Generation Z Economics: Teenagers Are Wary of Debt

Student loan affordability. The ROI of college. Whether to rent or buy. How to interpret the vast amount of data and advice available online. Making money at work and in the stock market.

And D-E-B-T. High school students care a lot about avoiding debt.

Juniors and seniors know about the subprime mortgage crisis that preceded last decade’s Great Recession. The thought of another recession makes them nervous. Moreover, as they prepare for adulthood, they’re trying to navigate saving and spending on a personal level.

They want to know: How can Generation Z avoid some of the debt pitfalls that have hurt previous generations?

Many of these questions surfaced during a recent event at our Little Rock Branch. During Dinner with an Economist, about two dozen students heard from St. Louis Fed Economist Don Schlagenhauf, who analyzes consumer debt for a living. The students attended with their educators.

Dareon B. (right), a student at Camden Fairview High School in Arkansas, shares his plans for the future with St. Louis Fed Economist Don Schlagenhauf. Dareon’s class attended the Dinner with an Economist event at our Little Rock Branch with their teacher, JJ Mosley.

First, What Our Economist Had to Say

Schlagenhauf walked through concepts like:

The debt-to-disposable-income ratio of U.S. households. This is figured by dividing a household’s total debt (including credit card, auto and student loan, and mortgage balances) by its after-tax income. Schlagenhauf said economists used to worry if this ratio exceeded 80%; right before the recession, it spiked to over 120%.

“Since the Great Recession, household debt has fallen, but it’s still larger than disposable income. The problem is still there,” he said.

Whether household debt can hurt the economy. Schlagenhauf told students about economist Irving Fisher, who in 1933 theorized that private indebtedness can cause recessions: Consumers who are in over their heads default. This leads to sell-offs and price declines. That hurts businesses, leading to job losses and more bankruptcies.

“That’s exactly what happened in certain parts of the United States” during the late 2000s, Schlagenhauf said. “We had what Fisher called a ‘debt deflation cycle.’” Schlagenhauf explained how that differed from previous recessions, such as in the early 1980s, when the Fed intentionally tightened the money supply to tame high inflation.

Is household debt “bad?”: Knowing the risks of taking on too much debt, should today’s students worry if they have to borrow to pay for something?

“The one thing I want you to go away with is, not necessarily. It depends on where you are in your life cycle,” Schlagenhauf said, explaining that younger workforce participants may need to finance certain purchases.

“I could never buy a house when I was young without taking on mortgage debt,” he said. “But you can’t ignore the fact that any debt you take on has to be paid off in your lifetime. You’re going to have to suffer at some point and pay it off.”

Now, What the Students Had to Say

We caught up with Schlagenhauf after the event; see this companion blog post for a longer conversation on consumer debt.

For now, we’re turning it over to some of the Arkansas students who traveled long distances to attend Dinner with an Economist. They were kind enough to share pictures and quotes, telling us what they learned and what’s on their minds—economically speaking.

We’re also sharing a few excerpts from essays they submitted to their teachers.

Our Economic Choices Matter

Dinner with an Economist was a helpful experience for me. The focus of this event was debt and how to have less (if any) of it at a young age. As the speaker stated, I also can imagine that debt is hard to get rid of. He wanted to give more students like me a chance to actually understand and value our economic decisions before we have too much debt. He also said it’s OK to have some debt, but not a lot.

Although he made some very educational points during his lecture, the biggest thing that resonated with me was the “lifetime budget constraints.”

When the economist said, “You need to have an income that will support your lifestyle,” this really interested me because young adults entering today’s society should never bite off more than we can chew. By saying this, I am respectfully saying that our generation should be more responsible about our economic choices.

In conclusion, every choice we make as we enter into society affects our economy as a whole. Our economic choices will determine our future economy. As the future leaders of society, we need to study the past to help prevent the future from being the same.

-Dareon B., Class of 2020, Camden Fairview High School

Save a Little Money

One idea that I really took away was that I should live below my means, and to save a little money and not spend every dollar I make.

-Khalil A., Class of 2020, Camden Fairview High School

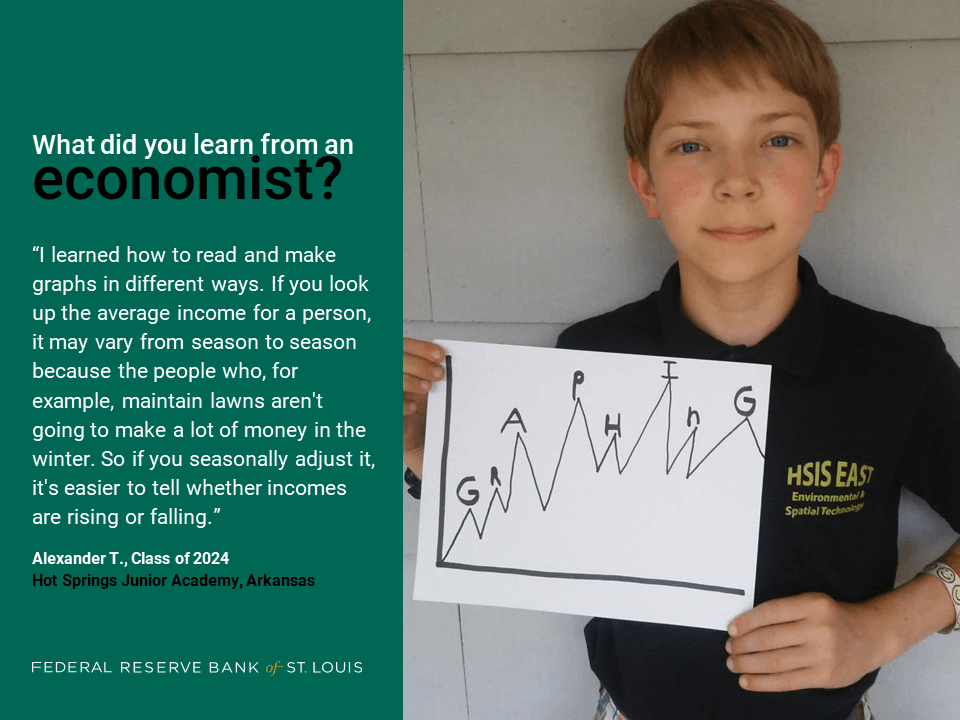

Tap the Power of Data

At Dinner with an Economist, I learned how to read and make graphs in different ways. You can make a graph easier to read by starting something at the same equity, such as comparing the U.S. economy to the Little Rock economy. The U.S. economy is so much larger than the Little Rock economy, yet you can make a graph useful by starting them at the same equity.

Another way to make it easier to read a graph is by adjusting for seasons. If you look up the average income for a person, it may vary from season to season because the people who, for example, maintain lawns aren't going to make a lot of money in the winter. So if you seasonally adjust it, it's easier to tell whether incomes are rising or falling.

Graphing can be a useful tool if you do it properly. Otherwise, a situation may get misrepresented. Let's say, inflation is rising and you make a graph that shows that inflation is predicted to skyrocket, then the animal spirits will take over and drive inflation higher.

-Alexander T., Class of 2024 Hot Springs Junior Academy

Prepare Students for Life through Financial Education

With current interest rates, houses are becoming less affordable to the newer generation of homebuyers. In today’s economy, minimum wage is on the rise, but so are housing prices. Many people in our generation are going into debt just to be able to own their own homes. This brings into question the sanctity of the housing market in general. During this rise of prices, the trend of renting houses is becoming more and more prevalent.

Debt is a terrifying aspect of being an adult. Many young people are choosing not to go to college rather than to owe the bank thousands of dollars.

Many people my age do not have any experience in the housing market or the stock market. I believe these should be taught more in schools as part of basic education to help better prepare us for the real world. The stock market is a very real option for people that are younger, if the money put into it is invested correctly.

If it was not for my Oral Communications class’ participation in the Stock Market Game, I would not have paid attention to the stock market, let alone visited a financial advisor. The money that I have made from my mutual funds is going into a bank account that, in the future, will be used to help acquire my first home as well as pay for my college education.

-Hailey D., Class of 2019, Camden Fairview High School

Debt, Loans and Credit

I learned that going in debt is not a good thing to do. Managing money will save you a lot of trouble in the future when it comes to purchasing things through credit. I would love to know more about student loans and how they can affect you in the future.

-Tyree H., Class of 2019, Camden Fairview High School

Making My Money Work for Me

I have always been interested in studying and majoring in engineering; it was nice to be exposed to other careers. As a future engineer, I am interested in ways to invest my money and make my money work for me. One of the points that really hit home with me is to live below my means and not to spend everything I make.

The event was very informative, and I believe it gave me the knowledge needed for my future career and financial decisions.

-Keith J., Class of 2019, Camden Fairview High School

Solving Debt on a Community Level

I found it interesting that Mr. Schlagenhauf said it is OK to be in a little debt but not a lot. I also found intriguing the fact that he described ways to solve debt problems not just on a personal level, but on a community basis.

-Jacob H., Class of 2019, Camden Fairview High School

Economic Education: About Dinner with an Economist

This event, part of the St. Louis Fed’s Economic Education initiative, provides students a window into the Federal Reserve System and a pathway to learning more about economics.

The Little Rock Branch has long provided economic education resources and outreach at some level. Having become a leader in standards development and curriculum materials for Arkansas, the Branch is at the forefront of education standards revisions, implementing new initiatives and offering expertise.

Dinner with an Economist was originally developed as a way for educators to connect with St. Louis Fed research economists—providing a deeper understanding of economic topics of current interest. Later expanded to include students in addition to teachers, this event has become a key component of our work to reach Office of Minority and Women Inclusion-designated schools.

This blog explains everyday economics and the Fed, while also spotlighting St. Louis Fed people and programs. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us