Has the Homeownership Rate Reached a New ''Normal''?

The post-Great Recession homeownership rate shows signs of stabilizing, according to the St. Louis Fed’s Center for Household Financial Stability.

But I wanted to find out, why are so many people still renting so long after the Great Recession?

In a recent essay, Policy Analyst Ana Hernández Kent and her co-author noted a Pew Research Center study showing that the share of renters in the U.S. has increased in recent years, from 31.2% in 2006 to 36.6% in 2016.Cilluffo, Anthony; Geiger, A.W.; and Fry, Richard. “More U.S. households are renting than at any point in 50 years.” Pew Research Center, July 19, 2017.

That's nearly 2 in 5 households, a level of renting last seen in the late 1980s.

I recently sat down with several members of the Center team: Kent, along with Lead Economist Bill Emmons and Lead Analyst Lowell Ricketts. When we opened up the discussion, I wanted to hear about the housing market in general, looking at both buying and renting.

Before and after the Boom

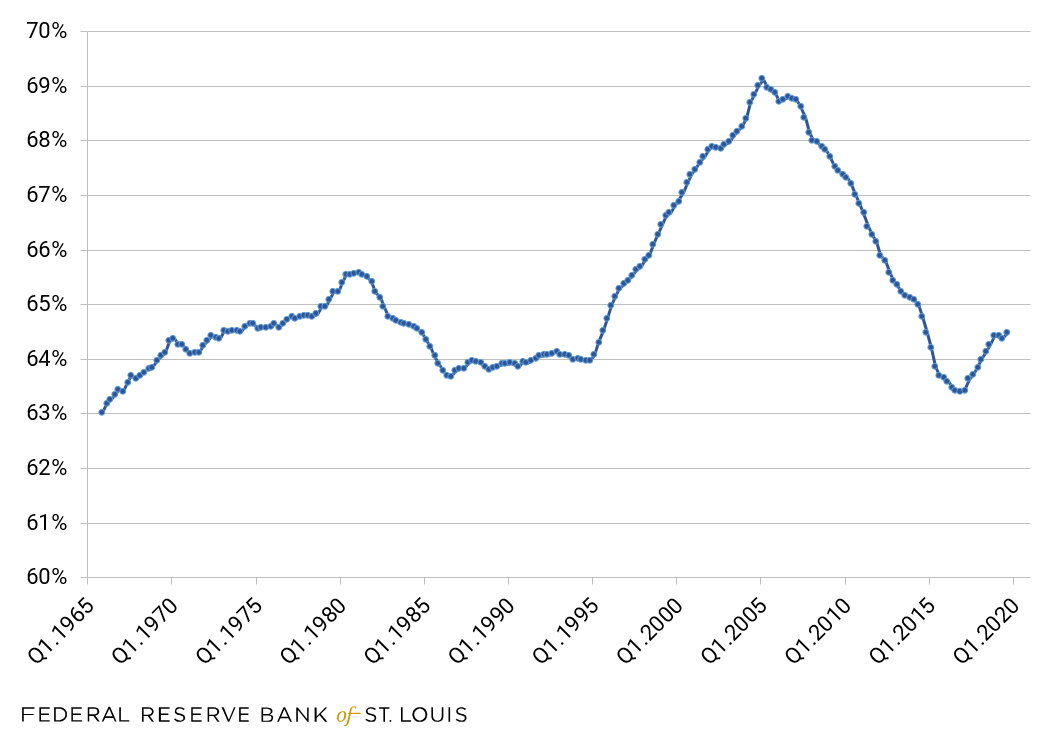

The Center team stated that the U.S. homeownership rate peaked in 2004, with rates declining until 2016. Meanwhile, the share of Americans renting steadily increased as many people lost their homes.

The team also noted that in the last two years, there was a small rebound in homebuying, but that seems to have leveled out. After further observation, the Center team says the market may be reaching an equilibrium for the time being.

“The four-quarter moving average of the homeownership rate increased steadily between the end of 2016 and the end of 2018. Since then, it has moved very little,” Emmons said. “Together with other signs that housing markets are cooling, I do not expect the homeownership rate to increase much more, if at all, in the near future.”

The figure below looks at the four-quarter moving average of the U.S. homeownership rate. According to the Center, it appears we have reached our “new normal.”

Four-Quarter Moving Average of U.S. Homeownership Rate

Description: This line chart shows a moving average of the homeownership rate, starting in the first quarter of 1965 at about 63%. During the mid-1990s values were around 64%, and then began to climb around 1995 — reaching a peak of about 69% in 2004 and hovering around that level in 2005. The rate then declined during and after the financial crisis before starting to rise again about three years ago. In the third quarter of 2019, the moving average was 64.5%.

Notes: Using the moving average — i.e., taking the average of the previous four quarters — helps to eliminate volatility due to seasonality and sampling variability. Census homeownership data is released quarterly.

Sources: U.S. Census Bureau and Haver Analytics.

Black Homeownership Saw a Steeper Drop

Parsing the homeownership rate further, the team pointed out the decline in homeownership rates among black and Hispanic households between the housing-boom period (2001-07) and the post-crash period (2010-16) was greater than it was for white households.

Emmons said, “Homeownership rates for black Americans have plummeted to the lowest averages seen in over 50 years, when looking at homeowners by race.”

| Rate amid Housing Boom (2001-07) | Rate, Post-Crash (2010-16) | Change | |

|---|---|---|---|

| Black | 48.8% | 45.1% | -3.7 percentage points |

| Hispanic | 47.3% | 45.5% | -1.8 percentage points |

| White | 74.9% | 73.2% | -1.7 percentage points |

Notes: A version of this table originally appeared in the Demographics of Wealth 2018 series (PDF). See Table 2, Page 8.

Sources: Federal Reserve’s Survey of Consumer Finances and authors’ calculations.

What about Millennials and Gen Z?

In addition to race/ethnicity, the Center also has examined renting households across generations.

Emmons in a recent essay looked at young adults who are renting, noting that most U.S. households headed by someone under age 35 today are renters.

“Many young adults rent because they are not financially ready to be homeowners, or they have not yet settled where they want to buy a house,” he wrote.

“The rising cost of higher education, the job-market impact of the Great Recession, and rapidly rising house prices in some areas also may have pushed more young people into renting in recent years,” he continued.

Still, Emmons noted, Americans born in or after 1980 were too young to directly experience the worst effects of the housing bubble and Great Recession. Despite a relatively high share of under-40 households renting today, he said we shouldn’t expect millennials and Generation Z to be forced to rent “forever.”

Housing Affordability and the “American Dream”

As I listened to the Center team, it seemed that housing affordability is a factor causing people to rent.

A September 2019 essay by Andrew Dumont of the Federal Reserve Board of Governors shed some light on this subject. He looked at U.S. households that are considered “housing cost burdened,” meaning that they spend 30% or more of their income on housing costs.Dumont, Andrew. “Housing Affordability in the U.S.: Trends by Geography, Tenure, and Household Income.” FEDS Notes, Sept. 27, 2019.

He concluded that:

- Middle-income renters are increasingly housing cost burdened.

- Middle- to higher-income homeowners are experiencing fewer housing affordability challenges.

- These trends may reflect “sorting” of households between renters and homeowners, as potential homeowners and those who were foreclosed on during the financial crisis likely have been self-selected out of the homeowner pool and into the renter pool.

What if affordability or other circumstances are forcing you to “rent forever”? Does that mean you will never close the gap on that homeownership dream?

Not necessarily; things are changing in the rental space.

The Center team said that for now, it looks like construction is tapering off for both apartments and single family homes. An interesting twist in the market is the trend of single-family housing stock turning into rentals: single-family rentals have been gaining attention from both renters and companies scooping up foreclosures the last 10 years. These attractively priced homes are targeting moderate-income home hunters who are ready to get out of apartment-style living.Immergluck, Dan. “Renting the Dream: The Rise of Single-Family Rentership in the Sunbelt Metropolis.” Housing Policy Debate, 2018. 28:5, 814-829.

Which begs the question: Does homeownership remain an ultimate goal for Americans? What if you like renting?

The Center team agreed that, generally speaking, it’s still the American dream to own your own home. They said that, compared to the coasts, lower housing costs in the Midwest make homebuying more attainable.

At a local level, they noted, there’s a belief that a high rate of homeownership leads to stronger communities.

Words of Wisdom: Think about Your Nest Egg, Not Just Your Nest

Nonetheless, the Center team said there are significant barriers to entering or re-entering the game of homeownership.

“Prospective first-time borrowers who have built a substantial nest egg, perhaps for a down payment, may find the dream attainable,” Ricketts said. “In contrast, those families that were ejected from their dream during the housing crisis may still fall short of their dream, despite continuing to aspire towards it.”

The St. Louis Fed researchers cautioned that prospective buyers should not look at a first-time home purchase as an investment to make unless they are financially stable.

“Homeownership should be treated as a ‘capstone’ financial event, not a first step,” Emmons stated.

He said families should focus on building a diversified balance sheet, lowering consumer debts and increasing liquid savings in order to be better prepared for successful homeownership.

A Long-Run View from a Housing Market Expert

Emmons has studied the housing market and household balance sheets extensively, among other research interests. He authors the St. Louis Fed’s quarterly publication, Housing Market Perspectives.

When asked to reflect on the market over the last decade, Emmons said: “The homeownership rate went way up, then way down. We saw many foreclosures and a big increase in single-family rentals—but the overall situation still hasn’t changed much.”

Further, Emmons noted that previous sentiment surveys have shown that more than four-fifths of people say they want to be homeowners at some point; meanwhile, third-quarter 2019 census data show that the U.S. homeownership rate is just under 65%.

It seems the shortfall between aspiring to own a home and the reality of owning one is still great for many.

Notes and References

1 Cilluffo, Anthony; Geiger, A.W.; and Fry, Richard. “More U.S. households are renting than at any point in 50 years.” Pew Research Center, July 19, 2017.

2 Dumont, Andrew. “Housing Affordability in the U.S.: Trends by Geography, Tenure, and Household Income.” FEDS Notes, Sept. 27, 2019.3 Immergluck, Dan. “Renting the Dream: The Rise of Single-Family Rentership in the Sunbelt Metropolis.” Housing Policy Debate, 2018. 28:5, 814-829.

Additional Resources

This blog explains everyday economics and the Fed, while also spotlighting St. Louis Fed people and programs. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us