Share of Americans in Financial Distress Reaches High Levels

Recent literature found that household financial distress matters when considering the effects of macroeconomic shocks in the economy.See Kartik B. Athreya, Ryan Mather, Jose Mustre-del-Rio and Juan M. Sánchez’s 2019 working paper “The Effects of Macroeconomic Shocks: Household Financial Distress Matters,” (revised September 2023). While households generally experienced low financial distress during the recovery following the COVID-19 recession, many are currently struggling to repay debts. This blog post examines households’ financial distress by comparing the recent incidence in delinquency for credit card debt, auto loans and mortgages with the incidence during earlier periods, including the Great Recession.

We use data from the Federal Reserve Bank of New York/Equifax Consumer Credit Panel to closely track the change in household financial distress during the Great Recession and during the recovery following the COVID-19 recession in 2020. According to our definition, an individual is in financial distress if he or she has an account that is 30 days or more past due, excluding severe derogatory debt (more than 120 days past due).Severe derogatory debt includes debt that has been charged off by the lender. Again, this measures the percentage of individuals experiencing distress, not distressed debt as a percentage of total debt, which still remains relatively low.

How Do Current Levels of Financial Distress Compare with Earlier Periods?

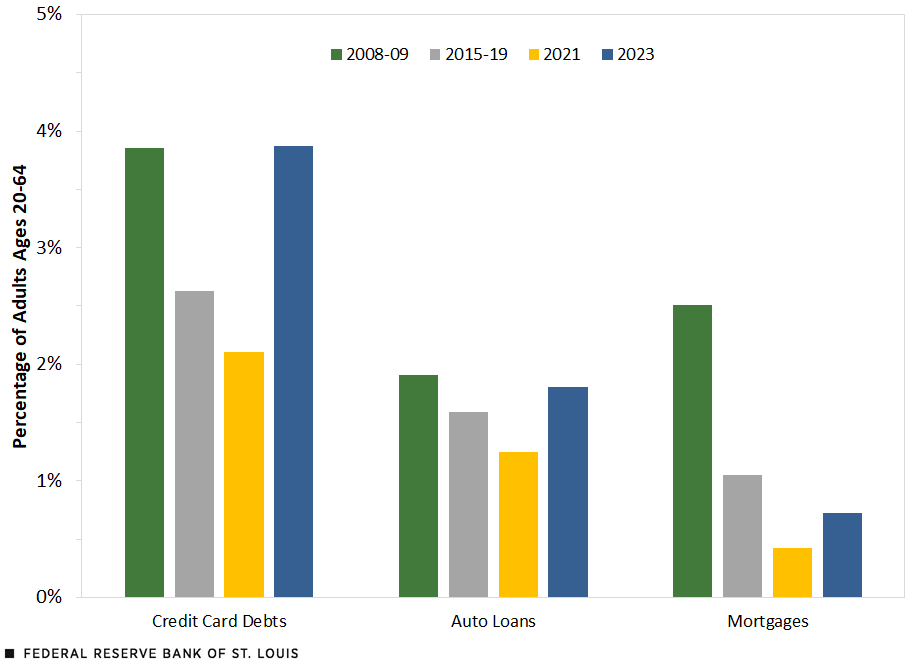

The figure below depicts the percentage of people among all U.S. adults (ages 20-64) who are in financial distress for different types of debt. To analyze the current economic conditions in relation to recent history, we consider credit card debt, auto loans and mortgages in the third quarters of 2008-09, 2015-19, 2021, and 2023. We use the third quarter for each year because the last data available are for the third quarter of 2023 and we want to control for changes that may be due to seasonality.

Percentage of U.S. Adults in Financial Distress on Key Consumer Debt

SOURCES: Federal Reserve Bank of New York/Equifax Consumer Credit Panel and authors’ calculations.

NOTES: The quarterly data are for individuals who are 20 to 64 years of age. The data are derived from a nationally representative, 5% random, anonymous sample of all individuals with a Social Security number and a credit report. An individual is in financial distress if she or he has an account with debt that is 30 days or more past due, excluding severe derogatory (charged-off) debt. Observations correspond to the third quarter of each year; for 2008-09 and 2015-19, the third quarters are averaged.

The green bars, which mostly capture the incidence of financial distress during the Great Recession, are the average of the third quarter of 2008 and the third quarter of 2009. The pre-pandemic incidence of financial distress, represented by the gray bars, is the average of the third quarters from 2015 to 2019. The yellow bars display the incidence of financial distress during the third quarter of 2021, which was before the Federal Reserve started tightening monetary policy. Finally, the blue bars represent the latest available observation, the third quarter of 2023.

Compared to the pre-pandemic level (2015-19), financial distress decreased for all types of debts in the third quarter of 2021 (yellow bars are lower than gray bars). Thus, restricted spending during lockdowns, government transfers, and forbearance programs allowed many households to escape financial distress.

However, financial distress for all types of debt increased since the midst of the pandemic (blue bars are higher than yellow bars). In particular, the delinquency rate for credit card debts, auto loans, and mortgages increased from the third quarter of 2021 to the same quarter of 2023 by 1.77 percentage points, 0.56 percentage points, and 0.30 percentage points, respectively. How significant is this increase? It depends on the type of debt.

Comparing Distress Changes by Type of Debt

For credit card debts, financial distress in the third quarter of 2023 is also higher than the pre-pandemic level (gray bars) and has surged to the same level as the Great Recession (green bars). The incidence of credit card debts in the third quarter of 2023 is 3.87%, and the rates during pre-pandemic period and the Great Recession were 2.62% and 3.85%, respectively. The incidence of financial distress for auto loans (1.80%) has also exceeded the pre-pandemic level (1.59%) and is nearing the level during the Great Recession (1.91%).

Finally, the incidence of financial distress for mortgage debt in the third quarter of 2023 (0.72%) is smaller than the pre-pandemic level (1.05%) and well below the incidence of financial distress during the Great Recession (2.51%). The difference in the behavior of mortgage debt is probably due to the large difference in the behavior of house prices. While house prices declined during the Great Recession, they have increased since the onset of the pandemic.

Overall, this post shows that the incidence of household financial distress has increased for the most common types of debts. For credit card debt and auto loans, the incidence has reached high levels, equal or close to those during the Great Recession.

Notes

- See Kartik B. Athreya, Ryan Mather, Jose Mustre-del-Rio and Juan M. Sánchez’s 2019 working paper “The Effects of Macroeconomic Shocks: Household Financial Distress Matters,” (revised September 2023).

- Severe derogatory debt includes debt that has been charged off by the lender.

Citation

Juan M. Sánchez and Masataka Mori, ldquoShare of Americans in Financial Distress Reaches High Levels,rdquo St. Louis Fed On the Economy, Dec. 26, 2023.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions