Retirements, Net Worth, and the Fall and Rise of Labor Force Participation

The uncertainty surrounding financial markets during the COVID-19 pandemic contributed to many atypical trends. A 2021 Economic Synopses essay discussed the retirement boom spurred by COVID-19, which may have contributed to a persistent decline in labor force participation (LFP). Labor force participation is the percentage of the civilian noninstitutional population age 16 and older that is employed or actively looking for work. At the same time, returns on some common asset classes—housing and stocks—were abnormally high. This led to large estimated increases in household net worth during 2020-21.

Standard economic theory offers a natural link between the two trends of rising wealth and declining labor force participation. We call this link the wealth effect on labor supply: Holding everything else constant, an increase in wealth tends to reduce labor supply both at the intensive (how many hours should I work?) and extensive (should I work at all?) margins.

The increase in wealth during 2020 and 2021 plausibly contributed to the fall in labor force participation: As cited in a 2022 Economic Synopses essay, through September 2021, about 15% of the observed drop in LFP could be attributed to rising asset valuations; when we updated those calculations to include all of 2021, rising valuations accounted for about 20% of the drop. Even if changes in net worth were not the primary driver of retirements and labor force exits in the previous period, they certainly compounded them.

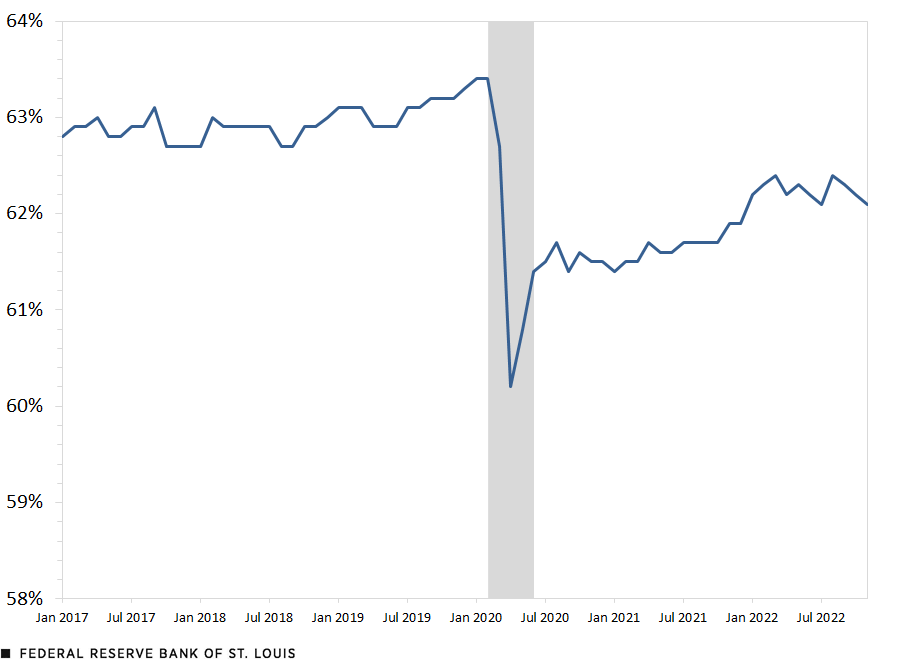

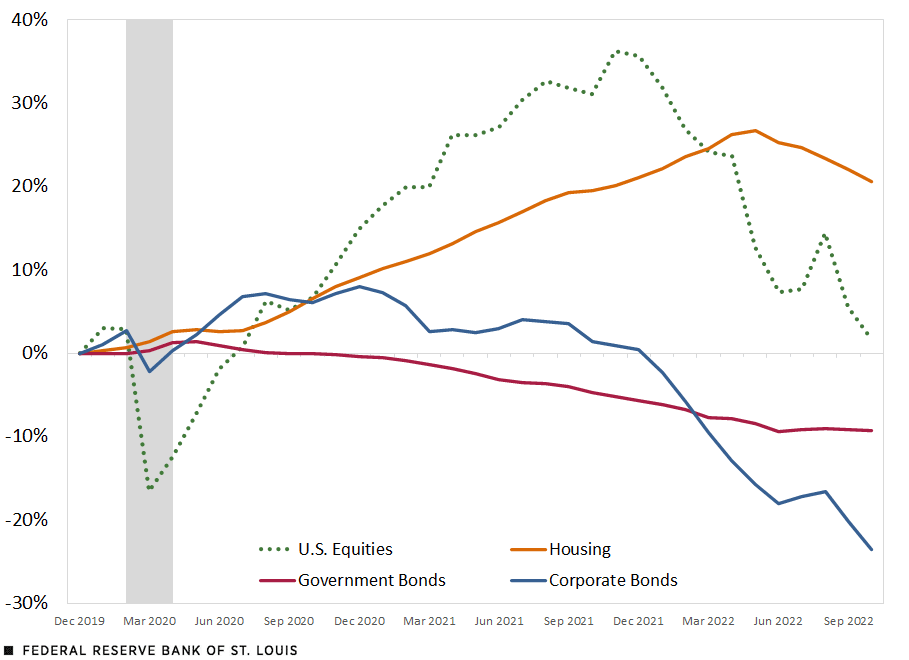

More recently, during 2022, we observed a reversal of these two trends: The recovery of labor force participation seemed to accelerate somewhat, as seen in the first figure below; this was especially true among older workers. Additionally, we observed a stabilization or even reversal of the large real gains posted by asset classes such as stocks and housing observed in 2020-21, as shown in the second figure. In this blog post, we update our previous analysis to account for the recent period of falling and negative financial returns across asset classes.

U.S. Labor Force Participation Rate

SOURCES: Census Bureau’s Current Population Survey and FRED.

NOTE: Shading indicates a recession.

Cumulative Real Returns by Asset Class

SOURCES: FRED, Haver Analytics and authors’ calculations.

NOTES: To determine returns, asset classes were represented by the following: the S&P 500 Index for U.S. equities; the S&P/Case-Shiller U.S. National Home Price Index for housing; the constant maturity 10-year Treasury yield for government bonds; and the ICE BofA U.S. Corporate Index for corporate bonds. All returns are adjusted by the core consumer price index. Shading represents a recession.

Updating the Data to 2022: Falling Financial Returns

In this post, we update key figures using two different time periods: 2020-21 and 2022. COVID-19 obviously did not end in 2022, but it was much less of an issue than it was in 2020 or 2021.

In 2022, the Federal Reserve started tightening monetary policy, which may have affected asset prices. Thus, standard economic theory suggests that we should have seen the opposite effects in 2022—falling asset prices and returns should have contributed to people returning to the labor force. There are, naturally, other reasons why the LFP rate should have recovered: The risk of contracting serious illness from COVID-19 was plausibly lower in 2022 than it was in 2020, and labor markets were extremely tight. Tight labor markets mean that employers have to compete for workers, with many doing so by raising worker compensation.

Stocks, housing and bonds constitute the three major asset classes held (directly or indirectly) by U.S. households. For the years 2020 and 2021, the first two asset classes posted high real returns, with the third posting modest but positive returns. These trends clearly inverted in 2022. The real return on stocks, as measured by the S&P 500 Index, was -25% for the year through October 2022, while the real return on housing was essentially zero for the same period. The real return on corporate bonds was -24%.

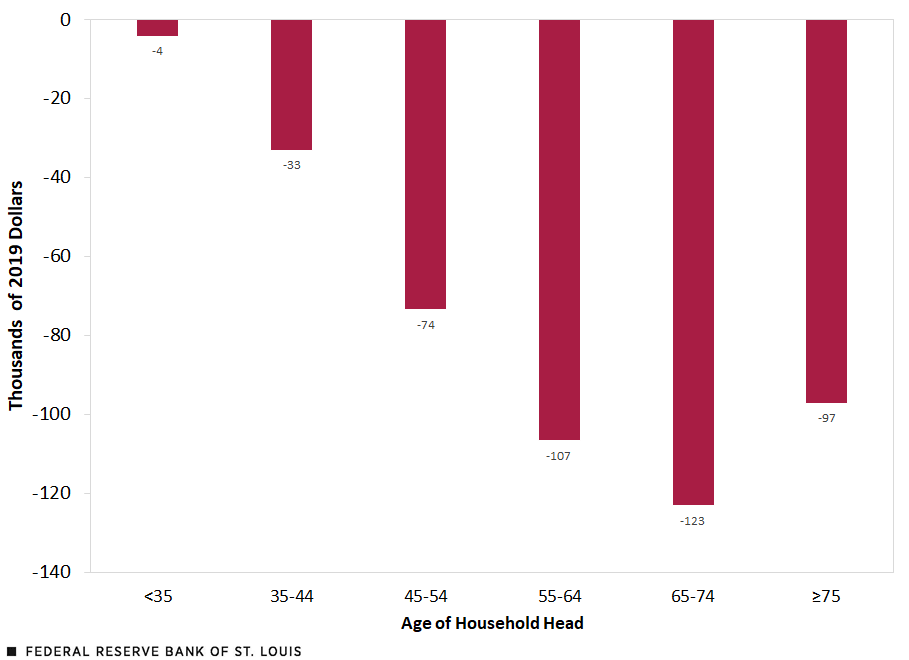

We use data from the 2019 Survey of Consumer Finances to estimate the impact of these real returns on the net worth of a representative sample of U.S. households. The figure below plots the estimated average change in net worth per head of household age category during 2022. People between the ages of 55 and 74 lost, on average, over $100,000 in net worth due to falling asset returns between January and October 2022. This partly reverses some of the net worth gains in 2020-21, which were particularly high for these age groups. This is explained by the high exposure (in absolute terms) of people in these age groups to asset classes such as stocks and bonds, which performed reasonably well in 2020-21 but posted significant negative returns during 2022.

How Average Returns Affected Estimated Net Worth, 2022

SOURCES: Federal Reserve’s 2019 Survey of Consumer Finances, FRED, Haver Analytics and authors’ calculations.

NOTES: For the method used to determine returns for major asset classes, see the notes with the previous figure. We assume households’ distribution of assets remained constant over the 2019-2022 period.

Effects of Declining Net Worth on Labor Force Participation

As previously mentioned, the LFP rate recovered slightly during 2022: from 61.9% in December 2021 to 62.2% in October 2022. The large declines in net worth shown in the last figure could have influenced the decision to return to the labor force by many who left during 2020-21.

We apply the same methodology as in our previous work to try to determine how much of this 0.3 percentage point increase in the LFP rate can be attributed to falling asset values. Focusing on only people between the ages of 51 and 65, whose decision to participate in the labor force tends to be more sensitive to wealth effects, we find that the decline in asset values may have caused an extra 170,000 people to return to the labor force. This corresponds to an increase in the LFP rate of 0.06 percentage points, or about 16% of the total increase observed through October 2022. If, instead, we consider all people age 51 and older, we find that falling asset values may have contributed to about 380,000 people joining the labor force, which would account for 36% of the increase in the number of people in the labor force.

Again, it should be noted that falling asset values may be just one among several reasons why people are returning to the labor force. Lower risk of contracting severe illness, tight labor markets and potentially more attractive working arrangements (such as the flexibility to work from home) may be other primary reasons.

Citation

Miguel Faria-e-Castro and Samuel Jordan-Wood, ldquoRetirements, Net Worth, and the Fall and Rise of Labor Force Participation,rdquo St. Louis Fed On the Economy, Jan. 5, 2023.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions