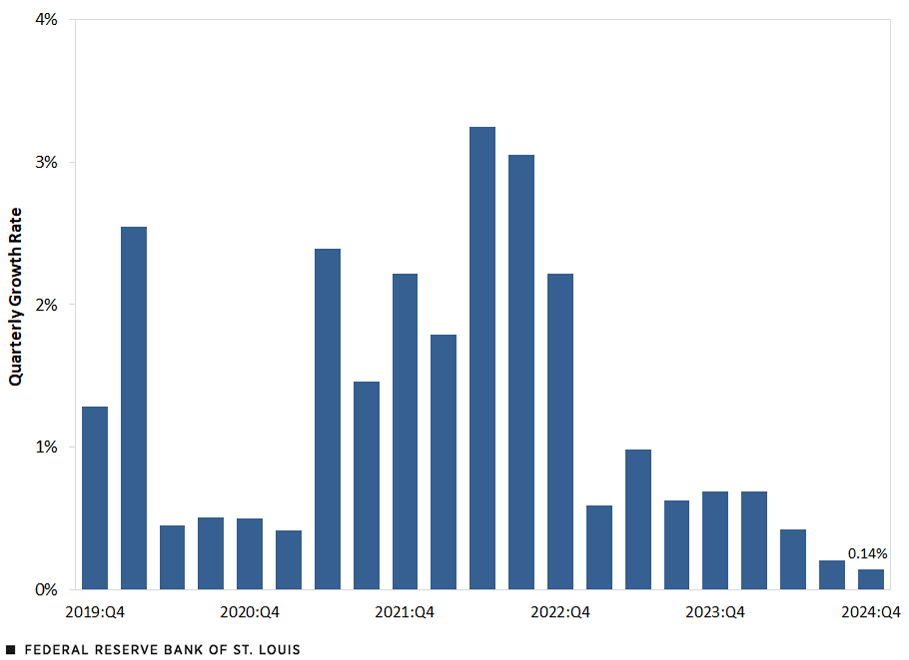

Banking Analytics: Commercial Real Estate Loan Growth Slows to 11-Year Low

Commercial real estate (CRE) lending by U.S. banks slowed again in the fourth quarter of 2024, when the overall dollar value of these loans increased only 0.14% from the third quarter.Commercial real estate loans are construction and land development loans, including one- to four-family residential construction loans; loans secured by owner-occupied nonfarm nonresidential properties and by other nonfarm nonresidential properties; loans secured by multifamily residential properties; and loans to finance commercial real estate, construction and land development activities not secured by real estate. Growth in total commercial real estate loan volume reflects the net change in new loans made and loans paid off in the one-quarter period. This was the slowest quarterly growth rate since the first quarter of 2013, when CRE lending shrank 0.17%.

CRE loans are vital for banks, especially at smaller firms, such as community and regional banks.The Federal Reserve defines community banks as those with less than $10 billion in assets and regional banks as those with total assets that are between $10 billion and $100 billion. Large banks are defined as those with total assets that are more than $100 billion. CRE loans are secured by various properties, including office buildings, hotels, multifamily housing and retail buildings, as well as construction of personal residences and subdivisions. Properties can be occupied by owners or leased out for income.

Growth in Total Commercial Real Estate Loan Volumes at U.S. Banks

SOURCE: Consolidated Reports of Condition and Income (Call Report).

Several factors likely explain the cooling in CRE lending. Higher prices for land, labor and materials, and higher property-related costs like taxes and insurance are squeezing project viability. Rising interest rates also make borrowing more expensive. Furthermore, developers are responding to supply and demand: Certain areas might have too many apartments or offices, making new projects less appealing. Developers, banks and investors all carefully weigh these factors when deciding whether a CRE project makes sense.

Notes

- Commercial real estate loans are construction and land development loans, including one- to four-family residential construction loans; loans secured by owner-occupied nonfarm nonresidential properties and by other nonfarm nonresidential properties; loans secured by multifamily residential properties; and loans to finance commercial real estate, construction and land development activities not secured by real estate. Growth in total commercial real estate loan volume reflects the net change in new loans made and loans paid off in the one-quarter period.

- The Federal Reserve defines community banks as those with less than $10 billion in assets and regional banks as those with total assets that are between $10 billion and $100 billion. Large banks are defined as those with total assets that are more than $100 billion.

Citation

Julianne Baer and Eldar Beiseitov, ldquoBanking Analytics: Commercial Real Estate Loan Growth Slows to 11-Year Low,rdquo St. Louis Fed On the Economy, May 12, 2025.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions