10 Popular Posts on Economic Topics in 2021

What did people most want to know about the economy in 2021?

Inflation and COVID-19’s effects on the economy were top of mind, judging by the popularity of posts on those topics in our On the Economy blog, which offers frequent commentary, analysis and data from our economists and other St. Louis Fed experts. But examinations of longer-run trends, such as employment growth over 20 years, also attracted attention.

For readers of our Open Vault blog, which explains everyday economics and the Fed, the nuts and bolts of topical subjects like central bank digital currency and Fed “tapering” struck a chord, as did a post about the economic concept of externalities, explained with canine and pandemic examples.

Here’s a look at a few of the posts that were among the favorites published from January through Nov. 30.

Inflation Trends

How COVID-19 May Be Affecting Inflation

The changing of U.S. consumer spending patterns during the pandemic may have affected the measurement of inflation, according to an On the Economy post published in February. The Bureau of Labor Statistics gathers information about prices in the U.S., weights the prices and aggregates them for the consumer price index, or CPI. Inflation is measured as the CPI’s rate of growth over a certain period.

But what happens if a certain category of goods or services becomes a bigger, or smaller, part of consumer spending? Based on spending habits in prior years, the official weights might not be the “true” weights in 2020, when social distancing led to more eating at home and less spending in restaurants.

What Are Risks for Future Inflation?

As U.S. inflation surged in 2021, an October On the Economy post identified some upside and downside risks for future inflation. A follow-up post examined whether higher inflation could “be attributed to a small group of goods and services or whether it is a more generalized event.” Looking at the overall price change over the period of the pandemic, “the role of outliers is greatly diminished, revealing that higher inflation is perhaps a broader phenomenon,” the post said.

Economic and Monetary Policy Explainers

Externalities: It’s What Pandemics, Pollution and Puppies Have in Common

Externalities are costs and benefits that impact or spill over to someone other than the producer or the consumer of a good or a service. As a June Open Vault post explained, that applies to everything from pandemics to puppies. In a pandemic, a lack of social distancing by one person creates an externality that is negative: a higher risk of infection for everyone. Puppies that only bark at strangers, meanwhile, could provide a positive externality for neighbors as a warning system.

A June Open Vault blog post highlighted the Economic Lowdown series video “Externalities.” What makes pollution a negative externality is explained in this clip.

Here’s What the Fed Means by Tapering

As anticipation built this fall for a Federal Open Market Committee decision to “taper,” so did curiosity about what tapering is. An Open Vault post answered that question: The Fed can turn to large-scale asset purchases when economic conditions warrant, and tapering means reducing the pace of those purchases. The post, published a week after the Nov. 3 announcement of the FOMC’s decision to start tapering, also explained how tapering works.

What Is the Federal Open Market Committee?

Readers curious about what tapering is could have learned earlier in the year about the committee that makes that and other monetary policy decisions. As a February Open Vault post explained, the FOMC is the main monetary policymaking body of the Federal Reserve and is comprised of leaders from around the Federal Reserve System.

People and Places

Older Workers Accounted for All Net Employment Growth in Past 20 Years

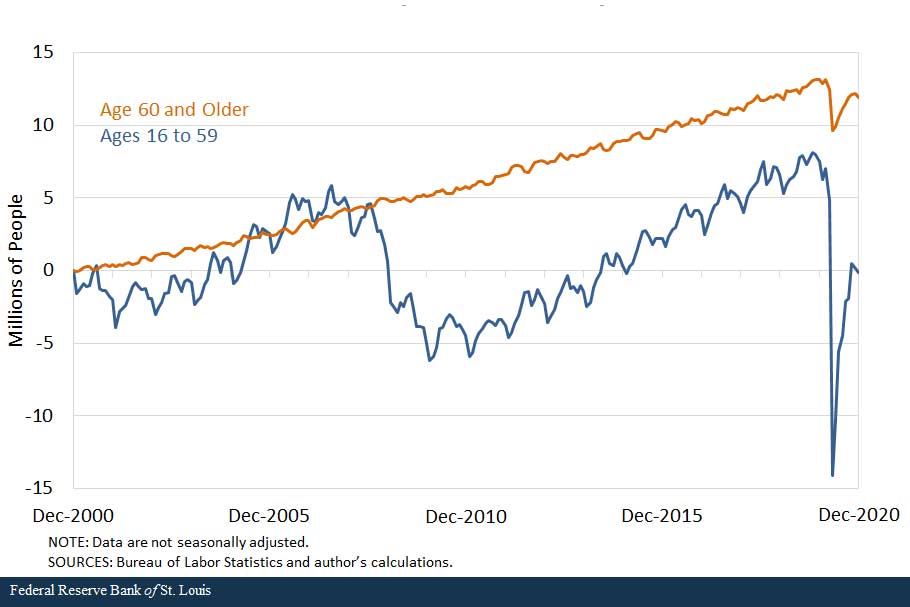

Before there was the “Great Resignation,” there was an employment increase: A February On the Economy post said that a rise in employment of people age 60 and older was responsible for U.S. employment growth of 11.8 million from December 2000 to December 2020. (See chart.) Among those workers, the increase in employment is attributed to the group’s population growth and increased employment-to-population ratio.

Cumulative Net Change in the Number of Employed People since December 2000

House Prices Surpass Housing-Bubble Peak on One Key Measure of Value

The steady increase of a house price-to-rent ratio “would imply increasing overvaluation” of houses, a May On the Economy post said. That was the case in early 2021 (using data available through March), when an index measuring the ratio of house prices to rent in the U.S. had risen rapidly over the course of a year and reached its highest level since at least 1975.

Sign up now for the free symposium, which has the theme, “Leading the Way in Challenging Times.” The event will run 6 to 8 p.m. CT on Feb. 23-24. Participants will hear insights from leading economists.

Inspiring Young Women to Pursue Economics

A January Open Vault post previewed a February 2021 event that is “designed to inspire young women and underrepresented minorities who may be interested in econ—and to encourage those pursuing a degree to persist.” The next Women in Economics Symposium is set for Feb. 23-24, 2022.

Money and Finance

Wealth Gaps between White, Black and Hispanic Families in 2019

Across education, family structure and generations, gaps persist between the wealth of white families and that of Black and Hispanic families, the authors of a January On the Economy post found.

For instance, they wrote: “More education was associated with more wealth for all the racial and ethnic groups considered. However, wide gaps remain at every education level, with Black and Hispanic families having less median family wealth than white families with the same education.”

And Black and Hispanic families are less likely than white families to have financial and other assets like homes and businesses, and when they do, those assets were more likely to have lower values.

Navigating the ABCs of CBDCs—Central Bank Digital Currencies

“You’ve likely heard of Bitcoin, Ethereum, or even Dogecoin, but you may not have heard of ‘Fedcoin,’ an informal name some have used for the idea of a digital currency tied to a central bank, namely the Federal Reserve,” a June Open Vault post said. The post highlighted short videos in which a St. Louis Fed economist answered questions on central bank digital currencies, including about possible effects on privacy and bank lending.

This blog explains everyday economics and the Fed, while also spotlighting St. Louis Fed people and programs. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us