Is a College Degree Worth the Investment?

College tuition outpaced inflation over the past few decades, making the cost of college rise relative to the price of other goods. So, is college still worth it? In other words, is the cost of tuition greater than or less than the economic benefits of a college degree?

In a March 2023 Regional Economist article, St. Louis Fed economist and Assistant Vice President Guillaume Vandenbroucke explored how the costs and benefits of college have changed over time. To do this, he calculated the rate of return on a college education over a career.

Costs and Benefits of Higher Education

The author used the average annual undergraduate tuition costs (which include fees and room and board) of four-year postsecondary institutions from the Digest of Education Statistics and the consumer price index (CPI) to compare the changes in cost of higher education to inflation. The average tuition costs 8.3 times more in 2020 and 3.7 times more in 2000 than it did in 1980. Using inflation measured by the CPI, $1 in 1980 has the same buying power as $2.20 in 2000 and $3.30 in 2020.

“That tuition has risen faster than inflation means that households must have given up more consumption to send their children to college in 2020 than they did in 2000, and even more than they did in 1980,” Vandenbroucke wrote.

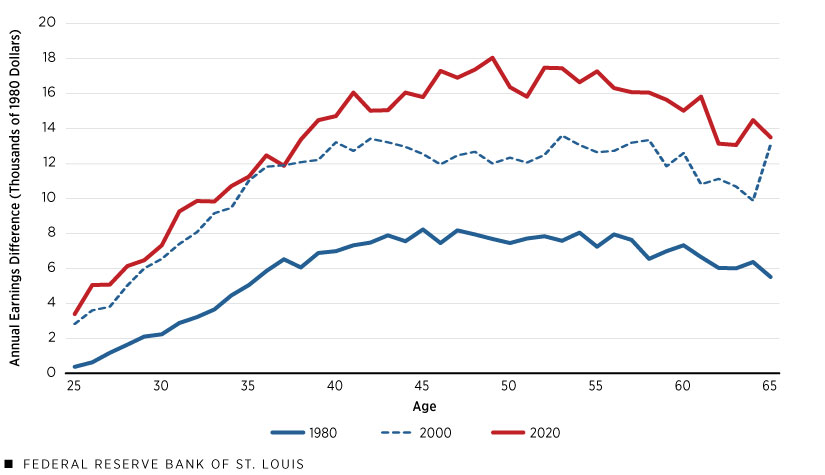

The pecuniary benefit of higher education, as calculated by the author, is the difference in lifetime earnings between someone with a college degree and someone without a college degree. This difference for white men who attended college in 1980, 2000 and 2020 is shown in the figure below.

Annual Earnings Difference by Age between Workers with and Workers without College (White Men)

SOURCES: IPUMS USA and author’s calculations.

NOTES: College education means that a worker has attended college but did not necessarily graduate. High school education should be interpreted similarly. Earnings differences are adjusted for inflation.

“In 1980, college-educated workers earned more than high school-educated workers, but the difference never exceeded $10,000,” Vandenbroucke wrote. “In 2000 and 2020, however, the earnings difference was noticeably higher than it was in 1980, even after adjusting for inflation.”

What Is the Rate of Return?

To compute the rate of return on college, the author compared the investment in higher education (the tuition costs) to an asset with returns equal to the pecuniary benefit of attending college.

(For more on his methodology for calculating these returns, see the Regional Economist article.)

His calculated rates of return on a college education for six demographic groups in 1980, 2000 and 2020 are shown in the table below.

“Although the rates of return vary greatly across time, gender and race, they are high relative to the returns one finds in financial markets,” Vandenbroucke wrote. “In all three years, the highest rates of return are for Asian men and Asian women. Black men and Black women have the lowest rates of return in two of the three years.”

| White Men | White Women | Black Men | Black Women | Asian Men | Asian Women | |

|---|---|---|---|---|---|---|

| 1980 | 20.5% | 21.6% | 22.9% | 23.9% | 24.6% | 26.1% |

| 2000 | 29.1% | 25.6% | 22.1% | 21.0% | 56.3% | 36.7% |

| 2020 | 24.1% | 22.7% | 14.2% | 13.5% | 35.9% | 31.1% |

| SOURCES: IPUMS USA and author’s calculations. | ||||||

| NOTE: Asian comprises Chinese, Japanese and other Asian or Pacific Islander. | ||||||

What Is Missing?

While the rate of return calculation is intuitive, the author noted, it leaves out some factors that may affect the estimated rate of return for higher education.

The author lays out four of these factors:

- The “Selection” Issue — Colleges tend to select those with the highest skill, who are expected to have higher earnings with or without college.

- The Employment Issue — High school-educated workers experience higher rates of unemployment.

- The Mortality Issue — Those with a life expectancy below 65 years old have a lower return for college because of less time to benefit.

- The Nonpecuniary Benefits Issue — Higher education has nonpecuniary benefits or costs, like better working conditions or more flexible work hours.

The author noted that his calculations yield estimates of a return that appears to be quite high.

“This should not be a surprise: Despite rising tuition over the years, college enrollment rates are still high because students and their families recognize that the payoff can be greater,” Vandenbroucke wrote.

Citation

ldquoIs a College Degree Worth the Investment?,rdquo St. Louis Fed On the Economy, July 25, 2023.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions