Boosting Financing for Small Businesses

Thinkstock/kirisa99

Print My Threads is a screen printing business based in Flatwoods, Ky. It had been looking to expand into a larger facility and had found it difficult to obtain financing. This small business ultimately obtained two loans from an economic development association.

With the loans, Print My Threads was able to acquire and renovate an abandoned roller skating rink and to purchase needed equipment. Now, the business has gone from three employees to 11, pays above the minimum wage and offers employees various other benefits, including a 401(k) plan.

An Initiative to Provide Credit and Capital

Print My Threads received financing because of the State Small Business Credit Initiative (or SSBCI, for short). This program, which was part of the Small Business Jobs Act of 2010, allocated nearly $1.5 billion to states to support small-business financing programs between 2010 and 2016.

The initiative was born out of the Great Recession to provide capital to small businesses at a time when small-business lending and investment had fallen sharply.

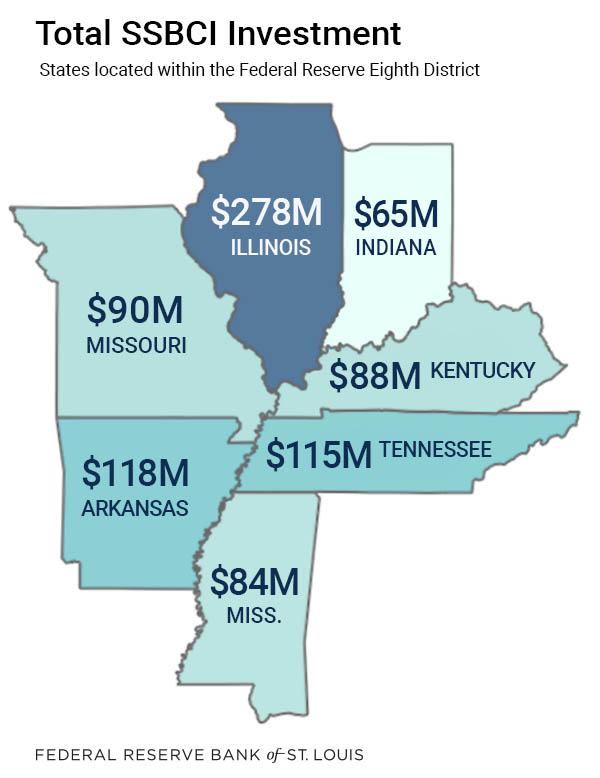

The St. Louis Fed’s Community Development team recently took a look at how the SSBCI was implemented across the U.S. as a whole. We also examined how states within the Eighth Federal Reserve District deployed capital and credit to small businesses. St. Louis Fed's district covers all of Arkansas and portions of Illinois, Indiana, Kentucky, Mississippi, Missouri and Tennessee.

How Did States Channel Funding?

Flexibility in Financing

States had the flexibility to support various forms of financing. For example:

- In Kentucky, the state prioritized collateral support programs, which provided cash to lenders to boost the value of available collateral.

- Tennessee prioritized venture capital programs, which provided financing by purchasing an ownership interest or providing equity-like loans to businesses that typically do not participate in debt financing markets.

The Role of Community Development Financial Institutions

The organization that lent Print My Threads its financing—the Kentucky-based Mountain Association for Community and Economic Development—is what’s known as a community development financial institution. These are mission-driven financial institutions that specialize in lending to people, projects and small businesses that may not fit standard underwriting criteria of traditional financial institutions. They can be nonprofit organizations, credit unions, banks or venture capital organizations.

The Kentucky organization was one of several community development financial institutions to make loans through the SSBCI program. Others in the St. Louis Fed’s district that were active in the program include Priority One Bank, BankPlus, Kentucky Highlands Investment Corp. and RiverHills Bank.

Low- and Moderate-Income Areas

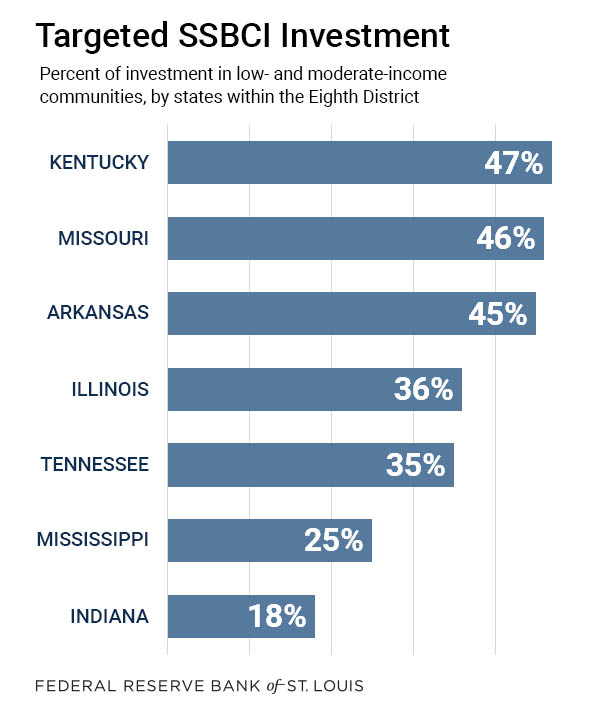

The SSBCI required that states develop a plan to target underserved or low- and moderate-income communities.

- In the St. Louis Fed’s region, Kentucky, Missouri and Arkansas performed the best, as each was responsible for directing more than 40 percent of SSBCI financing to small businesses located in low- and moderate-income communities.

- In contrast, Indiana and Mississippi directed 25 percent or less of SSBCI financing to small businesses in low- and moderate-income communities.

Key Takeaways

Our Community Development team was inspired to evaluate this program, in part, because of the availability of transaction-level data. It also allowed us to release an interactive tool that anyone can use to dive into the data, nationwide.

We wanted to provide a report and tool for officials administering the program—along with lenders and small business owners—to better tell the story and impact of the SSBCI on a local and national level.

What we found:

- At a time when capital for small businesses was in short supply, the SSBCI program created a strong and effective incentive for lenders and investors to meet the financing needs of small businesses throughout the U.S and, in particular, throughout the St. Louis Fed’s district.

- While 32 percent of investment financed small business in low- and moderate-income areas across our district, some states—such as Kentucky, Missouri and Arkansas—saw significantly higher investment in these areas.

- Finally, community development financial institutions played a critically important role in deploying capital to small businesses through the program.

Additional Resources

This blog explains everyday economics and the Fed, while also spotlighting St. Louis Fed people and programs. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us