Does Holiday Shopping Affect My Credit Score?

Getty Images/Yuri Arcurs

Save 20 percent on your whole purchase if you sign up for our store credit card!

Get 10 percent off today and every time you shop!

Earn cash back on all online purchases, plus FREE shipping, with this special rewards card!

It can be tempting, especially this time of year, to take up merchant credit card offers. Who doesn’t want to see a sizeable percentage knocked off at checkout? It’s up to each of us to decide whether the benefits offered by a particular card are too attractive to pass up. But consumers may want to learn how opening new cards might affect their credit score.

At-a-Glance: Credit Scores and Credit Reports

Your credit score is a three-digit number ranging from around 300 (poor) to 850 (excellent). A FICO score is the most common credit score used to determine your creditworthiness to lenders. Whether you’re applying for a home, auto, student or personal loan, lenders will want to know these three C’s:

- Your character, aka how reliable you will be in repaying the loan.

- Your capacity to repay the loan balance, plus interest. (What do you make? Is it steady income? What are your expenses?)

- Your collateral, meaning what assets you’ve amassed (bank savings, retirement savings, stocks, even your car) that could be liquidated or sold to repay the loan.

“Among other things lenders look at, they will check your credit score and count it as a proxy for your character,” says St. Louis Fed Economic Education Coordinator Barbara Flowers. “And it can be a proxy for your capacity, to some extent. Although it doesn’t really have your income on there, your credit score does reflect the amount of debt you have outstanding.”

That’s because your credit score is essentially a grade assessed on your credit report. A credit report is an evolving profile of your behavior paying bills and debt. Your credit report considers such factors as:

- Do you pay bills on time? If late, was it a one-time slip or a pattern?

- How close do you get to maxing out available credit?

- How long have you had accounts open?

- What’s your credit mix: credit cards, installment loans, a mortgage?

And: Are you opening several new credit accounts over a relatively short period? That’s where opening a lot of store cards would come into play.

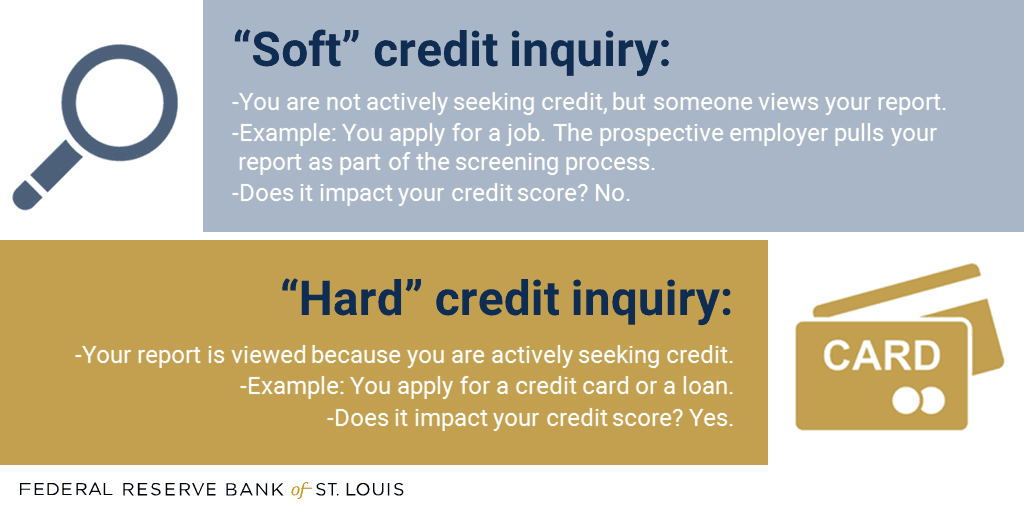

New Credit Cards Count as Hard Inquiries (vs. Soft Inquiries)

In addition to lenders scoping your credit score, various organizations will pull your credit report for evaluation reasons. These count as soft or hard inquiries.

A soft inquiry is made by organizations other than those you may be asking for credit. Flowers notes that this includes:

- Employers as part of a candidate screening process.

- Credit card companies looking for candidates to receive promotional offers.

- You, when you’re doing your own credit report self-check. (Which, by the way, you are entitled by law to check for free once a year. Each of the three big credit bureaus has a report on you, and they vary. Start at AnnualCreditReport.com to get your free credit report.)

“Soft inquiries do not impact your credit score,” Flowers says. “Prospective employers may do this with your consent. Credit card companies do it to see who they can be shipping those pre-approved offers to.”

A hard inquiry is made when you actively seek new credit. This includes:

- Mortgage-lenders and car dealerships.

- Your existing credit card company, if you request an increase to your credit line.

- Issuers of new credit cards, such as if you reply to a pre-approved offer or take out a store card.

“Hard inquiries do impact your credit score,” Flowers says. “FICO considers this in its scoring models because hard inquiries signify that you are looking for new credit.”

According to FICO credit scoring expert Tom Quinn, data show that people who are seeking credit are riskier when compared to consumers who aren’t. In fact, he says, research indicates that consumers who have five or more hard inquires within a year were six times likelier to fall behind on payments.

The Impact of Multiple Inquiries

Not all inquiries are treated alike, Flowers explains. Say you have multiple inquires in a short time span involving a mortgage, auto or student loan. That indicates you are shopping around for the best loan for your needs—not taking out multiple loans for the same house or car. As such, these will count as one inquiry on your credit report. FICO says that the newest version of its scoring formula counts that shopping-around period as any 45-day span.

Meanwhile, each new credit card opened is its own inquiry. Says Flowers: “Let’s say you go out around the holidays. Everywhere you go, they’re saying, ‘You could get 20 percent off this order if you open a new credit card with us!’ If you start doing that, it’s going to drop your credit score a little each time.

“Let’s say you’re out shopping for a car, and you’re calling many lenders about getting a loan,” she continues. “It’s an application for credit in both cases—you’re applying for four credit cards in one case, and you’re looking into four different auto loans in another case. In the case of the credit cards, the credit reporting agencies know you’re applying for four credit cards; you’re not shopping. So every one of those is going to be a hard inquiry. Your credit score will fall, and prospective lenders could interpret all of this activity as a sign that you are having problems, and you’re trying to make as much credit available to you as possible."

Cause for Consumer Consideration

Flowers reminds consumers that taking out multiple lines of new credit is just one factor that influences your credit score. Paying your bills on time, every time remains vital. Keeping card balances low also matters.

But because hard inquiries stay on your credit report for two years—with their impact lessening over time—she says that people who are planning to move, change jobs or apply for a loan within the first six months of the new year may want to weigh the temptation of applying for merchant credit cards to realize a one-time discount.

This blog explains everyday economics and the Fed, while also spotlighting St. Louis Fed people and programs. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us