Banking Analytics: Understanding the Composition of Bank Loan Portfolios

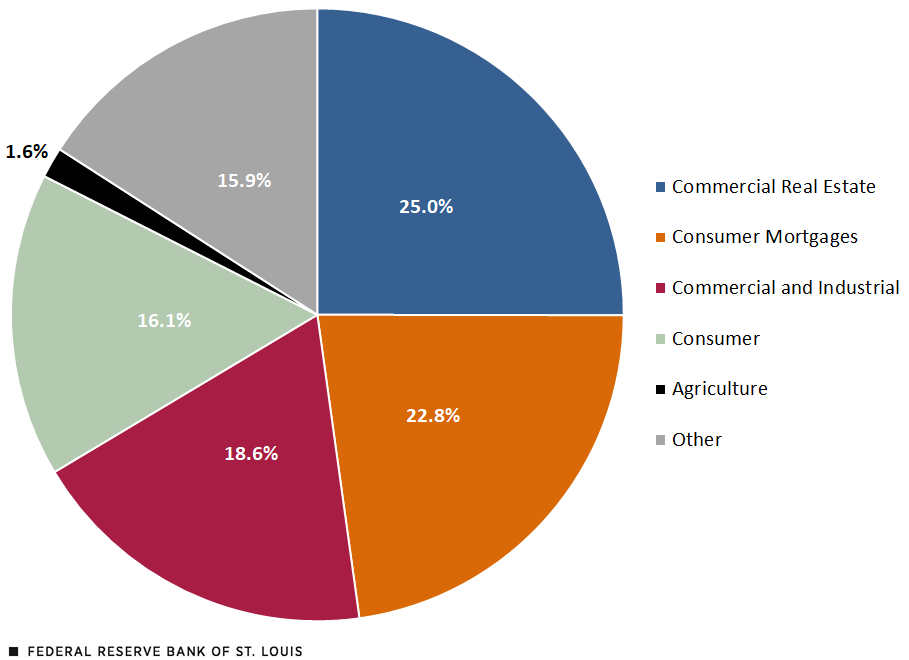

As of the fourth quarter of 2024, U.S. banks held diverse loan portfolios that reflected lending for various purposes. (See figure below.) Generally, bank lending portfolios are classified by their collateral. For example, real estate loans can consist of consumer mortgages (loans secured by residential property) or commercial real estate loans (which are often, but not always, secured by a commercial mortgage).Commercial real estate projects under construction are generally secured both by a mortgage on the land itself and by the unfinished project’s potential value upon completion. For more on CRE lending, see last week’s blog post. Commercial and industrial loans, on the other hand, are typically business loans secured by assets other than real estate, such as inventory, supplies or equipment. Consumer loans can be either secured or unsecured and cover a range of personal loans, including credit card, automobile, student, and other revolving and nonrevolving personal loans.

Loan Portfolio Composition of U.S. Commercial Banks in 2024

SOURCE: Consolidated Reports of Condition and Income (Call Report).

NOTE: Data are year-end.

Banks also lend to agriculture, financing both production and land purchases. Other loan categories include lending to other banks and credit unions (depository institutions), and to a wide array of nonbank financial institutions. These nonbanks range from mortgage and insurance firms to government-backed lenders and investment banks. In addition, banks extend credit to state and local governments, excluding bonds and leases, and engage in lease financing receivables.

The makeup of bank loan portfolios has shifted over time. For instance, commercial banks now do less agricultural lending as a portion of their overall loan portfolio, but considerably more lending to nonbanks, especially over the past decade.

Note

- Commercial real estate projects under construction are generally secured both by a mortgage on the land itself and by the unfinished project’s potential value upon completion. For more on CRE lending, see last week’s blog post.

Citation

Amalia Estenssoro and Reed Romanko, ldquoBanking Analytics: Understanding the Composition of Bank Loan Portfolios,rdquo St. Louis Fed On the Economy, May 19, 2025.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions