Pandemic Cuts into Families' Financial Health

The percentage of survey respondents with less education who said they were doing at least OK financially dropped by 5 points between fall 2019 and April 2020, to 64%. But those with a bachelor’s degree were equally as likely to say that they are doing OK this year as was the case last fall.

“Adults with less education tend to have smaller financial buffers for emergencies, and are less likely to be able to work from home, and hence are less likely to be able continue working in the pandemic,” said Jeff Larrimore, a researcher with the Federal Reserve Board of Governors, which conducted the surveys.

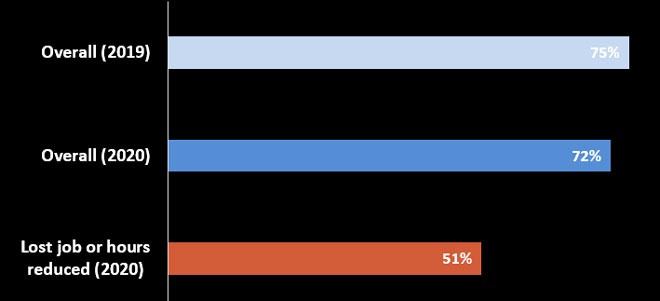

Among those who had a job loss or reduced hours in April, only 51% indicated that they were doing at least OK financially in April, whereas 48% were either “finding it difficult to get by” or “just getting by.”

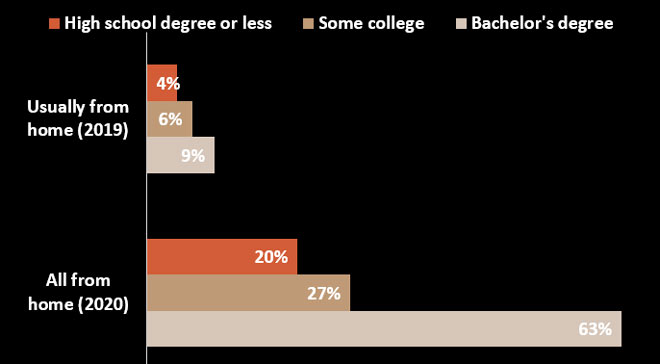

Respondents Who Have College Degrees Work More from Home

SOURCES: Federal Reserve Board 2019 Survey of Household Economics and Decisionmaking and 2020 supplement survey.

NOTES: The bar chart shows that 9% of 2019 respondents with bachelor’s degrees said they usually worked from home, which increased to 63% doing all work from home in 2020. Of those surveyed who had a high school degree or less, meanwhile, 4% said in 2019 that they usually worked from home, a number that increased to 20% doing all work from home in 2020.

Larrimore, who leads the community research section of the Board’s Division of Consumer and Community Affairs, was one of the authors of the seventh annual Report on the Economic Well-Being of U.S. Households.

The report draws from the Survey of Household Economics and Decisionmaking (SHED), which examines the economic well-being and financial lives of U.S. adults and their families. More than 12,000 adults were surveyed in October, offering a picture of personal finances before the COVID-19 pandemic. A supplemental survey of just over 1,000 adults was conducted in April for updated information as the disease spread in the U.S.

Watch a 3-minute video about the Survey of Household Economics and Decisionmaking and Report on the Economic Well-Being of U.S. Households.

Seventy-five percent of people who responded to the survey said in October that financially they were doing all right or better. Six months later, in the midst of stay-at-home orders and closures due to the pandemic, that percentage declined by 3 points. It remained the same for those with at least a bachelor’s degree—at 88%.

The Percent of Respondents Financially Doing OK or Better Declined

SOURCES: Federal Reserve Board 2019 Survey of Household Economics and Decisionmaking and 2020 supplement survey.

NOTES: The bar chart shows that 75% of 2019 respondents overall said they were doing at least OK financially, with 72% overall giving that response in 2020, but only 51% of 2020 respondents who lost jobs or had hours reduced said they were doing OK or better financially.

While most adults were doing at least OK financially at the end of the year, some faced challenges that could affect how they fare this year, Larrimore said.

The people facing challenges in 2019 included those whose income varied month to month and weren’t confident they would be approved for credit cards, Larrimore said. They also included respondents who had attended a for-profit college or university rather than a public or nonprofit institution.

Larrimore and two of his coauthors from the community research section, Principal Economist Ellen Merry and Economist Mike Zabek, spoke about the report during a May 14 webinar. Daniel Davis, vice president and community affairs officer with the St. Louis Fed, was the moderator.

The report highlighted financial concerns for many households that predate the public health crisis. For example, it found 34% of those surveyed in October in the Eighth Federal Reserve District reported they would be unable to cover three months of expenses using savings or borrowing. The Eighth District is served by the St. Louis Fed and includes all of Arkansas, eastern Missouri, southern Indiana, southern Illinois, western Kentucky, western Tennessee and northern Mississippi.

More to Explore

A Snapshot of Record-High U.S. Household Debt

Families Most Vulnerable to Income Shock and COVID-19

This blog explains everyday economics and the Fed, while also spotlighting St. Louis Fed people and programs. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us