Deja Vu? The Recent Rise in Credit Card Debt Delinquencies

KEY TAKEAWAYS

- Due to job losses that occur during recessions, some people may reduce or stop payments on credit card debt, which results in delinquent accounts.

- Although credit card delinquency rates were low during the COVID-19 recession, they have been on the rise since the end of 2021.

- Current delinquency rates for younger people are near where they averaged in the 2007-09 global financial crisis, but delinquent debt as a share of total credit card debt is smaller.

Americans often use credit cards to borrow money. In 2022, 82% of U.S. adults had credit cards, of which 48% carried a balance.See table 22 in the Federal Reserve report Economic Well-Being of U.S. Households in 2022. When borrowers fail to make payments on balances they carry, their accounts become delinquent, which results in interest charges, fees and penalties to the borrower’s credit score. Severe delinquency results in account closure and loss of access to credit.

Credit card delinquency rates reached all-time highs during the global financial crisis (GFC).The global financial crisis refers to the period from the fourth quarter of 2007 through the second quarter of 2009. These dates correspond with the National Bureau of Economic Research recession timeline measured quarterly. Credit card delinquencies may increase during recessions for a few reasons. One cause for delinquencies is job loss,Bankruptcy can occur if debt remains delinquent. In their 2006 paper (PDF), Satyajit Chatterjee, Dean Corbae, Makoto Nakajima and José-Víctor Ríos-Rull found that 12.2% of people who filed bankruptcy reported doing so because of job loss while 41.3% cited credit misuse, 14.3% cited marital disruption, 16.4% cited health care bills and 15.9% cited a lawsuit or harassment. which rises during recessions, because individuals may reduce or stop payments on credit card debt due to the loss of income.

Another cause could be that when credit conditions are tight,Credit supply tightens when banks face uncertainty or interest rates are high. banks may remove promotional offers, such as 0% APR balance transfers, eliminating borrowers’ abilities to roll over unpaid debt.Balance transfers allow a credit card holder to move unpaid debt to a new account. Promotions, such as 0% APR, allow a borrower to skip interest payments for a designated amount of time. For more, see this 2021 Federal Reserve Bank of Philadelphia article (PDF) by Lukasz Drozd. However, thanks to forbearance programs, restrained spending during lockdowns and generous government benefits,As mentioned in our May 2021 On the Economy blog post, a U.S. Census Bureau report found that 15.7% of stimulus recipients used their first stimulus checks to pay down debt. households maintained record low delinquency rates during the COVID-19 recession and immediately after. Credit card delinquencies then began to grow near the end of 2021. In this article, we compare the recent spike in credit card delinquency rates with the increase during the global financial crisis.

Analyzing Delinquencies by Age, ZIP Code

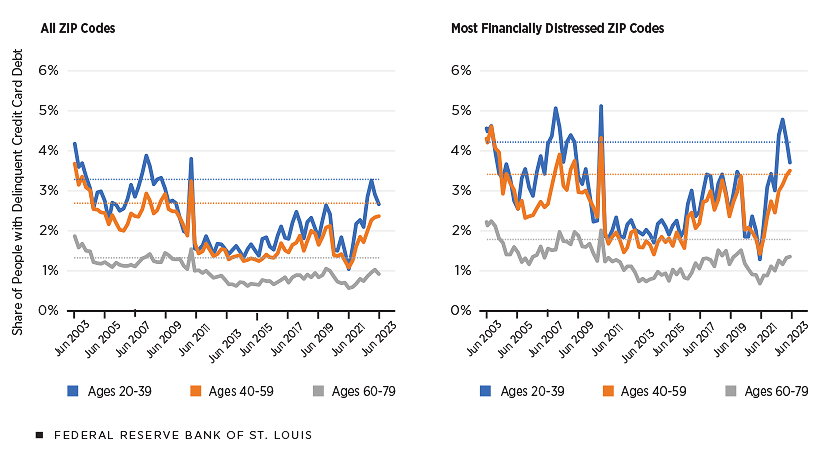

We define credit card delinquency as an account that is 60 days or more past due, excluding severe derogatory debt (more than 120 days past due).Severe derogatory debt includes debt that has been charged off by the lender. The figure below depicts the percentage of people among all U.S. adults (not just credit card holders) who are late on payments by age group.The people in this sample are heads of households in the Equifax data. We exclude everyone younger than 20 or older than 79. The left panel of the figure includes people from every ZIP code in the U.S. The right panel contains only those from the country’s most financially distressed ZIP codes.We use the fraction of households in each ZIP code that were 30 days or more delinquent on credit card debt in 2018, as defined by Kartik Athreya, Ryan Mather, José Mustre-del-Río and Juan M. Sánchez in the 2019 St. Louis Fed working paper “The Effects of Macroeconomic Shocks: Household Financial Distress Matters” (PDF). Then we use the ZIP codes with the highest fraction of people in delinquency that make up 20% of the U.S. population. This category accounts for 20% of all households. We emphasize this group of ZIP codes because previous research has shown that weak economic conditions affect them more negatively and they respond with larger declines in consumption than the general population.

Percentage of People Delinquent on Credit Card Debt, 2003-2023

SOURCES: Federal Reserve Bank of New York/Equifax Consumer Credit Panel and authors’ calculations.

NOTES: Data are quarterly. Delinquency is defined as an account with debt that is 60 days or more past due. Delinquency rates exclude severe derogatory (called-off) debt. The most financially distressed ZIP codes refer to ZIP codes with the highest rates of credit card delinquency in 2018 as defined by Athreya, Mather, Mustre-del-Río and Sánchez (PDF). The horizontal dotted lines represent the average delinquency rate during the global financial crisis (the fourth quarter of 2007 through the second quarter of 2009).

The figure shows that age is correlated with delinquency. The blue lines in each panel show the delinquency rates for people ages 20-39 for each group of ZIP codes. In both the aggregate group of ZIP codes (left panel) and the most financially distressed group of ZIP codes (right panel), this youngest cohort tends to have a higher fraction of individuals experiencing delinquency than the two older cohorts, ages 40-59 and 60-79 and shown in orange and gray, respectively. The youngest cohort may have higher delinquency rates because of higher unemployment ratesFor more, see this table from the Bureau of Labor Statistics. or because of more restricted access to credit (due to shorter credit history), among other reasons.

In all age categories, the most financially distressed group of ZIP codes (right panel) has a larger percentage of people suffering delinquency than the whole sample (left panel). This shows that financial distress is persistent, because the group of most financially distressed ZIP codes was constructed based on delinquencies in 2018, not delinquencies over all years. The dotted blue lines in both panels represent the average proportion of adults ages 20-39 who were late on paying off credit card debt during the GFC. Similarly, the dotted orange and dotted gray lines represent the same average for those ages 40-59 and 60-79, respectively.

The left panel (all ZIP codes) shows that delinquency has increased significantly across all age categories since 2021. However, as of the second quarter of 2023, delinquency for all three age cohorts was slightly below average levels (the dotted lines) seen during the GFC. The delinquency rates for the two youngest cohorts in the most financially distressed collection of ZIP codes (right panel) both recently reached their GFC averages. The delinquency rate for the middle cohort (ages 40-59) exceeded its GFC average by 0.1 percentage points in the second quarter of 2023, while the delinquency rate for the youngest cohort (ages 20-39) surpassed its GFC average in the third quarter of 2022 but has since declined over the last two quarters. These statistics suggest that households younger than age 60 in the most financially distressed ZIP codes are in the same or comparable situations as they were during the GFC.

Understanding the Percentage of Debt

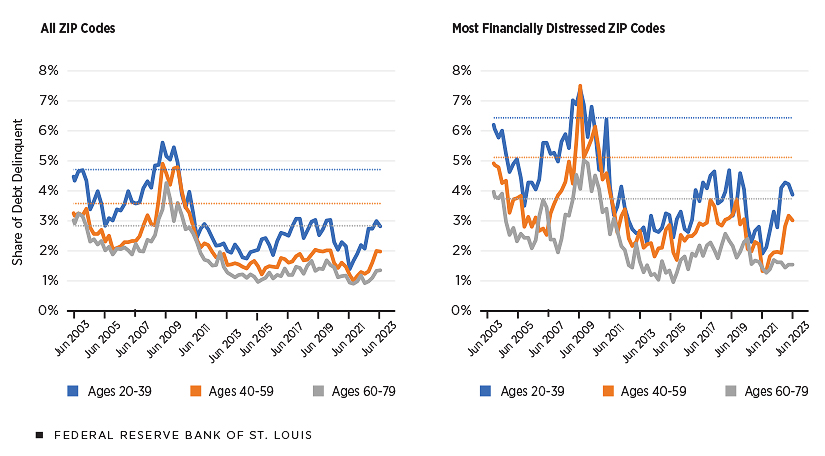

To gain a more complete picture of debt in the U.S., one should know how large the debt in delinquency is. The following analysis provides a different perspective by looking at the extent of delinquent credit card debt as a percentage of all credit card debt.

The figure below depicts the percentage of delinquent credit card debt by age cohort for both the whole group of ZIP codes and the most financially distressed ZIP codes. The horizontal dotted lines represent the average percentage of delinquent debt during the GFC for each cohort. Again, blue lines represent debt held by the youngest cohort (ages 20-39), orange lines represent debt held by the middle cohort (ages 40-59) and gray lines represent debt held by the oldest cohort (ages 60-79).

Percentage of Credit Card Debt Delinquent, 2003-2023

SOURCES: Federal Reserve Bank of New York/Equifax Consumer Credit Panel and authors’ calculations.

NOTES: Data are quarterly. Delinquency is defined as an account with debt that is 60 days or more past due. Delinquency rates exclude severe derogatory (called-off) debt. The most financially distressed ZIP codes refer to ZIP codes with the highest rates of credit card delinquency in 2018 as defined by Athreya, Mather, Mustre-del-Río and Sánchez (PDF). The horizontal dotted lines represent the average delinquency rate during the global financial crisis (the fourth quarter of 2007 through the second quarter of 2009).

As in the first figure, the most financially distressed group of ZIP codes (right panel) have greater rates of delinquent debt across age categories than the aggregate group of ZIP codes (left panel). In contrast to the previous figure, however, none of the cohorts in either group of ZIP codes has shares of debt in delinquency approaching those recorded during the GFC.

In the second quarter of 2023, the percentage of debt in delinquency for all cohorts was much lower than their GFC averages. The main message from the second figure is that the fractions of unpaid credit card debt have been fairly low but are reverting to levels recorded in the years immediately preceding the COVID-19 pandemic for some age categories, particularly the youngest and middle cohorts, but not for the oldest individuals.

A Trend toward Worsening Credit Card Delinquencies?

Overall, credit card debt delinquency in the second quarter of 2023 is not fully comparable to its state in the GFC. Even while the percentage of credit card accounts in delinquency for younger individuals is near the GFC average, the delinquent debt as a fraction of total credit card debt is smaller. Data for the most recent quarters, however, suggest that households’ financial situation may be stabilizing, particularly for individuals younger than age 40.

What behaviors may explain the difference in the share of people in delinquency and the percentage of debt in delinquency is an open question for future research, as is understanding the critical role of the COVID-19 pandemic in this phenomenon.

Notes

- See table 22 in the Federal Reserve report Economic Well-Being of U.S. Households in 2022.

- The global financial crisis refers to the period from the fourth quarter of 2007 through the second quarter of 2009. These dates correspond with the National Bureau of Economic Research recession timeline measured quarterly.

- Bankruptcy can occur if debt remains delinquent. In their 2006 paper (PDF), Satyajit Chatterjee, Dean Corbae, Makoto Nakajima and José-Víctor Ríos-Rull found that 12.2% of people who filed bankruptcy reported doing so because of job loss while 41.3% cited credit misuse, 14.3% cited marital disruption, 16.4% cited health care bills and 15.9% cited a lawsuit or harassment.

- Credit supply tightens when banks face uncertainty or interest rates are high.

- Balance transfers allow a credit card holder to move unpaid debt to a new account. Promotions, such as 0% APR, allow a borrower to skip interest payments for a designated amount of time. For more, see this 2021 Federal Reserve Bank of Philadelphia article (PDF) by Lukasz Drozd.

- As mentioned in our May 2021 On the Economy blog post, a U.S. Census Bureau report found that 15.7% of stimulus recipients used their first stimulus checks to pay down debt.

- Severe derogatory debt includes debt that has been charged off by the lender.

- The people in this sample are heads of households in the Equifax data.

- We use the fraction of households in each ZIP code that were 30 days or more delinquent on credit card debt in 2018, as defined by Kartik Athreya, Ryan Mather, José Mustre-del-Río and Juan M. Sánchez in the 2019 St. Louis Fed working paper “The Effects of Macroeconomic Shocks: Household Financial Distress Matters” (PDF). Then we use the ZIP codes with the highest fraction of people in delinquency that make up 20% of the U.S. population.

- For more, see this table from the Bureau of Labor Statistics.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us