Children of College Graduates Earn More and Are Richer

KEY TAKEAWAYS

- Most family heads (71 percent) follow in their parents’ educational footsteps.

- Both a family head’s education and that of his or her parents affect how much income and wealth a family has.

- Nongrads have higher income and wealth when at least one of the household head’s parents is a college graduate.

College graduation rates are on the rise. In 1989, 23 percent of American families were headed by someone with a four-year degree. By 2016, this number had increased to 34 percent.Emmons, William R.; Kent, Ana H.; and Ricketts, Lowell R. “The Financial Returns from College across Generations: Large but Unequal.” The Demographics of Wealth 2018 Series, Federal Reserve Bank of St. Louis, February 2018, Essay No. 1. Not only are more people graduating, but six-year graduation rates have also increased (meaning people attending college are more likely to get a degree).“Digest of Education Statistics.” U.S. Department of Education, National Center for Education Statistics, Integrated Postsecondary Education Data System (IPEDS), Spring 2002 through Spring 2013 and Winter 2013-14 through Winter 2015-16, Graduation Rates component; and IPEDS Fall 2009, Institutional Characteristics component.

These are very good trends, because a college degree is an important predictor of financial success. The typical family headed by a college graduate enjoys over twice the income that a typical nongraduate does and over five times the wealth. It pays to have a college degree.

But, as we know, not everyone has the same likelihood of achieving a college degree. One factor that impacts college graduation is parents’ education. In a world of equal opportunities, we might expect that a child without a college graduate parent would be just as likely to graduate from college as a child with a college graduate parent. However, that is not the case. Where you come from impacts educational achievement and thus financial outcomes.

Intergenerational Educational Persistence Is Strong

I looked at patterns in intergenerational education and found that children tend to mimic their parents. Nineteen percent of working ageThe following analyses include people age 30-61. This range allows for people to have completed a four-year college degree and ends at early retirement age. family heads are “persisters,” or people for whom college attainment has persisted for at least two generations.In the following analyses, education refers to the family head’s education level, and parents refer to the parents of the family head.

While this type of persistence is good, another type has a negative financial correlation: A whopping 52 percent of families are “no-college,” where neither generation has achieved a college degree. This leaves 16 percent as “first generation,” or people who have a four-year degree but whose parents do not, and 13 percent as “downwardly mobile,” or people who break the college attainment pattern.

These numbers show that most family heads (71 percent) follow in their parents’ educational footsteps. Thus, parents’ education strongly influences their children’s educational attainment.

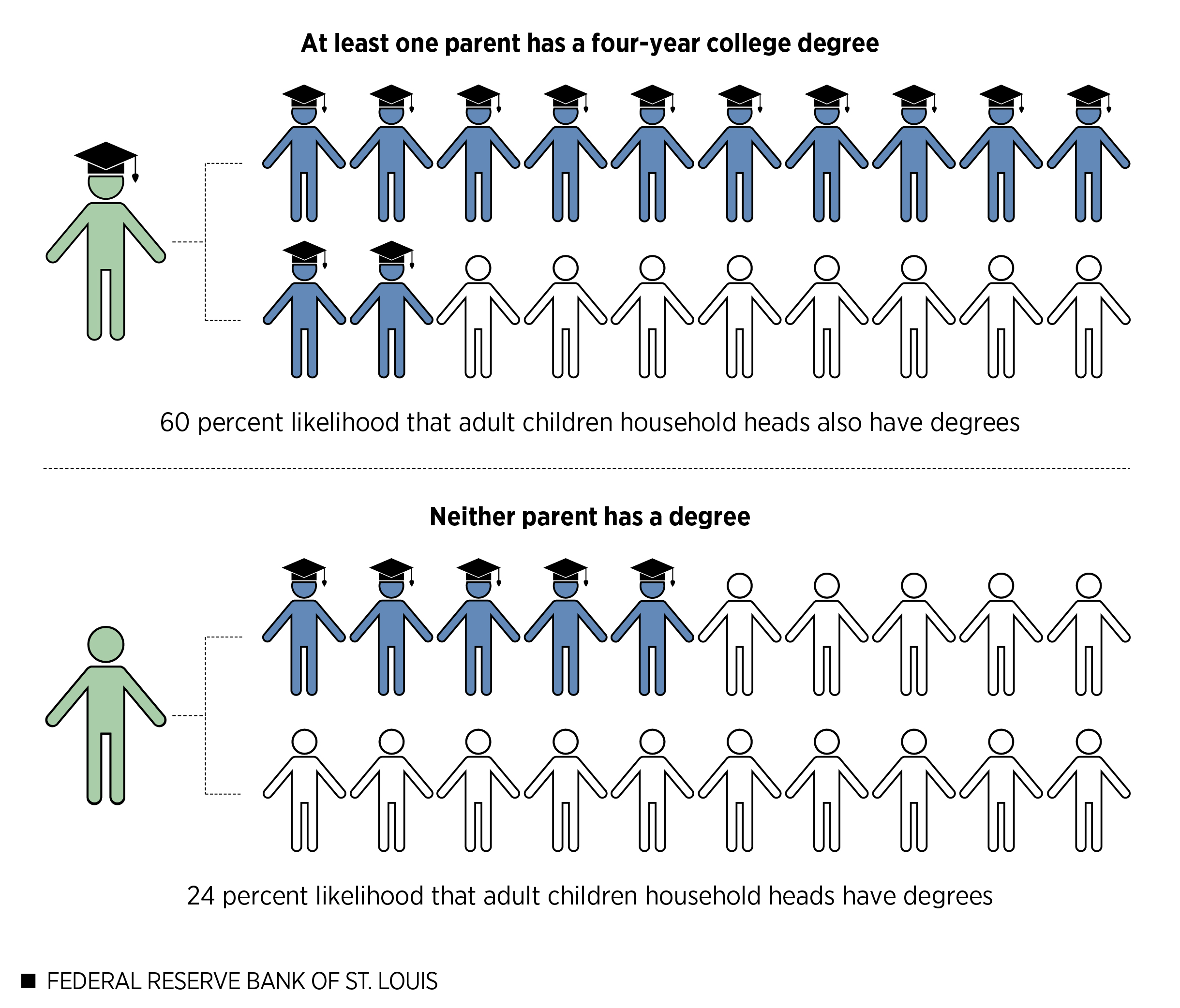

Breaking this relationship down further, I found that intergenerational educational persistence is really driven by the strong connection between parents not having a degree and their children subsequently not earning a degree, as shown in the infographic.

Children of College Graduate Parents also Tend to Have Degrees

NOTES: The infographic shows the percentage of families headed by college graduates and nongraduates by the education of one of the head’s parents. A figure of a person with a graduate cap indicates at least one of a household head’s parents had a four-year college degree. Next to that figure are those of 20 people. Twelve of them, or 60 percent, have graduation caps, indicating they are four-year college graduates. Next to a parent figure without a graduate cap, only five of 20 figures wear the caps, representing the 24 percent who are college graduates.

SOURCES: Federal Reserve Survey of Consumer Finances and author’s calculations.

Three in five family heads achieve a college degree when a parent has done so. If neither parent has a degree, however, the odds of a family head having a degree drop to 1 in 4. Clearly, parents’ education matters.

Persisters Thrive

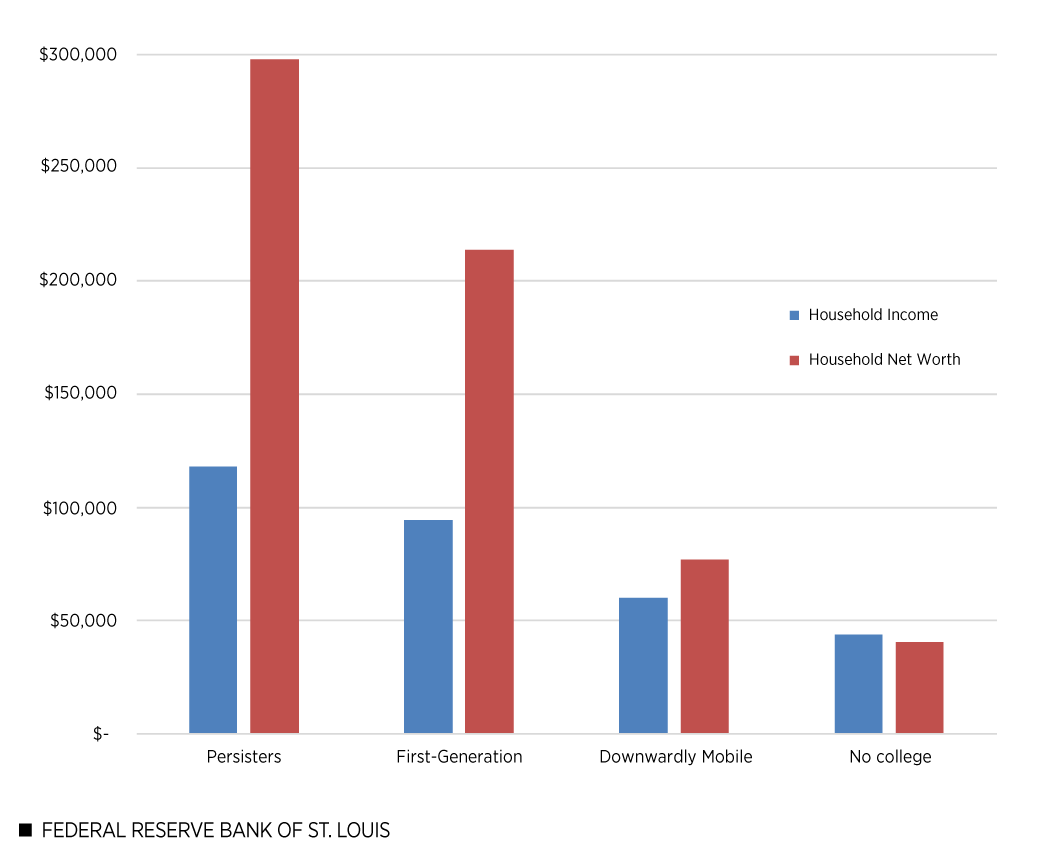

Why does parents’ education matter so much? For one thing, it strikingly impacts financial outcomes like income and wealth. The figure below shows the median income and wealth for the four categories of families defined above.

Intergenerational College Persistence Affects Finances

NOTES: This bar chart shows the median net worth and annual income of the following groups from left to right: persisters, first-generation, downwardly mobile and no-college. The figures for persisters are income of $118,000 and net worth of $298,000; for first-generation college households, they are $95,000 in income and $214,000 in net worth; for the downwardly mobile, they are $60,000 in income and net worth of $77,000; and for families with no college in either generation, they are $44,000 in income and net worth of $41,000. All numbers are 2016 dollars rounded to the nearest $1,000.

SOURCES: Federal Reserve’s Survey of Consumer Finances and author’s calculations.

The income of a typical persister family was 25 percent larger than that of a typical first-generation family and over two and a half times larger than that of a no-college family. Underscoring the importance of parents’ education, the typical downwardly mobile family had an income 37 percent larger than that of a no-college family.

For wealth, or net worth, the differences are even more pronounced. The wealth of a typical persister family was 39 percent larger than that of a typical first-generation family and over seven times larger than that of a no-college family. The wealth of the typical downwardly mobile family was nearly double that of the typical no-college family.Note that the median wealth of families without a college degree pales in comparison to that of college graduate families.

These findings highlight the importance of parental education, which may influence adult children’s financial outcomes through educational matching and human capital resources. College graduate parents may be more involved in their child’s schooling“Reading to Young Children.” Child Trends Databank, June 2015. and have greater financial resources and institutional know-how for sending their children to college and having them achieve a degree. As shown above, college grads are more likely to have grads, and grads have greater wealth.For a more in-depth analysis, see Section III in Emmons, William R.; Kent, Ana H.; and Ricketts, Lowell R. “Is College Still Worth It? The New Calculus of Falling Returns.” Federal Reserve Bank of St. Louis, January 2019. Parental education may also influence income and wealth through extensive networks, such as through setting their children up for success with internships and lucrative job opportunities even if those children do not achieve a four-year degree themselves.

The Importance of Improving Intergenerational College Persistence

As Americans, we like to think that:

- Every child has an equal opportunity to graduate from college.

- Financial outcomes for graduates will be similar.

However, as these numbers have shown, that type of thinking is incorrect on both counts.

Breaking out of the no-college intergenerational cycle is very difficult. Only 1 in 4 family heads without college graduate parents achieve it. Given the clear financial advantages that stem from a college degree, this intergenerational no-college persistence is troubling. Future policy should explore not only how to improve intergenerational college persistence but also how to break people out of the no-college cycle.

Endnotes

- Emmons, William R.; Kent, Ana H.; and Ricketts, Lowell R. “The Financial Returns from College across Generations: Large but Unequal.” The Demographics of Wealth 2018 Series, Federal Reserve Bank of St. Louis, February 2018, Essay No. 1.

- “Digest of Education Statistics.” U.S. Department of Education, National Center for Education Statistics, Integrated Postsecondary Education Data System (IPEDS), Spring 2002 through Spring 2013 and Winter 2013-14 through Winter 2015-16, Graduation Rates component; and IPEDS Fall 2009, Institutional Characteristics component.

- The following analyses include people age 30-61. This range allows for people to have completed a four-year college degree and ends at early retirement age.

- In the following analyses, education refers to the family head’s education level, and parents refer to the parents of the family head.

- Note that the median wealth of families without a college degree pales in comparison to that of college graduate families.

- “Reading to Young Children.” Child Trends Databank, June 2015.

- For a more in-depth analysis, see Section III in Emmons, William R.; Kent, Ana H.; and Ricketts, Lowell R. “Is College Still Worth It? The New Calculus of Falling Returns.” Federal Reserve Bank of St. Louis, January 2019.

Note: This article originally appeared in the St. Louis Fed’s In the Balance, a series of research-based essays that focused on understanding and strengthening the balance sheets of American households. View the full archive in our digital library.

This blog explains everyday economics and the Fed, while also spotlighting St. Louis Fed people and programs. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us