Community Development Organizations Strive to Meet Needs in the Pandemic

Neshanta Larry

Neshanta “Chef Nesee” Larry, owner of North St. Louis County small business That’s So Good, switched from pop-up buffets to delivery and food relief because of the pandemic.

In 2017, Neshanta “Chef Nesee” Larry decided to open That’s So Good, a pop-up food and catering service in North St. Louis County.

Earlier this year, the pandemic forced her to shift her business model to delivery, which damaged her overall revenue. Larry applied for an emergency loan offered for small businesses under the Paycheck Protection Program (PPP), but she did not receive any funding.

“This was a disappointment because my business had the potential to do well during this crisis if I had received financial support,” Larry said. “However, I was able to turn this into a positive outcome by feeding the elderly and at-risk members of my community.”

The COVID-19 pandemic and ensuing economic crisis exacerbated challenges and created urgent needs for low- and moderate-income (LMI) households and communities like those Larry is helping serve.

To get a more accurate lens on what is happening in the Eighth Federal Reserve District, the Engagement team within the St. Louis Fed’s Community Development department spoke with 25 stakeholder organizations across the region during April and May to better understand urgent needs and how the Federal Reserve System can act as a resource in the midst of the pandemic.

In this blog post, we highlight some actions those organizations have taken to help provide assistance to LMI individuals and communities during the pandemic.

The Pandemic Changed Operations and Squeezed Nonprofits’ Finances

Near the end of March, most nonprofit organizations ceased onsite operations and migrated staff to a work from home environment. Service providers converted financial or housing counseling, in-person support services, training, and other meetings to virtual formats. Some providers reoriented their primary focus to responding to the crisis, including supporting access to food and providing communities with relief funds. One Memphis-based community development corporation made more than 300 food deliveries, highlighting residents’ urgent need.

Nonprofits reported funding constraints and anticipated decreases in funding for general operations. Although relief funds became available under PPP, small, mid-size and minority-led organizations experienced challenges navigating the application process. While some organizations had existing relationships with financial institutions, smaller nonprofits reported being overlooked.

Momentum Nonprofit Partners, based in Memphis, and the Community Builders Network, based in St. Louis, responded when partners cited a need for guidance on the repayment and documentation process for PPP loans.

At the beginning of the pandemic, local nonprofits were searching for information on everything pandemic-related, and many were receiving conflicting information, said Kevin Dean, CEO of Momentum Nonprofit Partners.

“When the PPP loans were provided through the CARES Act, we immediately disseminated guidance on applying for those funds,” Dean said. “Many organizations reported that they never would have had the information they needed to make an informed decision on applying without the help and support of Momentum.”

Funding Partners Have Offered Relief to Nonprofits

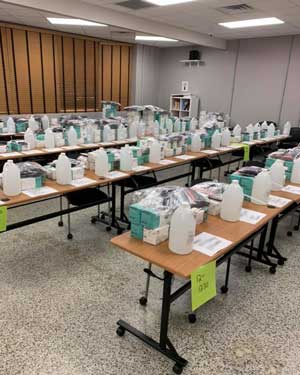

Momentum Nonprofit Partners

Momentum Nonprofit Partners prepares to distribute supplies such as masks and hand sanitizer to local nonprofits during the pandemic.

- The Community Foundation of Greater Memphis created the Mid-South COVID-19 Regional Response Fund and partnered with Momentum Nonprofit Partners, the City of Memphis, Shelby County Government and United Way of the Mid-South to administer grants to nonprofit organizations. The fund deployed over $2.4 million in operating grants to 91 organizations from March to June. This amount represented about 60% of the total available funds. The remainder was saved for recovery and resilience funding.

- Arkansas Community Foundation raised $3.4 million to create a relief fund. The fund awarded 678 mini-grants in $1,000 increments in April and May, and awarded over $1.9 million in grants to 119 organizations in early June.

- St. Louis Community Foundation brought together a coalition to establish the Regional Response Fund with capital from different funder communities. Through April, the fund had distributed approximately $1 million in grants.

- The Deaconess Foundation, with support from the Robert Wood Johnson Foundation, established the $2.2 million Equitable Relief and Recovery Fund to provide grants of $5,000 to $50,000 to social service or social change organizations headed by Black leaders.

- Rural LISC, a national program to aid rural community development, established the $500,000 Mississippi Nonprofit Resiliency Fund to give emergency relief grants to nonprofits in Mississippi that are facing immediate financial threats because of the pandemic.

Government Relief Aided Nonprofits and Borrowers

Dean, of Momentum, shared that his organization conducted a survey of its 300 members. The survey showed nonprofit losses due to:

- Reduced individual and corporate giving

- Lost special event revenue

- Lost earned income

The losses were more than $32 million in March, followed by an estimated $20 million loss per month through August 2020.

“Without direct government intervention through the CARES Act and information dissemination through intermediaries like Momentum Nonprofit Partners, many more nonprofit organizations would be furloughing their employees or closing their doors altogether,” Dean said.

CDFIs shared with CD staff that resources were constrained due to deferred loan repayments and forbearances provided to their borrowers. During the early months of the pandemic, CDFIs like Justine PETERSEN, a not-for-profit corporation based in St. Louis that helps LMI individuals and families build assets, leveraged COVID-19 specific Small Business Administration debt-relief options provided to microlenders, allowing them to expand their lending activities and make more microloans.

“The SBA was fairly expeditious in addressing the plight of microlenders at the outset of COVID-19,” said Robert F. Boyle, a founder and CEO of Justine PETERSEN.

“Namely, the relief, which included six months of payments on microloans and community advantage loans, not only aided the borrower, but also provided a roadmap for our payment support team on how to navigate loan performance for the immediate future,” he said.

Focus Turned to Food and Housing Concerns

Driven by the loss of jobs from the economic shutdown, food insecurity, a situation where people don’t consistently have access to healthy food, became an urgent issue. Organizations throughout the Eighth District shared that food access has become one of their biggest challenges and visits to food pantries have increased.

Despite the federal moratorium on foreclosures and evictions, BLDG Memphis reported that there were 6,000 pending eviction cases as of May. Organizations expressed interest in how funding from the CARES Act could be directed toward rental assistance and housing needs at the county level. Financial institutions and funders were providing borrowers with mortgage relief and forbearance options.

- The Opportunity Home Loan Fund allowed borrowers experiencing hardship to defer payments for April, May and June.

- The Works Inc. provided support to tenants with one-time rental payments to prevent displacement and delinquencies on credit reports.

Future opportunities in affordable homeownership have stalled due to the crisis. Habitat for Humanity of St. Charles County temporarily shut down their home selection process in March, at a time when they had 40 homebuyer applications pending review. The process has since restarted. Some potential buyers were not being approved for financing because financial institutions have tightened underwriting standards, with some banks raising their minimum credit score requirements.

Many families living in substandard or unaffordable housing were working in industries hard hit by the economic challenges brought on by the coronavirus pandemic, said Michelle Woods, executive director of the St. Charles County nonprofit. Numerous applicants faced job and home losses that left them at an even greater risk of housing instability, she said.

“Through it all, the strength we saw in the families was inspiring, as they picked up second jobs and additional hours and pieced together the support needed to keep their family safe and well,” Woods said.

Small Businesses Find Accessing Loans Challenging

Similarly to some nonprofits, small businesses that we contacted found the PPP process inefficient. Small businesses were greatly affected as part of the shutdown, and there is concern that minority-owned businesses are being disproportionately impacted.

Our outreach found that accessing PPP loans and the SBA Economic Injury and Disaster Loan (EIDL) funds has been challenging. The SBA is accepting new EIDL applications on a limited basis to provide relief to small businesses, including agricultural businesses, and nonprofit organizations. Intermediaries and CDFIs are providing technical assistance to help small businesses manage these emergency loans. These partners stated that a central resource library would help support this process.

Community Development Organizations Keep Pushing to Help

That’s So Good owner Larry hopes small, community-based businesses like hers will get access to more flexible and reliable support systems to grow their businesses and strengthen their communities. She currently relies on donations and some minor contracts to prepare and deliver meals to needy families.

Although the ultimate effects of COVID-19 on LMI individuals and communities have yet to be seen, it is apparent that the efforts of community development organizations and nonprofits within the Eighth District remain stronger than ever.

Additional community development-related resources to provide assistance during the pandemic can be found on our Community Development COVID-19 Resources page.

This blog explains everyday economics and the Fed, while also spotlighting St. Louis Fed people and programs. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us