Monetary Policy Surprises and Inflation Expectations

People either implicitly or explicitly harbor some expectation of what future inflation will be. People’s expectations of inflation are an important aspect of nominal contracts between lenders and borrowers. In a previous blog post, we investigated how inflation rate surprises, as well as updates in inflation expectations, imply an “inflation tax.” These surprises often originate from information about macroeconomic policies.

In this blog post, we discuss one source of such surprises: monetary policy, as captured by changes in the nominal interest rate. We study how monetary policy shocks affect inflation expectations, and how the effect contrasts with that on realized inflation. In other words, when there is a surprising change in monetary policy, how well do people’s expectations adjust compared with the actual outcome of realized inflation?

Inflation Expectation Data and Monetary Policy Surprise Measures

To get a measure of overall expectations in the economy, we used inflation expectation data from the Cleveland Fed. The data contain expectations all the way from the one-year to the 30-year horizon, estimated from professional forecaster surveys and inflation swaps.

For monetary policy shocks, we used the measure developed by Michael Bauer and Eric Swanson in their 2022 working paper.See Michael D. Bauer and Eric T. Swanson. “A Reassessment of Monetary Policy Surprises and High-Frequency Identification.” NBER Working Paper 29939, National Bureau of Economic Research, April 2022. The authors used changes in eurodollar futures (a nominal interest rate measure) before and after a short window of Federal Open Market Committee announcements, including speeches by Fed chairs, from 1988 to 2019 to calculate a measure of monetary policy surprise (MPS). An increase of one unit of this variable is equivalent to a 1 percentage point shift in the short-term yield curve, measured by eurodollar futures contracts between one and four quarters after the surprise. This measure will be positive if it is a “hawkish” surprise, in which the Fed is more aggressive in fighting inflation than expected, and negative if it is a “dovish” surprise, in which the Fed is less aggressive in fighting inflation than expected.

How Monetary Policy Surprises Affect Inflation Expectations

To find these effects, we calculated the impact on inflation expectations of different horizons around an MPS.We use the MPS data set from Bauer and Swanson’s 2022 paper, and we control for year fixed effects and a recession dummy in the regression. For example, if an MPS occurred in March 2020, we wanted to understand how it may have changed people’s inflation expectations from one month before the shock (February 2020) to one month after the shock (April 2020).

To do so, we calculated the effect on inflation expectations for the one- to 30-year horizons following the MPS. Finally, we also computed how the MPS affects realized inflation for the corresponding horizons, which allowed us to compare updates in people’s expectation with the actual effects on inflation.We use accumulative inflation from one to 30 years, calculated using the consumer price index, and annualize the measure.

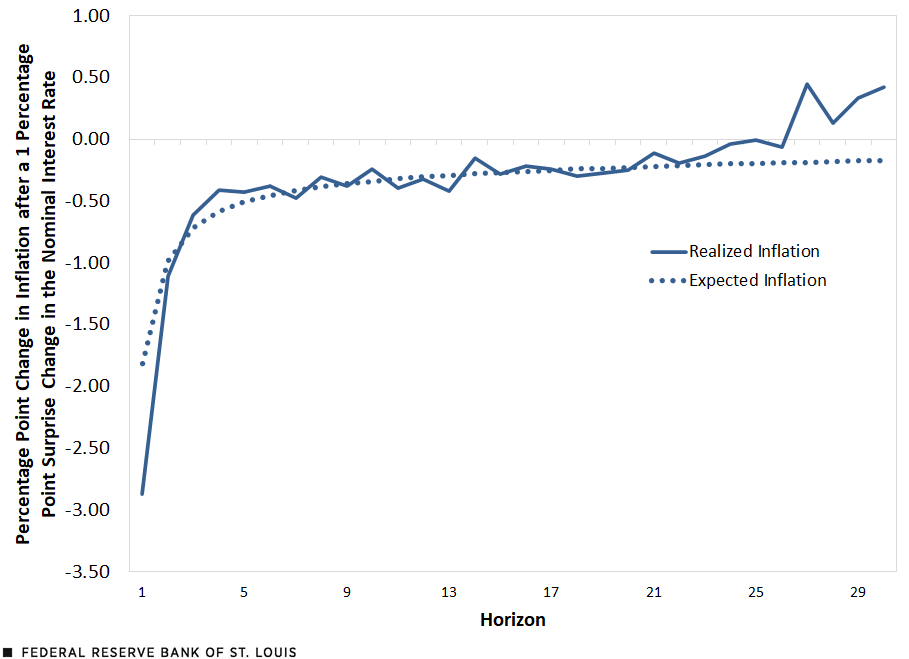

The figure below plots the resulting estimated effect of the surprise measure on inflation expectations and realized inflation of different horizons.

Effects of a Monetary Policy Surprise on Inflation Expectations: Change from One Month Before to One Month After

SOURCES: Michael Bauer and Eric Swanson, 2022 (PDF); and the Cleveland Fed.

NOTE: The interest rate surprise is the change in short-term nominal yield curve of eurodollar futures.

In the medium and long run, the effects of monetary policy surprises on people’s inflation expectations are roughly consistent with the effects on realized inflation, aside from some noise in the longest horizons. The size of the effect is relatively small in the long run. This is intuitive because a surprise increase in nominal interest rate in March 2020 is unlikely to have a large effect on accumulative inflation long term.

However, in the short term, a monetary policy surprise has a strong effect on realized inflation. A hawkish surprise that shifts the short-term nominal yield curve of eurodollar futures by 1 percentage point leads to a decrease in realized inflation measure of nearly 3 percentage points. In contrast, the monetary policy surprise leads to a smaller update in people’s expectations: around a decrease in inflation expectations of 2 percentage points. In other words, people’s expectations seem to “underreact” in comparison to the realized shocks in the immediate term.

Understanding the Impact of Monetary Policy Surprises

The effect that monetary policy surprises have on the private sector’s expectations for inflation is an important measure for understanding the full impact of policy changes. We used a new measure of monetary policy surprises and the Cleveland Fed’s inflation expectations data to study how the private sector reacts to these policy surprises. Overall, this analysis implies that the private sector may slightly underestimate the short-term impact of the surprise but typically may predict longer-term effects fairly well.

Notes

- See Michael D. Bauer and Eric T. Swanson. “A Reassessment of Monetary Policy Surprises and High-Frequency Identification.” NBER Working Paper 29939, National Bureau of Economic Research, April 2022.

- We use the MPS data set from Bauer and Swanson’s 2022 paper, and we control for year fixed effects and a recession dummy in the regression.

- We use accumulative inflation from one to 30 years, calculated using the consumer price index, and annualize the measure.

Citation

Yu-Ting Chiang and Jesse LaBelle, ldquoMonetary Policy Surprises and Inflation Expectations,rdquo St. Louis Fed On the Economy, Oct. 13, 2022.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions