Insights on Advancing Shared Rural Prosperity

The book “Investing in Rural Prosperity” seeks to help rural individuals and communities achieve shared economic prosperity.

On Nov. 16, 2021, the Federal Reserve System hosted a Connecting Communities webinar exploring a new “TRIC” framework for how to advance shared economic prosperity across rural America. The framework was proposed in a chapter of “Investing in Rural Prosperity,” a new book published by the Federal Reserve Bank of St. Louis in collaboration with the Federal Reserve Board of Governors.

Long-standing inequities have hindered the advancement of shared economic prosperity and have contributed to instability and to diminished cohesion as a nation. Now is the time to tackle these issues because we are all in this together and rural communities have a key role in the future of our country.

Those were the conclusions of four panelists who participated in a webinar on Nov. 16 that launched “Investing in Rural Prosperity.” During the event, they discussed the past, present and future of shared economic prosperity in rural America.

The four panelists were:

- Donna Gambrell, president and CEO of Appalachian Community Capital (ACC);

- Justin Maxson, deputy undersecretary for rural development for the U.S. Department of Agriculture (USDA);

- Lisa Mensah, president and CEO of the Opportunity Finance Network; and

- Marietta Rodriguez, president and CEO of NeighborWorks America.

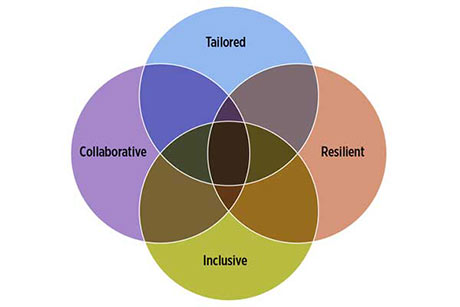

The TRIC to Rural Development

In addition to reflecting on the importance of access to economic opportunity in rural America, the panelists commented on the relevance of a new “TRIC” framework (PDF) proposed in the book to rural development policy, practice, funding and research. (See the box below for an explanation of this framework.)

Rodriguez highlighted how TRIC principles align with the fundamental beliefs that guide the work of NeighborWorks America and the NeighborWorks network. They use the capacity of place-rooted organizations to address the needs of communities, identified through inclusive engagement with residents, and advanced through a collaborative approach focused on enhancing physical, economic and social resiliency.

For example, Rodriguez showcased the work of CASA of Oregon, which works with resident-owned manufactured housing communities to develop disaster resilience plans, and Wealth Watchers (PDF) in Florida, which helps people of color learn construction skills to address a worker shortage while also expanding access to living wage jobs.

Mensah noted how the tailored principle is at the heart of the investment efforts of community development financial institutions (CDFIs), explaining how CDFIs emerged to address the specific needs of their communities. In another example, she cited the work of the Partners for Rural Transformation (PDF) and its mission to address the specific, unique needs of rural communities that are experiencing persistent poverty.

Gambrell described the highly collaborative, tailored and inclusive work of ACC and its 25 members. She outlined ACC’s partnership with communities in Ohio, Virginia and West Virginia that connects them with technical assistance providers from within and outside the region who could bring specific expertise to get “opportunity zone” projects off the ground. Opportunity zones are economically distressed communities that have been certified by the Secretary of the U.S. Treasury and where new investments, under certain conditions, may be eligible for preferential tax treatment.

Maxson asked why more rural development efforts aren’t built with these principles when we have strong evidence that they are critical to success. He noted several areas where the USDA is trying to incorporate these principles into its approach and policy recommendations, including in a potential new iteration of the Obama-era StrikeForce initiative, and in the proposed Rural Partnership Program. Both proposals seek to provide additional funding support to rural community development, including in Tribal Nations.

Investing in Rural Prosperity for All

The panelists also identified opportunities for rural development stakeholders to advance practices consistent with the framework’s principles. While acknowledging that money can’t fix everything, the panelists agreed that more resources were needed, including capital to support development projects, funding for technical assistance and resources to support the development of capacity (PDF) in addition to the work of building resilient collaborations.

Several panelists highlighted misalignments between the resources that have been provided in the past and what is needed to advance shared economic prosperity that lasts. One major mismatch the panelists identified was the difference between the duration of funding that is usually made available and the time it takes to achieve real change, emphasizing the fact that current funding is too short-term.

Maxson noted overly burdensome applications for some USDA programs remain a barrier to accessing resources, particularly in capacity-strapped rural communities. He said USDA Rural Development is trying to bolster community and economic development capacity in its national and field offices to ensure that communities can access programs and that funded projects advance a broader strategy.

The panelists closed out the session by encouraging listeners to focus on building relationships, investing and supporting rural leadership development (PDF).

This blog explains everyday economics and the Fed, while also spotlighting St. Louis Fed people and programs. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us