The Role of Single-Family Rentals in the U.S. Housing Market

When homeownership and home sales plummeted in 2010 in the wake of the housing market collapse, investors responded by purchasing single-family homes and renting them out to households that could not afford to buy such homes but still desired this type of housing. Subsequently, investor-owned single-family rentals (SFRs) increased as a share of total single-family properties, and they continue to increase as a housing supply shortage and higher mortgage rates make homeownership difficult for many first-time homebuyers. This blog post summarizes economic research that has been done on the role of investor-owned SFRs in the U.S. housing market.

Such research has found that the vast majority of SFRs are owned by small-scale investors. Properties owned by large-scale investors tend to increase prices of nearby homes,Rohan Ganduri, Steven Chong Xiao and Serena Wenjing Xiao. “Tracing the Source of Liquidity for Distressed Housing Markets.” Real Estate Economics, March 2023, Vol. 51, No. 2, pp. 408-40. while ownership by small-scale investors appears to have the opposite effect.Keith Ihlanfeldt and Cynthia Fan Yang. “Not in My Neighborhood: The Effects of Single-Family Rentals on Home Values.” Journal of Housing Economics, December 2021, Vol. 54, Article 101789. Research has also found that investor-owned SFRs expand housing options available to rentersCarolina K. Reid, Rocio Sanchez-Moyano and Carol J. Galante. The Rise of Single-Family Rentals after the Foreclosure Crisis: Understanding Tenant Perspectives. Terner Center for Housing Innovation, University of California, Berkeley; April 2018. but may negatively impact renter welfare in terms of eviction filingsElora Raymond, Richard Duckworth, Ben Miller, Michael Lucas and Shiraj Pokharel. “Corporate Landlords, Institutional Investors, and Displacement: Eviction Rates in Single-Family Rentals.” Federal Reserve Bank of Atlanta, Community and Economic Development Discussion Paper No. 04-16, December 2016. and rent increases.Umit G. Gurun, Jiabin Wu, Steven Chong Xiao and Serena Wenjing Xiao. “Do Wall Street Landlords Undermine Renters’ Welfare?” The Review of Financial Studies, January 2023, Vol. 36, No. 1, pp. 70-121.

Single-Family Rental Trends

The share of single-family homes bought by SFR investors ballooned in the aftermath of the 2007-10 foreclosure crisis, when the housing market was flooded with low-priced single-family properties. As the housing market recovered through the 2010s, homeownership rates rose, and growth in investor-owned SFRs stalled. As of 2021, the SFR share of total rentals was commensurate with precrisis levels.Ingrid Gould Ellen and Laurie Goodman. Single-Family Rentals: Trends and Policy Recommendations (PDF). The Hamilton Project, an initiative of the Brookings Institution; November 2023. However, this trend has reverted since the COVID-19 pandemic. Higher home prices and higher mortgage rates, as well as lower numbers of single-family homes for sale, have resulted in home purchases falling to a 30-year low in 2025.The State of the Nation’s Housing 2025. Harvard University, Joint Center for Housing Studies. Investor-owned SFRs are again rising in response: A record high 30% of single-family home purchases in the first half of 2025 were made by investors.Rebecca Picciotto. “With Individual Home Buyers on the Sidelines, Investors Swoop into the Market.” The Wall Street Journal, July 27, 2025.

The purchasing activity of small-scale, “mom and pop” investors accounts for most of the current increase in SFRs, as well as the one associated with the 2007-10 foreclosure crisis. While large-scale, “institutional” investors exert considerable influence in the 20 largest U.S. metropolitan areas, where they primarily operate,Laurie Goodman, Amalie Zinn, Kathryn Reynolds and Owen Noble. A Profile of Institutional Investor-Owned Single-Family Rental Properties. Urban Institute, April 13, 2023. they form a small fraction of the national SFR market. In 2025, their share of single-family home purchases was only one-fifth that of mom-and-pop investors.Picciotto (2025).

Impact of Single-Family Rentals on Home Values

The impact that investor-owned SFRs have on nearby property values appears to differ by investor size. In looking at the 2007-10 foreclosure crisis, researchers found institutional investor-owned SFRs tend to increase the prices of homes in the area surrounding them. This might be because institutional investors tend to buy dilapidated properties that they renovate after purchase,Laurie Goodman and Edward Golding. “Institutional Investors Have a Comparative Advantage in Purchasing Homes That Need Repair.” Urban Institute, Urban Wire blog, Oct. 20, 2021. or because they improve the quality of neighborhoods in which they are concentrated by supplying public goods like security officers and street lights.Gurun et al. (2023). When home values plunged during the crisis, this price effect helped distressed housing markets recover.Ganduri et al. (2023). As home values rose through the 2010s, the same effect worsened housing affordability, especially for low-priced homes that typically would be bought by first-time homeowners.Carlos Garriga, Pedro Gete and Athena Tsouderou. “Investors and Housing Affordability” (PDF). February 2021.

In contrast, mom-and-pop investor-owned SFRs appear to have the opposite effect on neighboring property values, as one study involving Florida real estate found.Ihlanfeldt and Yang (December 2021). Small-scale investors do not have the capital to spend on renovation or neighborhood safety like large-scale investors do. Moreover, renters in general tend to take less care of homes than owner-occupiers, have lower incomes and contribute less to community projects like park maintenance or school fundraising.

The Single-Family Home Renter Experience

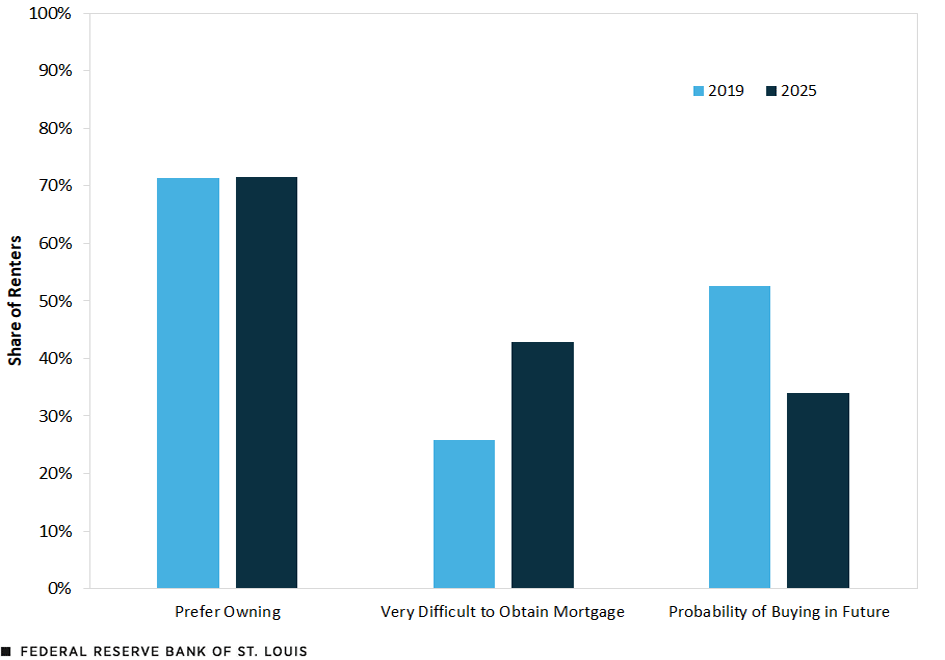

The majority of renters—just over 71%—would prefer to own their homes, according to the New York Fed’s SCE Housing Survey, part of the broader Survey of Consumer Expectations. (See the figure below.) However, almost half of renters in 2025 believe that it would be very difficult to obtain a mortgage, up from one-quarter of renters in 2019. Consequently, many renters believe it is unlikely they will own a home in the future. In 2025, survey respondents assigned a 33.9% probability of homeownership, down from 52.6% in 2019.

Many Renters Want to Own but Don’t Expect To

SOURCE: New York Fed’s 2025 SCE Housing Survey.

SFRs provide an important resource to renters who do not have the ability and/or desire to buy a home. These renters might prefer to rent single-family homes for raising children, as a short-term option or because there are no multifamily rental units near them.Reid et al. (2018). SFRs also allow households to enter communities where they might generally be unable to liveKeith Ihlanfeldt and Cynthia Fan Yang. “Single-Family Rentals and Neighborhood Racial Integration.” Journal of Housing Economics, September 2021, Vol. 53, Article 101780. if residences in those communities are primarily single-family houses that require a certain credit score or income level to purchase.

However, renters may face significant challenges while living in SFRs. Concerns have been raised, for example, over behavior of SFR investors as landlords when it comes to evictions and rent increases. Here, the difference between ownership by small-scale investors and institutional investors remains salient.

Researchers have found that institutional SFR investors file for eviction at a higher rate than small-scale investors,Raymond et al. (2016). suggesting a greater degree of housing insecurity among residents of institutionally owned SFRs. Studies have also found that after a series of mergers in the late 2010s consolidated institutional SFR investors into a few large firms,Gregg Colburn, Rebecca J. Walter and Deirdre Pfeiffer. “Capitalizing on Collapse: An Analysis of Institutional Single-Family Rental Investors.” Urban Affairs Review, November 2021, Vol. 57, No. 6, pp. 1590-1625. those firms gained a degree of price-setting power over rents in areas they dominated.Gurun et al. (2023). Rents increased at a higher rate in those areas than in others.

Conclusion

Investor-owned SFRs will continue to be a common subject of discourse and research as the current housing market evolves. The benefits and costs of SFRs are not always clear-cut. Going forward, their nuanced impact on the housing environment may merit more attention.

Notes

- Rohan Ganduri, Steven Chong Xiao and Serena Wenjing Xiao. “Tracing the Source of Liquidity for Distressed Housing Markets.” Real Estate Economics, March 2023, Vol. 51, No. 2, pp. 408-40.

- Keith Ihlanfeldt and Cynthia Fan Yang. “Not in My Neighborhood: The Effects of Single-Family Rentals on Home Values.” Journal of Housing Economics, December 2021, Vol. 54, Article 101789.

- Carolina K. Reid, Rocio Sanchez-Moyano and Carol J. Galante. The Rise of Single-Family Rentals after the Foreclosure Crisis: Understanding Tenant Perspectives. Terner Center for Housing Innovation, University of California, Berkeley; April 2018.

- Elora Raymond, Richard Duckworth, Ben Miller, Michael Lucas and Shiraj Pokharel. “Corporate Landlords, Institutional Investors, and Displacement: Eviction Rates in Single-Family Rentals.” Federal Reserve Bank of Atlanta, Community and Economic Development Discussion Paper No. 04-16, December 2016.

- Umit G. Gurun, Jiabin Wu, Steven Chong Xiao and Serena Wenjing Xiao. “Do Wall Street Landlords Undermine Renters’ Welfare?” The Review of Financial Studies, January 2023, Vol. 36, No. 1, pp. 70-121.

- Ingrid Gould Ellen and Laurie Goodman. Single-Family Rentals: Trends and Policy Recommendations (PDF). The Hamilton Project, an initiative of the Brookings Institution; November 2023.

- The State of the Nation’s Housing 2025. Harvard University, Joint Center for Housing Studies.

- Rebecca Picciotto. “With Individual Home Buyers on the Sidelines, Investors Swoop into the Market.” The Wall Street Journal, July 27, 2025.

- Laurie Goodman, Amalie Zinn, Kathryn Reynolds and Owen Noble. A Profile of Institutional Investor-Owned Single-Family Rental Properties. Urban Institute, April 13, 2023.

- Picciotto (2025).

- Laurie Goodman and Edward Golding. “Institutional Investors Have a Comparative Advantage in Purchasing Homes That Need Repair.” Urban Institute, Urban Wire blog, Oct. 20, 2021.

- Gurun et al. (2023).

- Ganduri et al. (2023).

- Carlos Garriga, Pedro Gete and Athena Tsouderou. “Investors and Housing Affordability” (PDF). February 2021.

- Ihlanfeldt and Yang (December 2021).

- Reid et al. (2018).

- Keith Ihlanfeldt and Cynthia Fan Yang. “Single-Family Rentals and Neighborhood Racial Integration.” Journal of Housing Economics, September 2021, Vol. 53, Article 101780.

- Raymond et al. (2016).

- Gregg Colburn, Rebecca J. Walter and Deirdre Pfeiffer. “Capitalizing on Collapse: An Analysis of Institutional Single-Family Rental Investors.” Urban Affairs Review, November 2021, Vol. 57, No. 6, pp. 1590-1625.

- Gurun et al. (2023).

Citation

Charles S. Gascon and Lillian Fu, ldquoThe Role of Single-Family Rentals in the U.S. Housing Market,rdquo St. Louis Fed On the Economy, Oct. 31, 2025.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions