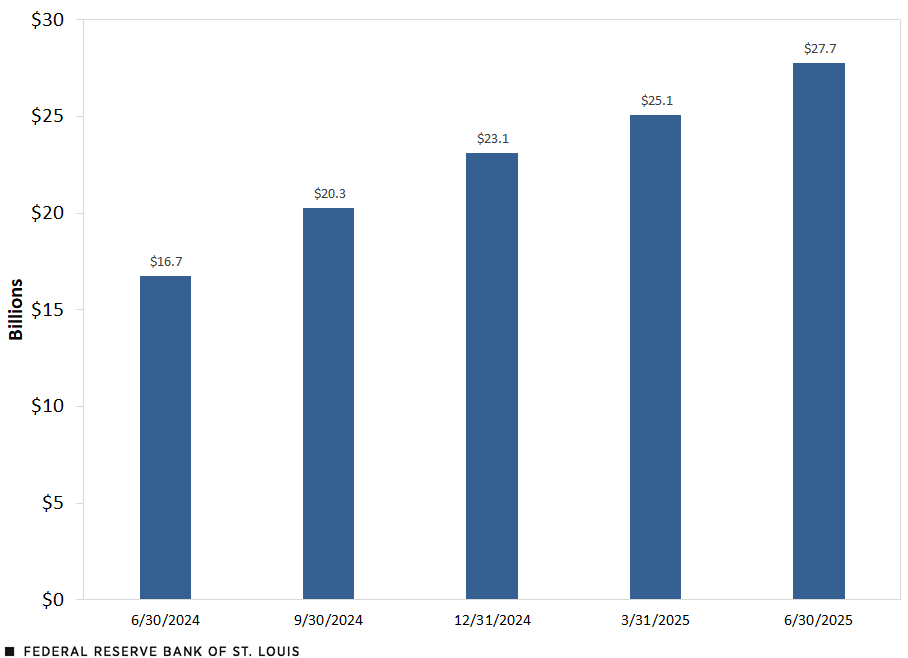

Banking Analytics: Modifications to Commercial Real Estate Loans Rise

As of June 30, U.S. banks reported a 66% increase in the total value of commercial real estate (CRE) loan modifications over the last four quarters.We aggregated CRE loans modified to borrowers experiencing financial difficulty in compliance with the terms of the loan, as well as CRE loans that were not in compliance with their modified terms. CRE loans include construction and land development loans, including one- to four-family residential construction loans; loans secured by owner-occupied nonfarm nonresidential properties and by other nonfarm nonresidential properties; and loans secured by multifamily residential properties at commercial banks with domestic offices and total consolidated assets greater than $5 billion. According to accounting standards, banks are required to disclose loan modifications in which a loan is experiencing financial difficulty and the modification results in the form of principal forgiveness, an interest rate reduction, a significant payment delay, a term extension or any combination of these activities.

Total Value of Modified Commercial Real Estate Loans Held by U.S. Banks

SOURCES: Consolidated Reports of Condition and Income (Call Report) and authors’ calculations.

Lenders often work together with borrowers in times of stress, such as during the COVID-19 pandemic. Lenders may modify a loan by extending the maturity date or by temporarily deferring principal payments and collecting interest payments only to reduce the overall loan payment made by the borrower. Prudent modifications done in a safe and sound manner can serve to mitigate adverse effects on borrowers and their communities. Banks closely monitor the volume of modified loans on their balance sheets, as these loans can pose a higher risk of loss and require increased monitoring in response to this risk.

Although modifications as a percentage of outstanding commercial real estate loans remain historically subdued, recent increases in modifications to CRE loans are worth paying attention to. While it is difficult to pinpoint a specific cause using the data reported by banks, several factors may be at play, including changes in supply and demand for CRE, the rapid rise in interest rates from a low-rate environment, and increased expenses associated with operating CRE properties.

Note

- We aggregated CRE loans modified to borrowers experiencing financial difficulty in compliance with the terms of the loan, as well as CRE loans that were not in compliance with their modified terms. CRE loans include construction and land development loans, including one- to four-family residential construction loans; loans secured by owner-occupied nonfarm nonresidential properties and by other nonfarm nonresidential properties; and loans secured by multifamily residential properties at commercial banks with domestic offices and total consolidated assets greater than $5 billion.

Citation

Raelene Angle-Graves and Julianne Baer, ldquoBanking Analytics: Modifications to Commercial Real Estate Loans Rise,rdquo St. Louis Fed On the Economy, Oct. 6, 2025.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions