Reviewing the Impact of Energy Sanctions on Russia

This blog post reviews the recent costs and success of energy sanctions imposed on Russia.

A History of Growing Dependence

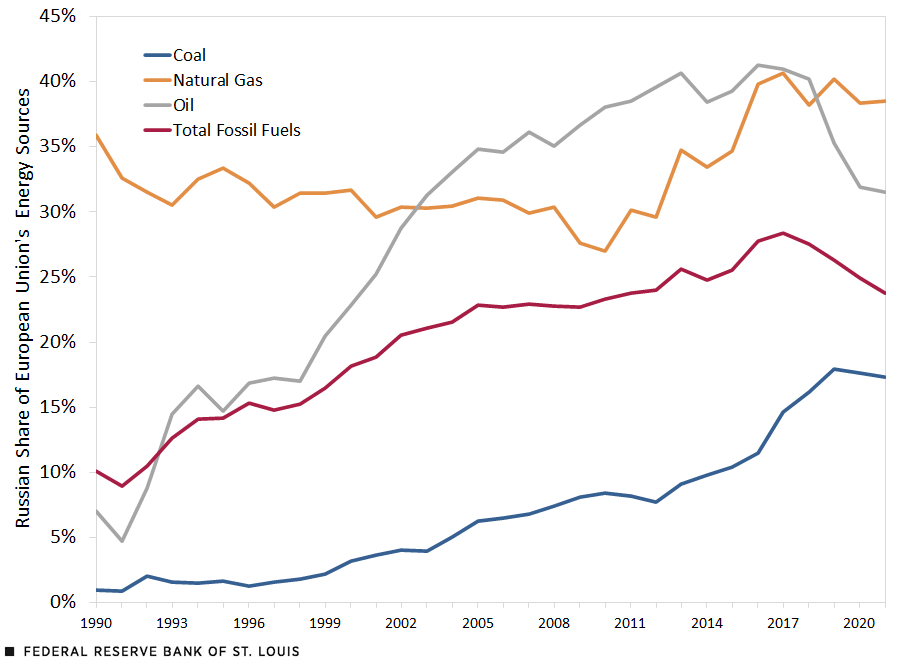

Over a long period following World War II, Europe became heavily dependent on oil and gas supplies from Russia’s huge reserves. This started during the 1960s, when the Soviet Union supplied its allies in Eastern Europe, and continued in subsequent decades, especially after the downfall of the Soviet Union. The U.S. government unsuccessfully opposed this growing dependence. By 2020, Russia was supplying 24.9% of the fuel needed by the European Union (EU 26), including 38.3% of its natural gas needs (see the first figure below), and energy exports constituted 14% of Russia’s gross domestic product in 2021.We define the EU 26 as the 27 countries of the European Union less Estonia, which we exclude because it appears to have very unusual movements in its statistics.

The European Union (EU 26) Has Relied Heavily on Russian Energy

SOURCES: Eurostat, International Energy Agency and authors’ calculations.

NOTE: EU 26 represents the 27 countries of the European Union less Estonia.

Russia’s Invasion of Ukraine and Sanctions

Although the 2014 Russian invasion of Ukraine prompted little economic pushback, the much broader 2022 invasion prompted Western nations to sanction Russia in many ways. The first measures cut the Russian financial system off from the rest of the world by prohibiting Russian use of the Society for Worldwide Interbank Financial Telecommunication (SWIFT) system and freezing Russian access to its foreign exchange reserves held in Western financial institutions.

Western countries also quickly sanctioned Russian energy exports. In March 2022, the U.S. banned imports of Russian oil and gas, while Europe and Japan stopped imports of Russian coal soon thereafter. The EU later agreed to stop seaborne Russian oil imports and planned measures to make it difficult for Russia to transport oil by sea. (See appendix for a detailed timeline.)

The Shut-off of Natural Gas over the Winter of 2022-23

During the summer and autumn of 2022, the EU prepared to shut down its imports of Russian natural gas through pipelines. This shutdown of Russian natural gas exports to Europe was one of the most important and costly sanctions for the EU because pipelines are the most economical way to ship natural gas and are difficult to quickly replace. The closest substitute would be liquified natural gas (LNG), from the U.S. or other sources, but LNG use requires specialized container ships and substantial infrastructure to take delivery of the gas through ports and transport it to inland destinations. Such infrastructure ordinarily requires several years to build, although its construction is being rushed. Other potential replacements, such as nuclear power and renewable sources, have drawbacks, such as greater cost or pollution, and would require years to construct.

Russia responded to these preparations and sanctions by repeatedly slowing and sometimes stopping natural gas exports to the EU, while threatening to end them entirely. In late September 2022, the Nord Stream 1 and 2 pipelines were apparently sabotaged, which shut down the flow of Russian gas to northern Europe.

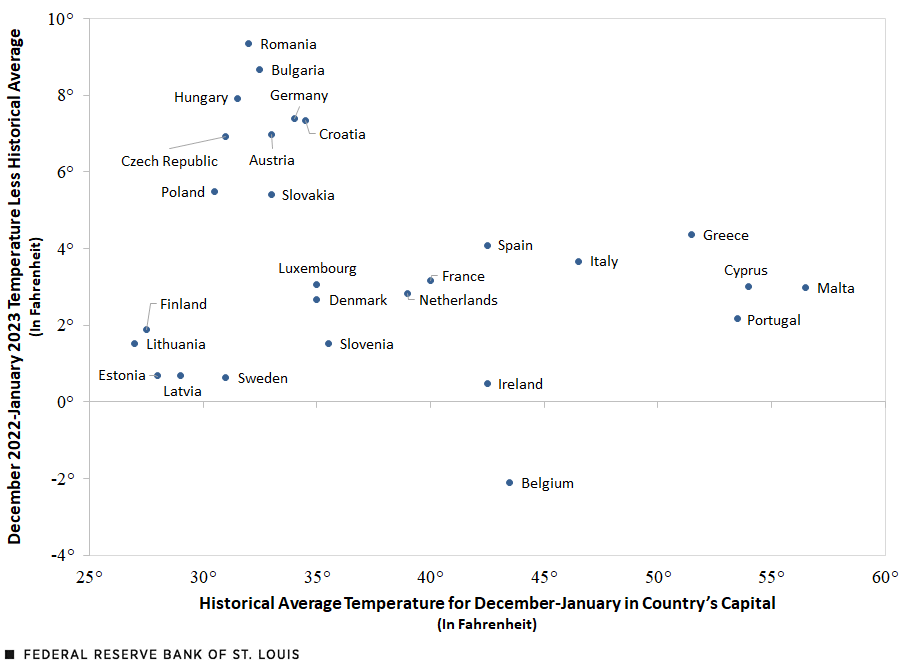

Heading into the winter of 2022, many observers feared that Europe would freeze without Russian natural gas, particularly countries that have cold winters and those that depend heavily on Russian gas.See Christopher Neely and Jason Dunn’s November 2022 essay “A Shutoff of Russian Natural Gas” in Economic Synopses. Fortunately, Europe has had a fairly mild winter thus far. The second figure shows that temperatures in each country’s capital in December 2022 and January 2023 have been higher than historical averages for all the EU capitals except Brussels.

Europe Has Had a Warmer-Than-Average Winter

SOURCES: Weather in the World (current data); Time and Date (historical data); and authors’ calculations.

An Oil Price Cap

Western countries have recently targeted Russian crude oil exports. Although Western states no longer import significant quantities of Russian oil, oil of a given grade is fungible, so it can still be sold to nonsanctioning states such as India or China, albeit at a substantial discount, while Western states buy oil that might have gone to nonsanctioning states. The fungibility of oil makes it difficult to greatly reduce Russian revenue from that commodity.Russian profits from continued oil exports are limited by higher shipping costs and discounts that must be given to buyers.

To remedy this situation and reduce Russian revenue from oil, the G-7, Australia and the EU established a $60 price cap on each barrel of Russian oil, starting Dec. 5, 2022.The G-7, or Group of Seven, comprises Canada, France, Germany, Italy, Japan, the United Kingdom and the U.S. This group enforces the cap through regulation of the major global shipping firms and shipping insurance firms based within their domains. Much to the surprise of many observers, the cap appears to have been successful through its first couple of months in reducing the prices that Russia receives for its oil.

Over the longer term, however, this price cap is likely to suffer from the same weaknesses as other sorts of price controls: Buyers and sellers will collude to evade the controls. In the context of the oil price cap, Russia is likely to evade the price cap by concealing the source of the oil, and buying and operating its own tankers, albeit at some cost.

Conclusion

Western sanctions on the Russian energy sector have reduced Russian revenues but have also created costs for the sanctioning nations. Fortunately for the EU, Europe has had a fairly mild winter, which has reduced the costs associated with boycotting Russian gas. In addition, the recently imposed price cap on Russian seaborne oil exports has been surprisingly successful, at least initially. It is likely, however, that Russia will eventually find ways to evade the price cap, reducing the effectiveness of that sanction.

Notes

- We define the EU 26 as the 27 countries of the European Union less Estonia, which we exclude because it appears to have very unusual movements in its statistics.

- See Christopher Neely and Jason Dunn’s November 2022 essay “A Shutoff of Russian Natural Gas” in Economic Synopses.

- Russian profits from continued oil exports are limited by higher shipping costs and discounts that must be given to buyers.

- The G-7, or Group of Seven, comprises Canada, France, Germany, Italy, Japan, the United Kingdom and the U.S.

| Date | Event |

|---|---|

| Feb. 28, 2022 | The U.S. and the International Energy Agency announce they would jointly release 60 million barrels of oil from strategic reserves. |

| March 8, 2022 | President Biden bans U.S. imports of Russian oil and gas. |

| March 23, 2022 | President Vladimir Putin announces that “unfriendly countries” must pay for natural gas in rubles. |

| April 7, 2022 | The EU bans Russian coal imports (to take effect in August 2022) as part of new sanctions, but the group remains divided over oil and gas sanctions. |

| April 8, 2022 | Japan bans coal imports from Russia as part of stricter sanctions. |

| April 27, 2022 | Russia stops natural gas flows to Poland and Bulgaria after the two countries refused to pay in rubles. |

| May 5, 2022 | The EU seeks to remove Sberbank, Russia’s largest lender and a main channel for oil and gas payments, from the SWIFT communication system. |

| May 8, 2022 | The G-7 commits to end imports of Russian oil, and the United States sanctions executives of Gazprombank, one of Russia’s largest banks. |

| May 30, 2022 | EU leaders agree to ban Russian oil imported by sea. |

| May 31, 2022 | The U.K. and EU coordinate a ban on insuring ships carrying Russian oil. |

| June 15, 2022 | Russia’s state oil company, Gazprom PJSC, warns of further reductions in gas flows through the Nord Stream pipeline to Germany, a day after a 40% cut on the quantity carried. |

| June 23, 2022 | Germany considers rationing natural gas after Russian cuts to supply. |

| July 20, 2022 | The European Commission urges EU members to cut their natural gas use by 15% and permit it to ration gas to prepare for a much-reduced supply of Russian gas. |

| Aug. 4, 2022 | Russian oil stops flowing through a pipeline to Central and Eastern Europe. Transneft PJSC, the government-owned oil pipeline operator, blames Western sanctions for payment difficulties. |

| Sept. 2, 2022 | Gazprom announced it would not resume pumping natural gas through the Nord Stream pipeline following two days of maintenance. |

| Sept. 26, 2022 | Nord Stream 1 and Nord Stream 2 pipelines are apparently sabotaged. |

| Oct. 6, 2022 | The EU Council announces it will prohibit the maritime transport of Russian crude oil (to go into effect Dec. 5, 2022) and petroleum products (to go into effect Feb. 5, 2023). |

| Oct. 12, 2022 | Putin proposes to redirect gas supplies from the damaged Nord Stream pipeline to a major European gas hub in Turkey. |

| Nov. 4, 2022 | The G-7 and Australia decide on a fixed—not floating—oil price cap. |

| Dec. 3, 2022 | The EU Council decides on Russian oil price cap of $60 per barrel. |

| Dec. 5, 2022 | The EU oil price cap goes into effect. |

| Dec. 27, 2022 | Putin bans the supply of oil products to nations abiding by the oil price cap, starting Feb. 1, 2023. |

| Jan. 27, 2023 | The EU extends its ban on Russian seaborne oil imports through July 31, 2023. |

| Feb. 1, 2023 | The Russian oil ban on EU goes into effect. |

| Feb. 5, 2023 | The EU petroleum products price cap goes into effect. |

| Feb. 10, 2023 | Russia announces that it will reduce its oil production by around 5% in response to the imposition of price caps. |

| SOURCE: Authors’ research of news reports and government press releases. | |

Citation

Christopher J. Neely and Jason Dunn, ldquoReviewing the Impact of Energy Sanctions on Russia,rdquo St. Louis Fed On the Economy, Feb. 16, 2023.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions