Are State Economic Conditions a Harbinger of a National Recession? An Update

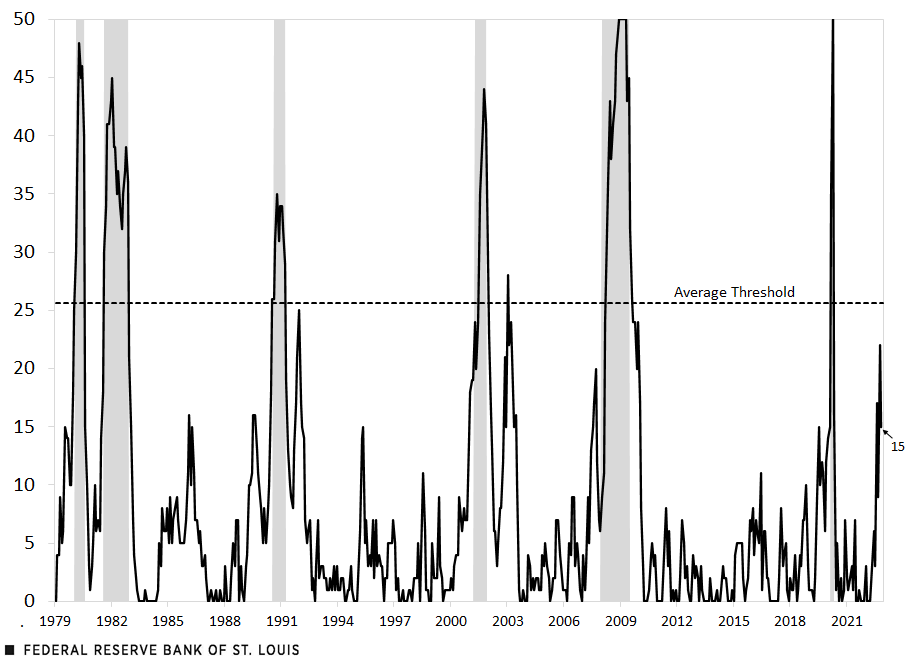

In an On The Economy blog post last week, we discussed a unique way to potentially identify turning points in the national economy from expansion to recession using state coincident indexes (SCIs) constructed by the Federal Reserve Bank of Philadelphia. Specifically, we used the SCIs to assess whether there is a threshold in the number of states experiencing negative SCI growth that might signal a national recession. Our analysis showed that, on average, when 26 states had reported negative SCI growth in a particular month, this was viewed as being highly correlated with the start of a national recession.

In this blog post, we update our analysis with revised data through November and answer some questions that readers asked about last week’s post.

The Impact of Data Revisions

In last week’s post, we noted one caveat: Populous states with large economies, like California, Texas and Florida, can sometimes exert a large influence on national economic activity. Our analysis did not adjust for this.

Unmentioned in our analysis was an implicit but important caveat: Revisions to the previous month’s source data from the Bureau of Labor Statistics can sometimes result in revisions in the number of states experiencing negative growth, as measured by the SCI. These and other technical issues about using the SCIs to date business cycles are detailed in Paul R. Flora’s 2016 article in the Philadelphia Fed’s Regional Spotlight (PDF).

After our blog post was published, the Philadelphia Fed released the November 2022 SCIs; the results reveal the significance of data revisions to this analysis. This release also included revisions (if any) to the previous month’s estimates. In our Dec. 28, 2022, blog post, the data showed that 27 states had negative SCI growth in October. The revised data now show that only 22 states had negative SCI growth in October.

The Recession Outlook with New Data

The November SCIs also showed a decrease in the number of states with negative SCI growth. Now, only 15 states had negative SCI growth in November, down from 22 in October and well below the average threshold of 26 states. See the figure below.

Philadelphia Fed’s State Coincident Indexes: Number of States with Negative Growth Using Data Through November 2022

SOURCES: Federal Reserve Bank of Philadelphia and Haver Analytics.

NOTES: The horizontal dotted line represents the average number of states across all episodes experiencing negative growth during the first full month of a national recession. Shaded areas represent recessions.

To address another set of questions related to our first caveat about state sizes, the table below lists the states that had negative growth in October. In the initial estimates, four of the 27 states with negative growth in October were among the 10 most populous states as of July 1, 2022: California, Florida, Illinois and Michigan. Combined, the population of these four states is about 84 million, or 25.2% of the total U.S. population. In the revised estimates that were released after our post published, only 22 states registered negative SCI growth in October, and three of the four most populous states mentioned before returned to positive SCI growth: California, Illinois and Michigan.

| Original Estimates* | Alabama, Arizona, California, Connecticut, Florida, Illinois, Indiana, Iowa, Kansas, Kentucky, Maine, Maryland, Michigan, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, Ohio, Oklahoma, Oregon, Rhode Island, South Carolina, Vermont, Wisconsin, Wyoming |

|---|---|

| Revised Estimates** | Alabama, Arkansas, Connecticut, Florida, Indiana, Iowa, Kansas, Kentucky, Maine, Maryland, Michigan, Mississippi, Missouri, Montana, Nebraska, North Dakota, Ohio, Oklahoma, Rhode Island, South Carolina, Vermont, Wyoming |

|

*Data used in our Dec. 28, 2022, blog post. ** Data released after the post’s publication. |

|

| SOURCES: Federal Reserve Bank of Philadelphia and Haver Analytics. | |

As noted in the figure, the data that were released in late December show that only 15 states had negative SCI growth in November. As in October, only one of the 10 most populous states—Michigan—experienced negative growth in November.These states had negative growth in November: Arizona, Arkansas, Delaware, Iowa, Kentucky, Maine, Michigan, Minnesota, Nevada, North Dakota, Rhode Island, Vermont, Washington, West Virginia and Wyoming.

Despite the complications posed by large states versus small states, data revisions, and the often disparate trends of each state’s underlying growth rates, the figure nonetheless shows that there tends to be an historically reliable recession signal emanating from the SCIs. Perhaps just as important, data that are subject to revision present a daunting challenge for monetary policymakers and others who must make decisions in real time with reliable, though imperfect, data.

Note

- These states had negative growth in November: Arizona, Arkansas, Delaware, Iowa, Kentucky, Maine, Michigan, Minnesota, Nevada, North Dakota, Rhode Island, Vermont, Washington, West Virginia and Wyoming.

Citation

Kevin L. Kliesen and Cassandra Marks, ldquoAre State Economic Conditions a Harbinger of a National Recession? An Update,rdquo St. Louis Fed On the Economy, Jan. 5, 2023.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions