Back-to-School: 4 Free Lessons on Personal Finance and Economics

The St. Louis Fed offers more than 400 free lesson plans, podcasts, videos, infographics, PowerPoint slides and SMARTboard activities that can be used in pre-K through college classrooms.

While our Economic Education team closely partners with educators, many of these award-winning personal finance and economics resources are great outside of the classroom, too.

Parents, kids and consumers: Our Economic Education team has curated four back-to-school idea starters for you. These are geared toward grades K-2, 3-5, 6-8 and 9-12.

Check them out, and happy learning!

Grades K-2

Get the parent Q&A for Alexander, Who Used to Be Rich Last Sunday

What does “opportunity cost” mean?

In economics, opportunity cost is the value of the next-best alternative given up when a decision is made. In other words, it’s the benefit missed from the choice you passed up.

Young children in the kindergarten- to second-grade age range can grasp this and other personal finance concepts—such as saving and spending—from the book Alexander, Who Used to Be Rich Last Sunday.

Our Econ Ed team has prepared a handy Q&A discussion for parents, so you can aid in your child’s learning.

(Because when it comes to reading, it’s hard to think of a next-best alternative for developing young minds. As Economic Education Officer Mary Suiter has noted, research shows that children can develop financial behaviors as early as age 7.)

Grades 3-5

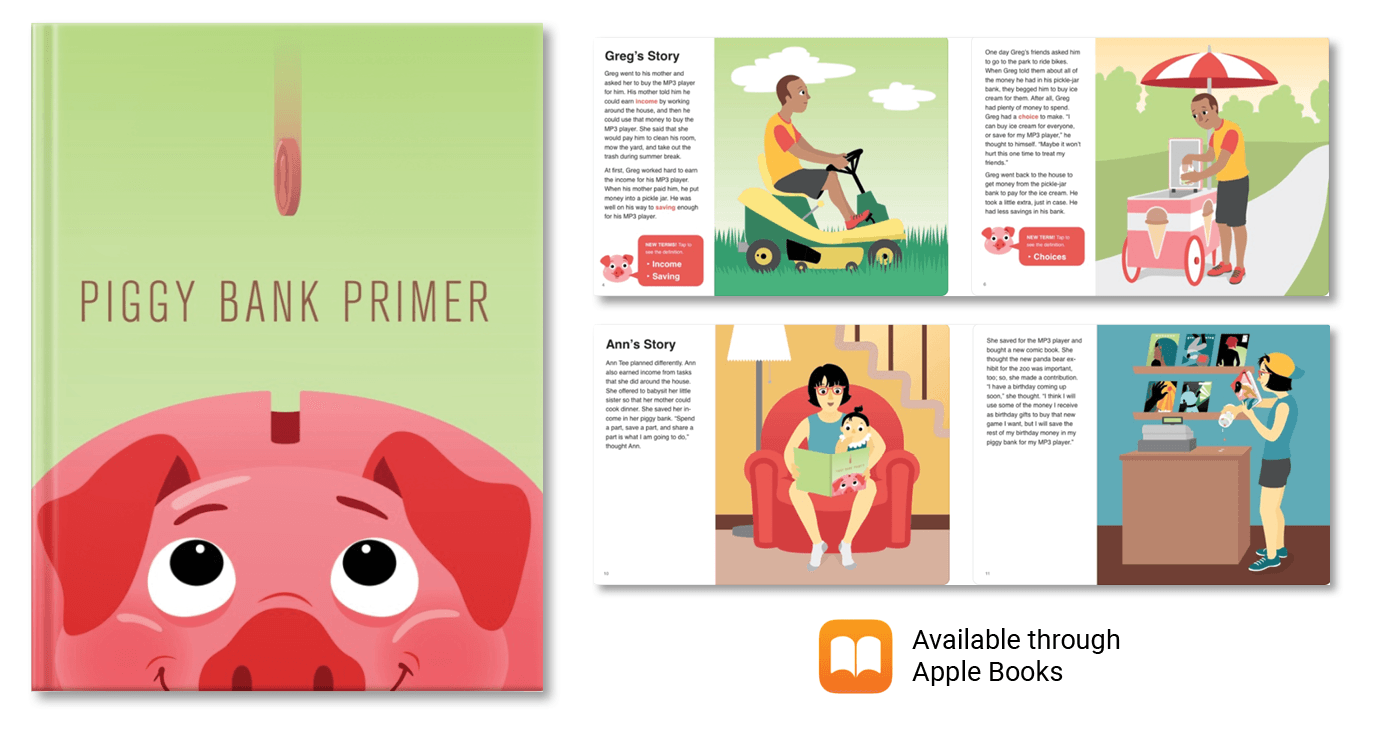

Get The Piggy Bank Primer free at Apple Books

Reading with children opens up the opportunity to teach important ideas and talk about them, too.

You can teach the basics of saving money to reach financial goals through The Piggy Bank Primer, a beautifully illustrated e-book. It’s designed for children in the third- to fifth-grade range. It uses a story, activities and puzzles to introduce basic economic concepts, including:

- Saving and savings plans

- Spending and costs

- Benefits

- Goods and services

Grades 6-8

See the No-Frills Money Skills series on YouTube

By junior high, students are ready to mature their grasp of finance and economics, tackling concepts that will serve them into adulthood.

That’s why the No-Frills Money Skills video series uses plain language and clear graphics so that students can relate unfamiliar topics to everyday life. It’s designed for middle- to high-schoolers … or anyone who could use a brush-up on subjects like retirement accounts, stocks and bonds and car insurance.

Episode 1, above, explains how compound interest helps money grow over time. “It’s not just how much you save, but when you start that will help your money grow. So start early and save often,” says Senior Economic Education Specialist Kris Bertelsen.

Grades 9-12

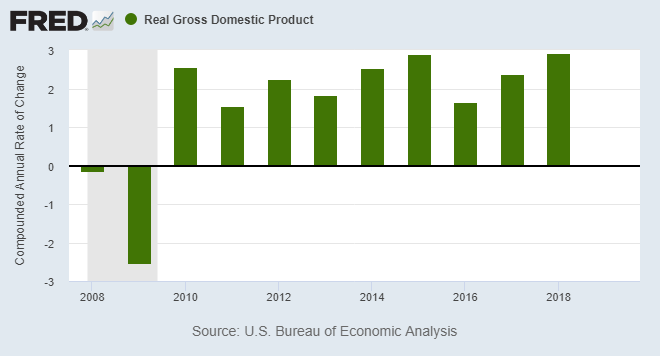

Learn how to graph real GDP in FRED

Data literacy is a big focus for the St. Louis Fed, which counts among its signature offerings a tool called “FRED.”

That’s short for Federal Reserve Economic Database, and it contains an ever-expanding list of economic and socioeconomic data series—aggregated from reliable primary sources around the world.

Foreign exchange rates? Find them in FRED. Unemployment? That’s in FRED. The yield curve? In FRED. Housing prices? You get the idea.

FRED is a powerful resource, and it’s totally free. Journalists, economists and finance professionals use FRED, and so can parents and students. To get started, try graphing real GDP (like I did above) with step-by-step instructions from our economic education team. You can make your graph any color you’d like!

You might also want to explore the FRED blog, which provides creative ideas for graphing data.

Like What You See? Let a Teacher Know

Our Econ Ed professionals are passionate about partnering with teachers nationwide, providing them with professional development and tools to teach economics and personal finance. Economic Education Coordinator Scott Wolla says this approach enables the team to “teach one, reach many.”

If you’d like to share resources with your child’s teacher, here are more idea starters:

Kindergarten

Get the Personal Finance, Language Arts, and Mathematics: Kindergarten Curriculum Unit

The St. Louis Fed and Dallas Fed joined with the Texas Council on Economic Education to produce five active-learning lessons for the kindergarten classroom. Each lesson is based on a story about two cousins: one who lives on a farm, one who lives in a city. Students will hear to the stories and recall information. They’ll develop an understanding of concepts while applying language arts and math skills. This lesson received the 2019 Curriculum Gold Award of Excellence from the National Association of Economic Educators.

Elementary

Access Ella's Adventures Online Courses

Students will follow young Ella as she learns important life lessons and concepts. How do bank accounts offer security and a return on savings? What is credit, and how does interest affect the final cost of something financed with credit? How do you make tough decisions? This lesson received the 2019 Curriculum Gold Award of Excellence from the National Association of Economic Educators.

Middle School

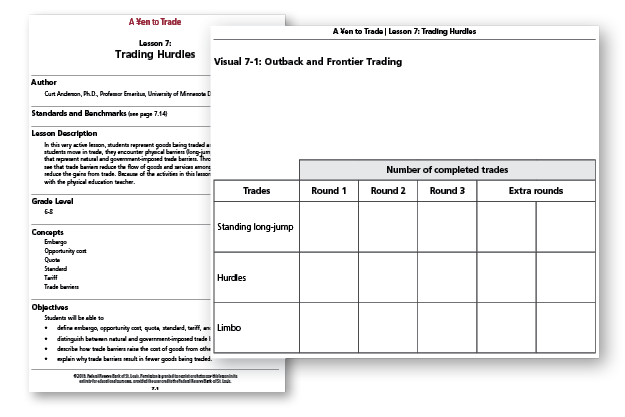

Discover the Yen to Trade Curriculum Unit

This set of 10 lessons helps students understand the basic rationale for making trades; the gains possible from trade; and how trading is done between people of different countries. Students learn fundamental concepts (scarcity, economic wants, resources, etc.) as well as international trade concepts (exports, imports, tariffs, quotas, exchange rates, trade routes). Most lessons employ simulations and other active-learning strategies—from jumping hurdles, to tossing a ball, to designing paper money. Activities integrate other curriculum areas including math, language arts and geography.

High School

Get Tools for Teaching with FRED

FRED offers endless opportunities for teaching macroeconomics, history, information literacy and more. The St. Louis Fed offers tutorials, instructional guides, lesson plans and activities so teachers can put data to work with their students. This includes a package of AP Macro activities that aligns with curriculum.

To explore additional resources, see our Econ Lowdown gateway.

This blog explains everyday economics and the Fed, while also spotlighting St. Louis Fed people and programs. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us