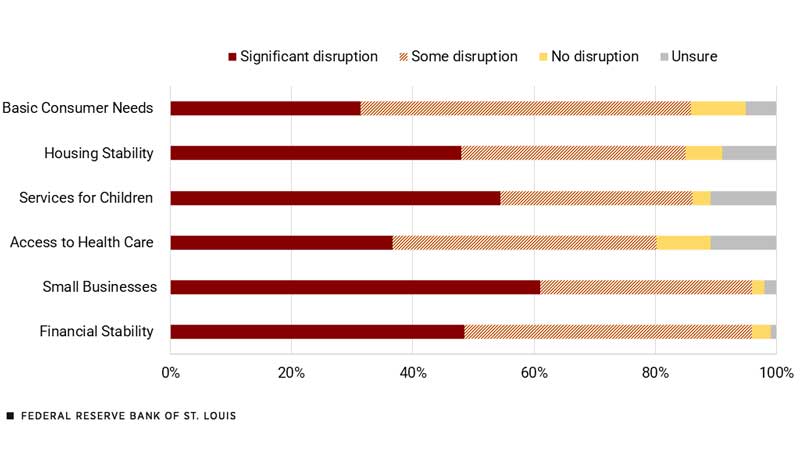

While 90% of respondents indicated some level of disruption at the time of the August 2021 survey, 40% indicated their communities were significantly disrupted, versus 80% at the peak of the pandemic.All three values are lower than at the national level, with 97% indicating some level of disruption at the time of the survey, 44% being significantly disrupted and 86% indicating significant disruption at the peak of the pandemic.

Level of Disruption for LMI Communities in the Eighth District

SOURCE: Federal Reserve’s 2021 Community Impact Survey

NOTES: The survey question was: Currently, what level of disruption is COVID-19 having on…? The results shown in this and all other charts in the post are based on responses to a survey conducted in August 2021 from entities providing services to LMI communities headquartered within the Eighth District's seven states.

Expected Time to Recovery for LMI Communities in the Eighth District

SOURCE: Federal Reserve’s 2021 Community Impact Survey

NOTES: The survey question was: From today, how long do you expect it will take for the communities you serve to achieve … conditions similar to pre-pandemic conditions? Only respondents who said the current situation is worse than pre-pandemic conditions responded to this question.

Hard Hit Areas Include Small Business and Children’s Services

Small businesses, services for children, and financial and housing stability were heavily hit in LMI communities.

More than 80% of respondents indicated that small businesses in their communities were still in worse shape than they were before the pandemic due to short- and long-term closures, supply chain disruptions and reduced demand, with 61% of the respondents indicating there was a significant level of disruption. In addition, 38% of respondents indicated that their communities would need at least four years to recover to pre-pandemic conditions.

About three-quarters of respondents indicated that services for children in their communities—including availability of early childcare and education, access to child welfare services, and adequate access to K-12 education—were in a worse situation than before the pandemic. About a third indicated that recovery could take up to four years. Furthermore, approximately 55% of respondents indicated there was a significant level of disruption in this sector at the time of the survey.

With respect to financial stability (including income loss and income instability), 76% reported worse conditions in the LMI communities they serve than pre-COVID, with half of respondents indicating a significant level of disruption and a third of respondents stating that recovery would take at least four years.

Similarly, housing stability—encompassing evictions, back rent, foreclosures and homelessness—was also significantly hit, with 70% of respondents indicating worse conditions, and half of respondents indicating a significant level of disruption at the time of the survey. Moreover, almost 45% of respondents indicated that recovery to pre-pandemic conditions in this area, if it ever happened, would take at least four years.

Respondents Said Hard-to-Access Relief Offered Vital Help

Federal funds and resources were very critical to the recovery of LMI communities; however, accessing these funds remained a significant challenge.

The survey asked about the criticality of several resources deployed in the past year. More than 60% of respondents indicated that stimulus checks, small business support, unemployment benefits and rent relief had been very critical. Additionally, 47% indicated that the child tax credit had been very critical.

Nevertheless, approximately 80% of respondents indicated there were challenges accessing these funds due to:

- eligibility issues or lack of capacity (with 35% claiming this was a significant challenge)

- complex processes and burdensome paperwork, or a lack of access to the internet (with 42% indicating that applying for funds had been a significant challenge)

- their lack of relationships with banks (with almost 30% indicating the bank channel was a significant challenge)

The critical nature of federal funds and challenges faced in accessing these funds are consistent with our national evidence.

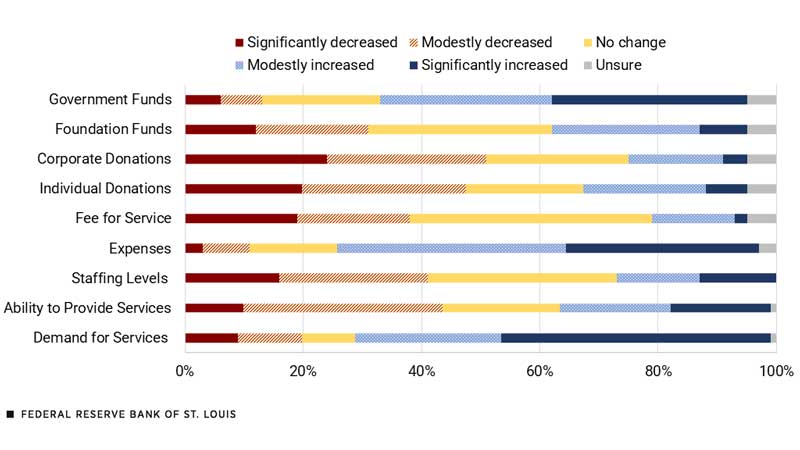

Financial Vulnerability Continues for LMI Community Entities

Entities serving Eighth District LMI communities were experiencing less disruption than at the peak of the pandemic but remained economically vulnerable.

Almost 70% of respondents indicated COVID-19 had caused a significant disruption for the entity they represented during the peak of distress, while 27% of the respondents indicated there was significant disruption at the time of the survey. Approximately 70% of entities also indicated demand for their services had increased compared to pre-pandemic levels, but only 36% noted an increase in their ability to provide services relative to their pre-pandemic ability.

Impact of COVID-19 on Entities Relative to Pre-Pandemic Conditions

SOURCE: Federal Reserve’s 2021 Community Impact Survey

NOTE: The survey question was: Comparing the current situation to pre-pandemic conditions, how is COVID-19 impacting the entity you represent in the following?

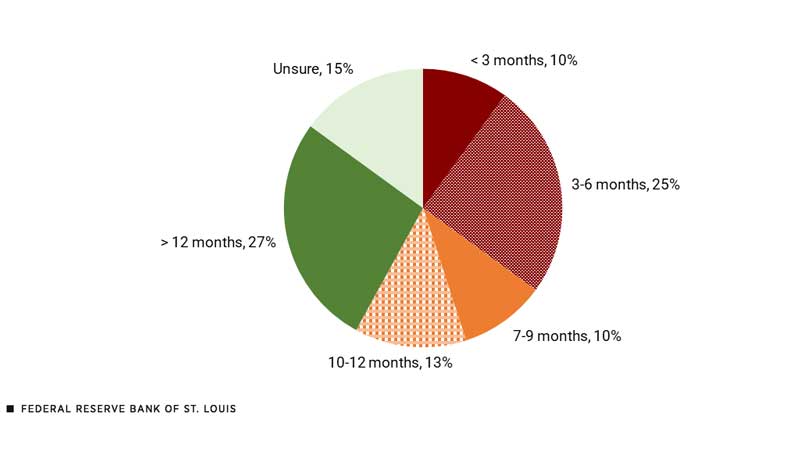

Months of Operation before Financial Distress

SOURCE: Federal Reserve’s 2021 Community Impact Survey

NOTES: The survey question was: Given your existing resources, how many months can the entity you represent operate in the current environment before exhibiting financial distress? Only respondents who reported their entities were adversely impacted by COVID-19 responded to this question.

Less than half of the reporting entities (46%) in the Eighth District expressed that COVID-19 had a negative impact on their financial health, compared with 51% at the national level. Nevertheless, it is worth noting that this survey was only answered by entities that had survived the pandemic and were still providing services at the time of the survey.

Out of the respondents who reported their entities were adversely impacted by COVID-19, almost 60% indicated their entity could operate for a year or less in its current environment before exhibiting financial distress, which includes reducing services, laying off staff, closing locations or shutting down entirely.

One-Third Say Recovery Will Take Years for Communities

As of August 2021, COVID-19 was still disrupting LMI communities and entities serving them in the Eighth District in ways similar to those at the national level. While economic recovery was under way, approximately a third of service providers indicated that it will take more than three years for their communities to return to pre-pandemic conditions.

This blog post contributes to the Institute for Economic Equity’s monitoring of COVID-19’s impact on the U.S. economy, with a specific focus on the Eighth District’s LMI communities. We will continue to work and provide timely information on the challenges and opportunities in the Eighth District’s LMI communities, especially in light of the ongoing pandemic.

Note

1 All three values are lower than at the national level, with 97% indicating some level of disruption at the time of the survey, 44% being significantly disrupted and 86% indicating significant disruption at the peak of the pandemic.

This blog explains everyday economics and the Fed, while also spotlighting St. Louis Fed people and programs. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us