How Your Credit Score is Determined and How to Improve It

In celebration of Financial Literacy Month, we’re featuring #FinLit-focused stories and tips to inspire readers throughout April.

Credit is based on trust. It’s your ability to buy goods or services before payment, with the understanding you’ll pay back what’s owed—often with interest. But our creditworthiness is not something we think about until we need a loan, a car or a new place.

We sat down with Barbara Flowers, a St. Louis Fed economic education coordinator who is passionate about financial literacy. She gave an overview of credit reports and the five main factors that determine your credit score. She also provided some tips for building or repairing credit.

The Basics: Credit Reports and Credit Scores

Credit reports: Flowers explained that your credit history is a living record of how you’ve used—or abused—credit over time. That information is reflected in a credit report. Each of the big credit bureaus (TransUnion, Experian and Equifax) offers a report capturing a consumer’s history.

Credit scores: Reports from the three big bureaus are used to determine a three-digit credit score. Flowers explained that one commonly used by lenders is the FICO score—specifically, FICO Score 8. FICO, which stands for Fair Isaac Corp., is an analytics company that offers credit products to lenders. A FICO score ranges from 300 to 850, with a higher number meaning a better score.

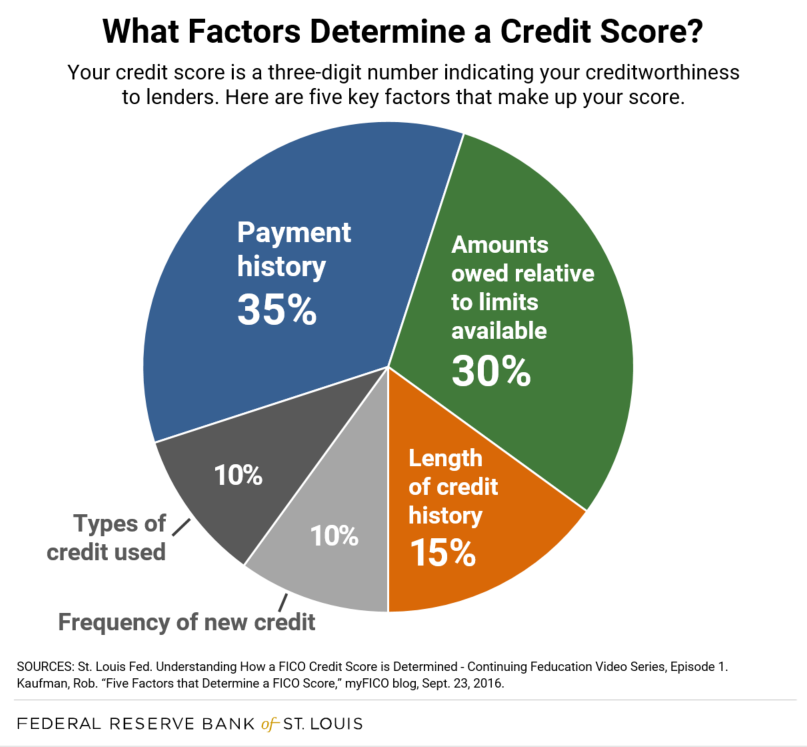

What goes into your credit score? These are the five key factors that make up your credit score.

1. Payment History: 35%

“Payment history is the most heavily-weighted part of your credit report,” Flowers said. “It focuses on how often you’ve missed a payment along the way.” This history takes into account:

- How many payments were late

- How late they were

- How recent a late payment was

- The total amount that was owed

Negative activity tends to fall off over time, with bankruptcies sticking around the longest (10 years). “Let’s say I missed a January 2013 payment on a credit card,” Flowers explained. “That little mistake will be on there for about seven years.”

2. Amounts Owed Relative to Limits Available: 30%

This category includes your debt-to-credit ratio. “That’s really important,” Flowers said, “because it considers the credit available to you versus how much of that credit you’re actually using.”

Let’s say you had two credit cards, each with a $5,000 limit. To earn rewards points, you decided to charge all of your monthly expenses ($1,000) to one of the cards and left the other alone. That’s a 10 percent utilization ratio. If you thought, “Hey, I’m not using this other card,” and cancelled it, your ratio would double to 20 percent.

A 20 percent debt-to-credit ratio isn’t objectively bad; a 2015 breakdown by The Motley Fool said anything under 30 percent is “considered to be good use of your available credit.”

And Flowers cautioned against opening another credit account just to try to game the system: “Really, what you want to do is keep the amount of credit that you’re using low relative to the amount that’s been provided to you,” she said. “The higher your credit limit, the more self-discipline is required.”

3. Length of Credit History: 15%

The longer you’ve been able to demonstrate responsible credit use and make on-time payments, the better your credit score likely will be. Obviously, that equation favors the seasoned credit consumer. But Flowers said young people seeking to establish credit can start off right by:

- Opening a bank account

- Making car payments and car insurance payments on time

- Paying other bills (like phone bills) on time and avoiding late fees

- Demonstrating responsible use of a credit card

4. Frequency of New Credit: 10%

Flowers said that if you have a lot of newly issued credit, it won’t look good to lenders. As explored in a previous blog post on credit, one scenario could present itself during the holiday season: A shopper trying to save money might accept merchants’ offers of immediate discounts for opening store cards.

“[P]rospective lenders could interpret all of this activity as a sign that you are having problems and you’re trying to make as much credit available to you as possible," Flowers said.

5. Types of Credit Used: 10%

While this is a smaller portion of your overall score, your credit mix also matters. Flowers explained that this category examines how well you’ve managed different kinds of credit: “Is all of your credit through credit cards? Do you have a student loan in there, a car loan? What about a mortgage?”

How Can You Check Your Credit Report and Score?

As the Federal Trade Commission explains, you are entitled to free copies of your credit reports from the big three bureaus, once a year each. The FTC also says that federal law grants you the right to see your credit score; however, the bureaus are permitted to charge “a reasonable fee” for that. Start at AnnualCreditReport.com or call 877-322-8228. (Note that this service is sponsored by the bureaus.)

While checking your report, keep an eye out for:

Suspected identity theft: These days, lots of ID theft monitoring services are available. Some are free, such as through a credit card company or bank with which you have an account. Flowers said you should still proactively review your own report once a year and immediately act if you suspect fraudulent activity. Here’s how, courtesy of the Consumer Financial Protection Bureau.

Errors: If you notice an error on your report—such as someone else’s information—contact the credit bureau and the business that reported the activity. Clearly identify the problem; Flowers said the credit bureau must investigate within 30 days. The myFICO site has more robust instructions on how to file disputes with TransUnion, Equifax and Experian.

How to Start Improving Credit

Fixing errors is a first step toward ensuring your credit report and score accurately reflect your use of credit. To improve your credit score, here are three of the biggest things you can do:

- Get your debt down. Focus on paying off high-interest accounts, such as credit cards.

- Make on-time payments your mission. Set up reminders or automatic payments so you never are late or miss a payment cycle.

- Exercise restraint. Open new accounts only when needed.

“There is no quick fix” for improving your credit score, Flowers said. But you can do it over time. And taking time now during Financial Literacy Month to learn about—and share—these responsible credit habits is a great start.

Additional Resources

The St. Louis Fed’s Economic Education team offers free resources, including:

- Video: Understanding How a FICO Credit Score is Determined

- Tutorial: It’s Your Paycheck - Credit Reports

- Tutorial: Credit Cred

This blog explains everyday economics and the Fed, while also spotlighting St. Louis Fed people and programs. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us